https://sputnikglobe.com/20211214/opec-shrugs-off-omicron-variant-scare-keeps-its-2022-oil-demand-growth-prognosis-unchanged-1091515803.html

OPEC Shrugs Off Omicron Variant Scare, Keeps Its 2022 Oil Demand Growth Prognosis Unchanged

OPEC Shrugs Off Omicron Variant Scare, Keeps Its 2022 Oil Demand Growth Prognosis Unchanged

Sputnik International

OPEC left its prognoses for oil demand growth in 2021 and 2022 unchanged despite fears over Omicron variant of the novel coronavirus.

2021-12-14T13:38+0000

2021-12-14T13:38+0000

2022-11-15T14:20+0000

brent

newsfeed

world

europe

middle east

opec

energy

wti

vaccination

crude

https://cdn1.img.sputnikglobe.com/img/07e5/07/02/1083295155_0:153:3097:1895_1920x0_80_0_0_36adee87a522b1d3c388fc6b4a1808b0.jpg

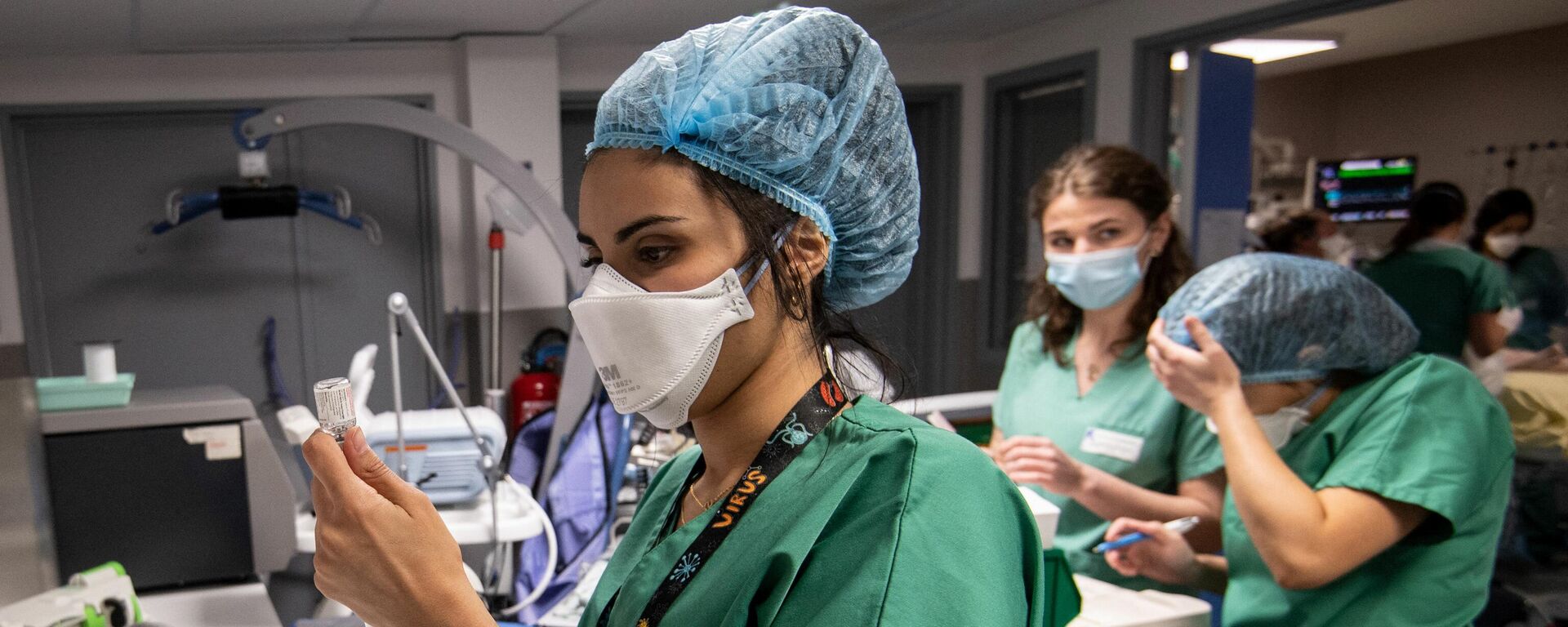

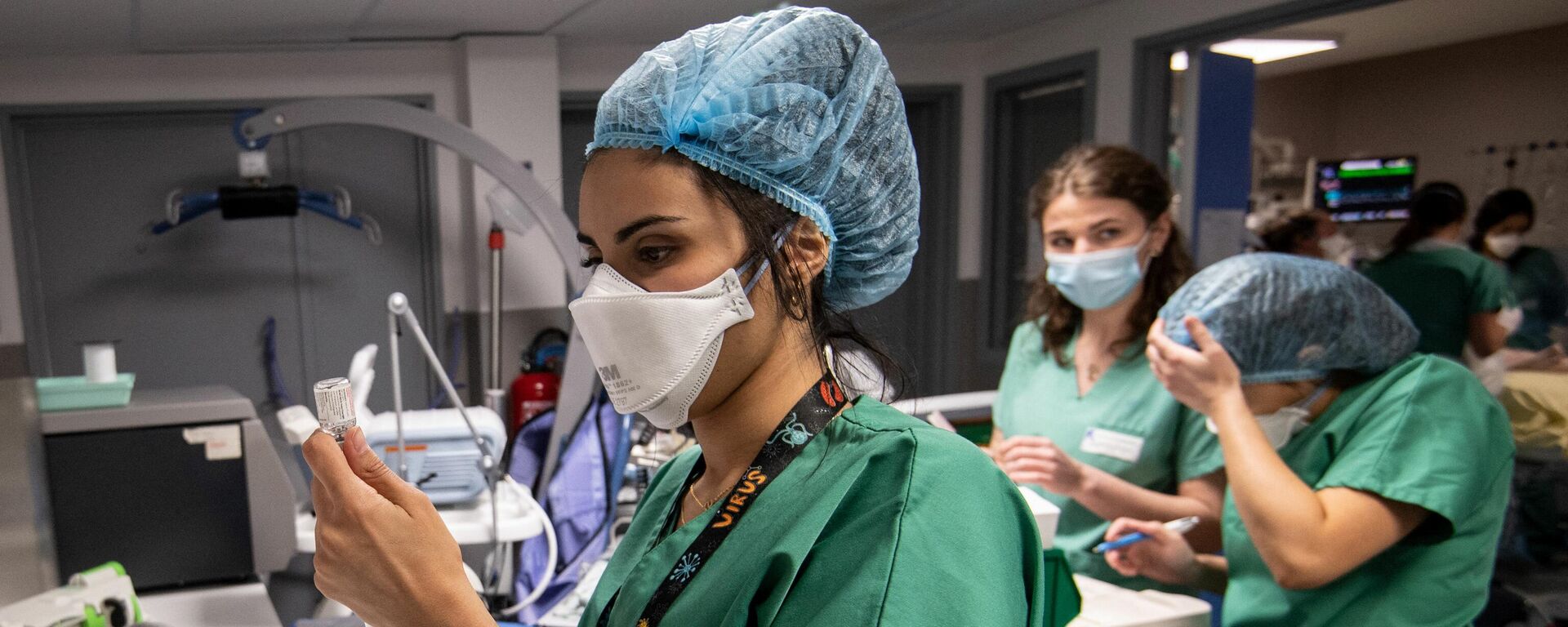

The impact of the new Omicron variant is expected to be "mild" and "short-lived", as the world becomes better equipped for handling the pandemic, OPEC's December report says, keeping its forecast for global oil demand growth unchanged for 2021 and 2022.The report notes that concerns regarding the emergence of the new Omicron strain of coronavirus and easing of the energy crunch sent crude oil spot prices down in November. Nevertheless, the MOMR shifts some demand previously expected in the fourth quarter of 2021 to the first quarter of 2022, projecting a more steady recovery throughout the second half of 2022.According to OPEC, the world oil demand will increase by 4.2 mb/d, year-on-year, in 2022, "given improved COVID-19 management and rising vaccination rates, enabling economic activity and mobility to return to prepandemic levels, supporting transportation fuels in particular".Oil demand in 38 high-income economies of the Organisation for Economic Co-operation and Development (OECD) is forecast to grow by 1.8 mb/d in 2022, according to the report. Meanwhile, the non-OECD region is projected to increase by 2.3 mb/d, "supported by steady momentum in economic activities, particularly China, India and Other Asia", the MOMR observes.When it comes to oil supply, the report highlights that non-OPEC participants of the OPEC Plus conglomerate, which was formed in September 2016, also continue to return their planned volumes to the market. According to OPEC, the main drivers of growth in 2021 for non-OPEC supply have been Canada, Russia, and China.The OPEC prognosis shrugs off fears of the potential negative impact of the Omicron variant on the world economy previously voiced by the OECD. Earlier this month, the OECD warned that the new COVID strain could cause a severe economic slowdown globally. The organisation named two potential scenarios, as quoted by The Guardian.“One is where it creates more supply disruptions and prolongs higher inflation for longer", said Laurence Boone, the chief economist of the OECD. "And one where it is more severe and we have to use more mobility restrictions, in which case demand could decline and inflation could actually recede much faster than what we have here".If Omicron turns out to be more contagious and deadly than previous variants, governments would need to allocate more fiscal support for businesses and introduce further anti-COVID measures, according to Boone.The Economist sounded similarly gloomy: "the Omicron variant of the coronavirus, first publicly identified on November 24th, may be able to circumvent the defences built up by vaccination or infection with COVID-19", the weekly newspaper wrote on 4 December, citing the World Health Organisation (WHO), which previously warned that Omicron poses a "very high" global risk.Meanwhile, market analysts, quoted by Market Watch, note that a lack of evidence that Omicron is causing severe disease has blunted its impact on crude prices, seeing Brent and WTI strongly rebounding last week from the November slump.

https://sputnikglobe.com/20211208/indian-oil-top-executive-not-ruling-out-decrease-in-oil-demand-due-to-spread-of-omicron-1091341884.html

https://sputnikglobe.com/20211214/who-expects-increase-in-number-of-hospitalisations-deaths-from-omicron-coronavirus-strain-1091507978.html

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2021

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

opec, oil prices, oil demand, oil supply, omicron, covid-19, economic recovery, pandemic measures

opec, oil prices, oil demand, oil supply, omicron, covid-19, economic recovery, pandemic measures

OPEC Shrugs Off Omicron Variant Scare, Keeps Its 2022 Oil Demand Growth Prognosis Unchanged

13:38 GMT 14.12.2021 (Updated: 14:20 GMT 15.11.2022) The Organisation of the Petroleum Exporting Countries (OPEC) is not buying into the emerging prognosis that the new Omicron variant of the coronavirus will slash global oil demand significantly, foreseeing further economic recovery worldwide.

The impact of the new Omicron variant is expected to be "mild" and "short-lived", as the world becomes better equipped for handling the pandemic, OPEC's December

report says, keeping its forecast for global oil demand growth unchanged for 2021 and 2022.

"World oil demand is kept unchanged compared to last month’s assessment, showing a growth of 5.7 million barrels per day (mb/d) in 2021", the cartel's Monthly Oil Market Report (MOMR) reads.

The report notes that concerns regarding

the emergence of the new Omicron strain of coronavirus and easing of the energy crunch sent crude oil spot prices down in November. Nevertheless, the MOMR shifts some demand previously expected in the fourth quarter of 2021 to the first quarter of 2022, projecting a more steady recovery throughout the second half of 2022.

According to OPEC, the world oil demand will increase by 4.2 mb/d, year-on-year, in 2022, "given improved COVID-19 management and rising vaccination rates, enabling economic activity and mobility to return to prepandemic levels, supporting transportation fuels in particular".

8 December 2021, 06:56 GMT

Oil demand in 38 high-income economies of the Organisation for Economic Co-operation and Development (OECD) is forecast to grow by 1.8 mb/d in 2022, according to the report. Meanwhile, the non-OECD region is projected to increase by 2.3 mb/d, "supported by steady momentum in economic activities, particularly China, India and Other Asia", the MOMR observes.

When it comes to oil supply, the report highlights that non-OPEC participants of the OPEC Plus conglomerate, which was formed in September 2016, also continue to return their planned volumes to the market. According to OPEC, the main drivers of growth in 2021 for non-OPEC supply have been Canada, Russia, and China.

"In 2022, non-OPEC supply is projected to see robust growth of 3.0 mb/d, year-on-year, on the back of an expected gradual increase in drilling and completion activities in the US", the report continues, adding that "the US and Russia are forecast to contribute two thirds of total expected growth, followed by Brazil, Canada, Kazakhstan, Norway, and Guyana".

The OPEC prognosis shrugs off fears of the potential negative impact of the Omicron variant on the world economy previously voiced by the OECD. Earlier this month, the OECD warned that the new COVID strain could cause a severe economic slowdown globally. The organisation named two potential scenarios, as

quoted by The Guardian.

“One is where it creates more supply disruptions and prolongs higher inflation for longer", said Laurence Boone, the chief economist of the OECD. "And one where it is more severe and we have to use more mobility restrictions, in which case demand could decline and inflation could actually recede much faster than what we have here".

If Omicron turns out to be more contagious and deadly than previous variants, governments would need to allocate more fiscal support for businesses and introduce further anti-COVID measures, according to Boone.

14 December 2021, 08:52 GMT

The Economist

sounded similarly gloomy: "the Omicron variant of the coronavirus, first publicly identified on November 24th, may be able to circumvent the defences built up by vaccination or infection with COVID-19", the weekly newspaper wrote on 4 December, citing the World Health Organisation (WHO), which

previously warned that Omicron poses a "very high" global risk.

Meanwhile, market analysts,

quoted by Market Watch, note that a lack of evidence that Omicron is causing severe disease has blunted its impact on crude prices, seeing Brent and WTI strongly rebounding last week from the November slump.