https://sputnikglobe.com/20230920/goldman-sachs-foresees-oil-at-100-as-global-economy-braces-for-impact-1113518692.html

Goldman Sachs Foresees Oil at $100 as Global Economy Braces For Impact

Goldman Sachs Foresees Oil at $100 as Global Economy Braces For Impact

Sputnik International

Central banks worldwide are facing a challenge with oil prices, soaring towards $100 per barrel, thereby prompting policymakers to navigate potential inflation... 20.09.2023, Sputnik International

2023-09-20T14:37+0000

2023-09-20T14:37+0000

2023-09-20T14:37+0000

world

peter praet

london

saudi arabia

russia

goldman sachs

bank of spain

international monetary fund

brent

treasury

https://cdn1.img.sputnikglobe.com/img/07e6/05/09/1095382086_47:0:3688:2048_1920x0_80_0_0_80e3e203850acbf3d82005416b1c1786.jpg

The Goldman Sachs Group Inc. rejoins the $100-per-barrel bandwagon, seeing prices at triple digits due to the substantial supply cuts by the OPEC+ heavy hitters, Saudi Arabia and Russia, in addition to an uptick in demand tightening the international oil market.Oil prices have undergone an over 30 percent hike, marking a pronounced upswing since mid-June, surpassing the $95 per barrel mark on Tuesday. Consequently, the prominent Wall Street financial institution has adjusted its annual forecast for the international standard Brent, raising it to $100 from its previous estimate of $93.Moreover, the upbeat economic prospects in the US and China that drive momentum amid dwindling stockpiles have also contributed to the oil rally in the past few months, reaching a 10-month peak. According to Goldman Sachs, most major economies are presently headed for an economic slowdown.Amidst the global shift towards a more stabilized monetary policy, a new wave of volatility looms over the world economy, driven by soaring oil prices. As crude oil inches closer to the $100 per barrel milestone, central bankers are confronted with a stark reminder that the season of market swings, initially set in motion by the pandemic and compounded by the Ukraine conflict, remains a pressing concern.The sudden upswing in crude prices prompts a pivotal question for central bankers convening this week in global financial capitals, from London to Washington. Discerning whether this surge is a fleeting anomaly or indicative of a prolonged trend is paramount, given oil's dual ability to stimulate consumer price inflation and act as a potential drag on economic growth.The abrupt escalation in commodity prices can signal an immediate cause for concern for central bankers. In a recent analysis, the International Monetary Fund examined over 100 instances of inflationary shocks dating back to the 70s. It was discovered that consumer-price growth showed an enduring downshift in only approximately 60 percent of cases within five years.World's Possible Economic PerilsRapid inflationary trends are exerting a significant impact on the bond market. Yields on two-year Treasury bonds have risen by over 30 basis points this month, nearing levels not seen in 16 years, witnessed in July. Similarly, German bond yields have undergone an uptick of roughly 25 basis points, propelling the 10-year yield near its highest point since 2011.This trend highlights a growing apprehension about the effects of inflation on interest rates.In a notable development last week (Sep. 14, 2023), the European Central Bank (ECB) indicated a momentary halt following a closely contested decision to implement rate hikes. This decision was promptly correlated with the escalating crude oil prices by its former chief economist, Peter Praet.Source: cbrates.comThis week and next, the global monetary policy landscape faces a critical juncture, marked by apprehensions surrounding the Federal Reserve's imminent decision to temporarily ease its tightening measures this Wednesday, with potential implications for future actions.The Bank of Spain has sounded the alarm regarding a twofold peril arising from an unexpectedly brisk surge in inflation for the current and forthcoming year, driven by a spike in crude oil prices and a tepid economic expansion. This caution has resulted in a dip in the euro's value, recently touching a six-month low, as markets cast doubt on the European economy's resilience in the face of elevated interest rates.Traders are already factoring in more than two anticipated quarter-point rate reductions for the ensuing year, notwithstanding the ECB's guidance indicating a prolonged period of high borrowing costs. The previous year saw the continent grappling with a crisis from losing access to Russian gas, causing a sharp euro depreciation against the dollar. This year, uncertainty persists regarding the European economy's performance if prices continue progressing.In the United States, the escalation of oil prices coincides with indications of strain on consumer balance sheets. A more significant portion of disposable incomes is now allocated towards interest payments, while the surplus savings accrued during the pandemic are closer to exhaustion.The prospect of elevated energy costs is anticipated to put a damper on consumer spending, potentially alleviating pressure on the central bank to maintain a tightening stance. The Fed is closely monitoring for any indications of inflation expectations rising, but thus far, such an occurrence remains absent.Central banks draw upon the sobering recollection of the 1970s as they chart their course. This period was characterized by extended oil shocks driven by supply constraints, resulting in persistent inflation and a subsequent impact on economic growth in advanced economies.Considering this context, much like certain policymakers posit that the critical inquiry regarding rates revolves around not their upward trajectory but the duration of their persistence at elevated levels, a parallel examination is warranted for the potential course of any future surge in crude prices.

https://sputnikglobe.com/20221205/oil-prices-surge-as-price-cap--embargo-on-russian-crude-enter-force-1105039725.html

https://sputnikglobe.com/20230916/new-debts-will-not-help-german-economy-chancellor-scholz-1113423921.html

https://sputnikglobe.com/20220323/dow-plummets-400-plus-points-as-oil-prices-surge-amid-concerns-over-inflation-supply-shortages-1094129432.html

london

saudi arabia

russia

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

oil prices, goldman sachs, opec+, saudi arabia, russia, brent, global economy, central banks, inflation, economic growth, monetary policy, interest rates, consumer spending, market volatility, central banks monetary policy meetings.

oil prices, goldman sachs, opec+, saudi arabia, russia, brent, global economy, central banks, inflation, economic growth, monetary policy, interest rates, consumer spending, market volatility, central banks monetary policy meetings.

Goldman Sachs Foresees Oil at $100 as Global Economy Braces For Impact

Central banks worldwide are facing a challenge with oil prices, soaring towards $100 per barrel, thereby prompting policymakers to navigate potential inflation risks and economic repercussions while grappling with prolonged market volatility concerns.

The Goldman Sachs Group Inc. rejoins the $100-per-barrel bandwagon, seeing prices at triple digits due to the

substantial supply cuts by the OPEC+ heavy hitters, Saudi Arabia and Russia, in addition to an uptick in demand tightening the international oil market.

Oil prices have undergone an over 30 percent hike, marking a pronounced upswing since mid-June, surpassing the $95 per barrel mark on Tuesday. Consequently, the prominent Wall Street financial institution has adjusted its annual forecast for the international standard Brent, raising it to $100 from its previous estimate of $93.

“The latest spike in oil prices is massively unhelpful... That said, it is important to keep these recent inflationary developments in context. We are not yet in danger of undoing 12 months of solid disinflationary progress – not even close,” Dario Perkins, an economist at GlobalData TS Lombard, stated in a report.

Moreover, the upbeat economic prospects in the US and China that drive momentum amid dwindling stockpiles have also contributed to the oil rally in the past few months, reaching a 10-month peak. According to Goldman Sachs, most major economies are presently headed for an economic slowdown.

Amidst the global shift towards a more

stabilized monetary policy, a new wave of volatility looms over the world economy, driven by soaring oil prices. As crude oil inches closer to the $100 per barrel milestone, central bankers are confronted with a stark reminder that the season of market swings, initially set in motion by the pandemic and compounded by the Ukraine conflict, remains a pressing concern.

5 December 2022, 06:50 GMT

The sudden upswing in crude prices prompts a pivotal question for central bankers convening this week in global financial capitals, from London to Washington. Discerning whether this surge is a fleeting anomaly or indicative of a prolonged trend is paramount, given oil's dual ability to stimulate consumer price inflation and act as a potential drag on economic growth.

“Oil’s run is going to play a factor for all central banks” as inflationary effects start to move in the “wrong” direction, said Brad Bechtel, global head of foreign exchange at Jefferies LLC in New York.

The abrupt escalation in commodity prices can signal an immediate cause for concern for central bankers. In a recent analysis, the International Monetary Fund examined over 100 instances of inflationary shocks dating back to the 70s. It was discovered that consumer-price growth showed an enduring downshift in only approximately 60 percent of cases within five years.

World's Possible Economic Perils

Rapid inflationary trends are exerting a significant impact on the bond market. Yields on two-year Treasury bonds have risen by over 30 basis points this month, nearing levels not seen in 16 years, witnessed in July. Similarly, German bond yields have undergone an uptick of roughly 25 basis points, propelling the 10-year yield near its highest point since 2011.

This trend highlights a growing apprehension about the effects of inflation on interest rates.

In a notable development last week (Sep. 14, 2023), the

European Central Bank (ECB) indicated a momentary halt following a closely contested decision to implement rate hikes. This decision was promptly correlated with the escalating crude oil prices by its former chief economist, Peter Praet.

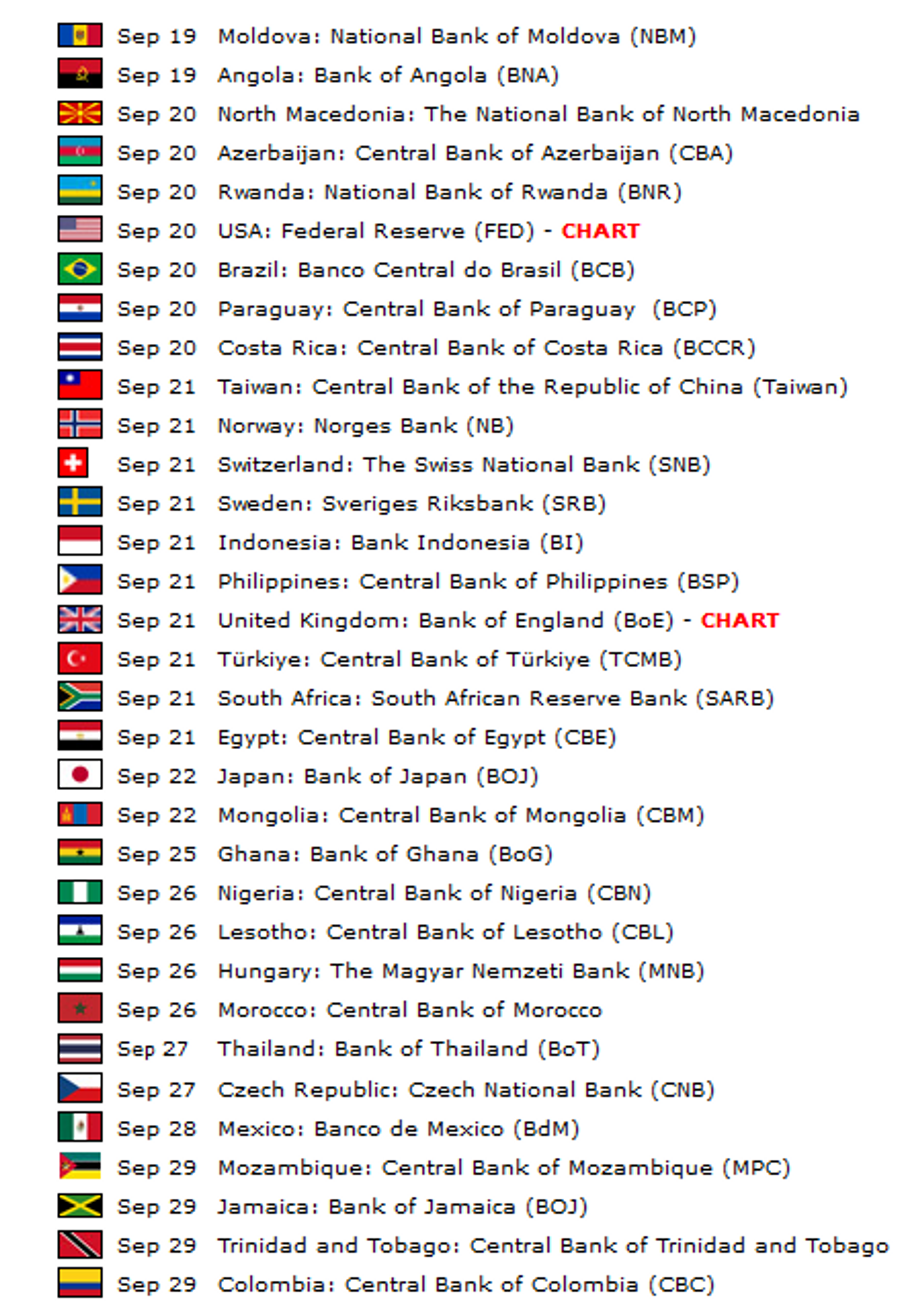

Source: cbrates.comThis week and next, the global monetary policy landscape faces a critical juncture, marked by apprehensions surrounding the Federal Reserve's imminent decision to temporarily ease its tightening measures this Wednesday, with potential implications for future actions.

The Bank of Spain has sounded the alarm regarding a twofold peril arising from an unexpectedly brisk surge in inflation for the current and forthcoming year, driven by a spike in crude oil prices and a tepid economic expansion. This caution has resulted in a dip in the euro's value, recently touching a six-month low, as markets cast doubt on the European economy's resilience in the face of elevated interest rates.

16 September 2023, 19:00 GMT

Traders are already factoring in more than two anticipated quarter-point rate reductions for the ensuing year, notwithstanding the ECB's guidance indicating a prolonged period of high borrowing costs. The previous year saw the continent grappling with a crisis from

losing access to Russian gas, causing a sharp euro depreciation against the dollar. This year, uncertainty persists regarding the European economy's performance if prices continue progressing.

In the United States, the escalation of oil prices coincides with indications of strain on consumer balance sheets. A more significant portion of disposable incomes is now allocated towards interest payments, while the surplus savings accrued during the pandemic are closer to exhaustion.

The prospect of elevated energy costs is anticipated to put a damper on consumer spending, potentially alleviating pressure on the central bank to maintain a tightening stance. The Fed is closely monitoring for any indications of inflation expectations rising, but thus far, such an occurrence remains absent.

Central banks draw upon the sobering recollection of the 1970s as they chart their course. This period was characterized by extended oil shocks driven by supply constraints, resulting in persistent inflation and a subsequent impact on economic growth in advanced economies.

Considering this context, much like certain policymakers posit that the critical inquiry regarding rates revolves around not their upward trajectory but the duration of their persistence at elevated levels, a parallel examination is warranted for the potential course of any future surge in crude prices.

“Central banks can’t do anything about these short-term supply-driven shocks, but they can do something to keep expectations in line. This is the big difference with the 1970s — we now have central banks that have more of a track record in bringing inflation to target," argued Charles Seville, an economist at Fitch Ratings in London.