MOSCOW, May 3 (RIA Novosti) – Russia’s Qiwi payment terminal operator has announced the pricing of its shares at $17 in the company’s initial public offering on the NASDAQ stock exchange, according to a message on the NASDAQ site.

That is in the middle of the previously announced price range of $16-18, and would value the company at around $884 million.

Qiwi is to sell 12.5 million class B shares in the form of American Depositary Receipts (ADR), with trading beginning on May 3.

Shareholders selling their stock are set to gain around $213 million.

The sum of the IPO does not include an additional 1.875 million shares which can be sold by the offering’s bank organizers within an additional 30 days, which would bring the total sum up to $244.4 million.

The offering is only the second Russian IPO on the NASDAQ this year.

Qiwi previously said that after its IPO, the amount of stock it had issued would total 52 million shares including 40 million class A shares and 12 million class B, with 24 percent of the company in free float.

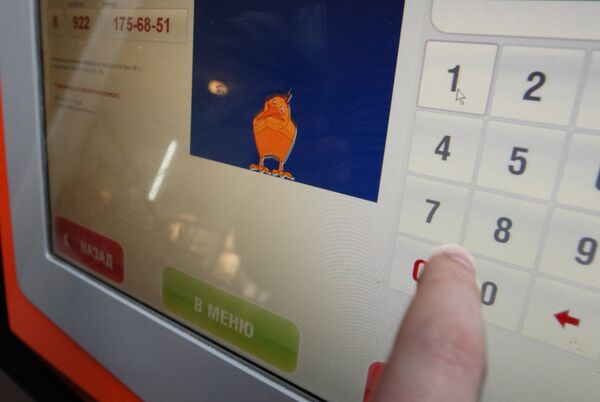

Qiwi, which started business in 2004, is a provider of instant payment services in Russia and the CIS.