MOSCOW, November 20 (RIA Novosti) – Russia’s financial regulator revoked the operating license of a major Moscow-based bank Wednesday, leaving depositors owed almost $1 billion and causing a wave of problems with withdrawals from ATMs.

Master Bank, the 41st largest bank in Russia by deposits according to a RIA Novosti rating, was guilty of conducting “large scale suspicious operations” and had violated laws against money laundering and the financing of terrorism, the central bank said in a statement explaining its decision.

The move is the latest in a series of such license revocations by Russia's financial regulator, which is seeking to tighten oversight on the country’s hundreds of banks, many of which are closely linked to specific businesses.

Master Bank, which counts President Vladimir Putin’s cousin, Igor Putin, as a member of its board of directors, has been mired in a money laundering investigation since 2011 that has led to the arrest of several top executives.

Russia’s Deposit Insurance Agency said Wednesday that initial estimates put payments owed to depositors at Master Bank at about 30 billion rubles ($914 million).

Central bank officials said Wednesday that there was also a 2 billion ruble ($60 million) hole in Master Bank’s balance sheet generated by loans made to companies affiliated to the bank's owners.

Master Bank’s branches were closed, and its website down Wednesday, and other Russian banks that had partnered with it to use its large network of ATMs issued cautions to their customers about withdrawal problems.

Alfa Bank, Russia’s largest private bank, warned clients in a statement not to use Master Bank ATMs.

Smaller Russian banks such as Finam and BFG-Credit said in statements that their customers were temporarily unable to use cards to withdraw money, or make payments.

Russian police said Wednesday that officers were currently inside Master Bank’s central office where they were confiscating material, apparently in connection with the long-running money laundering investigation at the bank.

Master Bank officials have been unavailable for comment.

Igor Putin, who first joined Master Bank in 2010, defended the lender last year from money laundering accusations after the homes of top executives were raided by police, suggesting that the law enforcement agencies’ attentions were part of an effort to discredit the bank.

Master Bank is 85 percent collectively owned by Boris Bulochnik, 64, who heads the financial organization, RBC Daily reported. His wife, Nadezhda Bulochnik, chairs Master Bank’s board of directors and their son, Alexander Bulochnik, is a vice president.

Bulochnik, one of the founders of a Moscow museum dedicated to explorer and artist Nikolai Roerich, has been head of Master Bank since 1994.

The cancellation of Master Bank’s license comes amid a crackdown on shadowy banking activity in Russia. Elvira Nabiullina, who was appointed as chairman of Bank Rossii earlier in June, has made the campaign a key part of her leadership of the regulator.

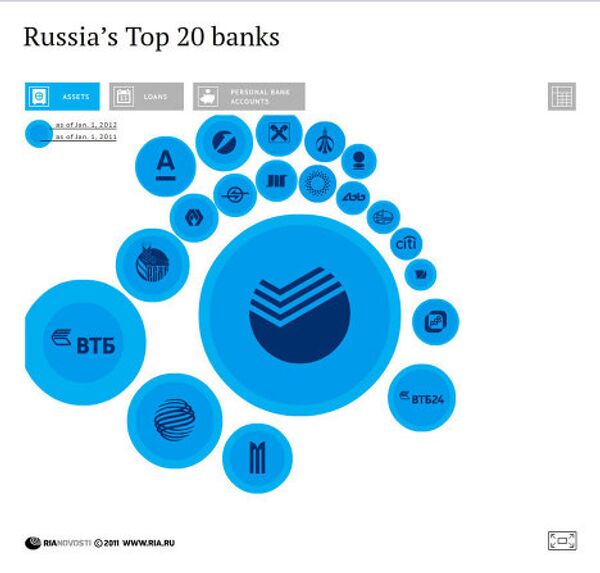

Master Bank is the 23rd bank to lose its license this year, according to the central bank. Although the banking market is dominated by a few giant lenders, Russia has almost 900 active banks.

Recast throughout and updated with new details, background and headline