NEW YORK, July 15 (RIA Novosti) – A new development bank from the world’s key emerging economies highlights a worrying “go-it-alone” attitude that will not resolve global monetary woes, an economist told RIA Novosti.

“This is a concerning development that shows how multilateral cooperation on economic issues is becoming more fragmented as developing countries lose faith in our current institutions. Rather than create new institutions, all countries should work together to reform the global monetary order,” said Adam Hersh from the Center for American Progress think tank.

“Governments should devise a way forward for international monetary relations so that countries don’t have to pursue export-led growth strategies while accumulating piles of foreign exchange reserves that are used inefficiently as insurance against the rest of the international financial system.”

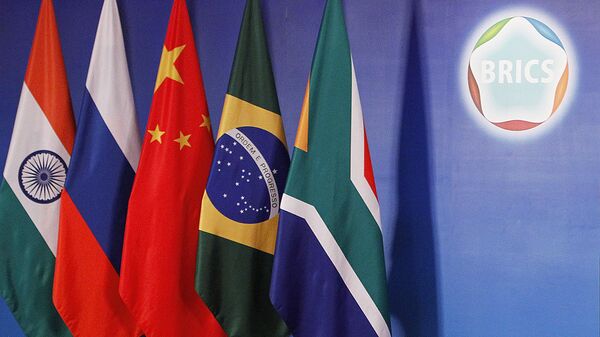

Envoys from Brazil, Russia, India, China, and South Africa (BRICS) are meeting in Fortaleza, Brazil, for a July 15-16 summit aimed at launching two $100 billion institutions, the BRICS Development Bank and Contingent Reserve Arrangement (CRA).

The BRICS Development Bank and the CRA mirror the World Bank and the IMF, which are criticized for being Western-dominated. They will help emerging nations borrow cash for building highways, power stations and other major infrastructure schemes.

The five BRICS states represent about one-third of the global population and a combined economy of $13.6 trillion. Critics describe a disparate group that is better at delivering anti-Western slogans than concrete action.