“We have seen a lot of the physical gold go from the West to the East and I’m sure that the central banks do not have anywhere near the gold they should have,” Egon von Greyerz said, explaining that China has been one of the largest buyers of gold recently, and asked for a physical delivery.

“It will be significantly high, definitely,” he said commenting on the price of gold in the future. “And the wise countries in the world, which is Russia, China, India – they understand this and they accumulate gold and buy more. Russia is continuously buying more, they understand what is happening.”

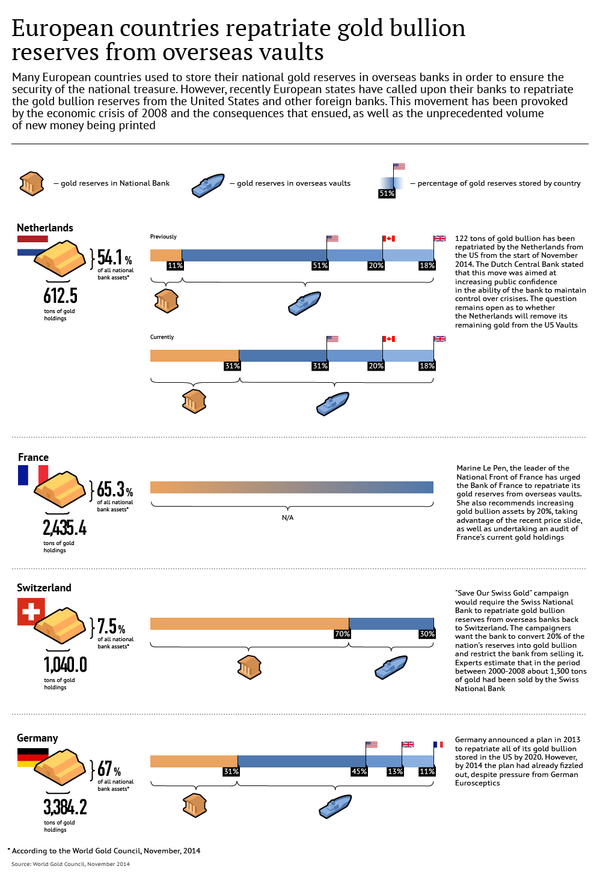

The United States, where many European countries kept their gold reserves may not even have the gold bars themselves and gold repatriation will not be feasible simply in physical terms. In the meantime, printing more money not backed by gold, devalues the paper money, as well as buys votes.

“Printing money is the way of buying votes, you buy votes of the people by printing more money. And you pretend it’s your real money,” Egon von Greyerz told Sputnik.

“As long as the governments destroy the value of paper money by just printing lots of it, gold is an important investment just to protect yourself against this destruction of paper money. This is what the Russian government sees, and what China and India see and the West, sadly, has a different view,” he stressed.

Egon von Greyerz also pointed out that central banks are not revealing how much gold they have and it is very likely that they have a lot less than they officially say that they have.

The West appears to be ignorant of the important role of gold, but eventually it will be gold that could stop them from printing money, he said.

Gold repatriation has recently become an issue in France, the Netherlands and Germany with people demanding their national reserves be returned home.