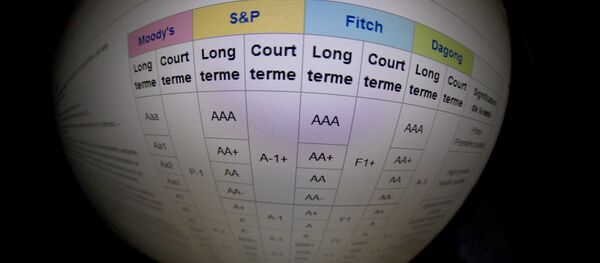

US rating agencies Moody’s, Standard & Poor’s (S&P) and Fitch use American political and ideological thinking to assess Russia’s risk of sovereign debt. As a result, Russia’s credit ratings were dropped to the level of BB– which is a totally unreasonable move, Jianzhong said.

“They are all ideological criteria and have nothing to do with a central government’s ability to generate revenues and its ability to repay debts. If one uses these standards to assess credit risks of the United States, one may come to the conclusion that the US economy would never default, because they can repay their debts by printing more money. It is obvious that these criteria are unfair.” – said the president of Dagong.

The downgrade of Russia’s credit ratings shows that even after the failure of 2008 that caused the global economic crisis, the perverse credit rating system, employed by Moody’s, S&P and Fitch, still controls the international credit system. The current credit system is an effective tool that the United States uses to spread its hegemony. The international community needs to reform the existing credit system to make it a fair deal for everyone, not just the United States, the president of the Chinese credit agency said.