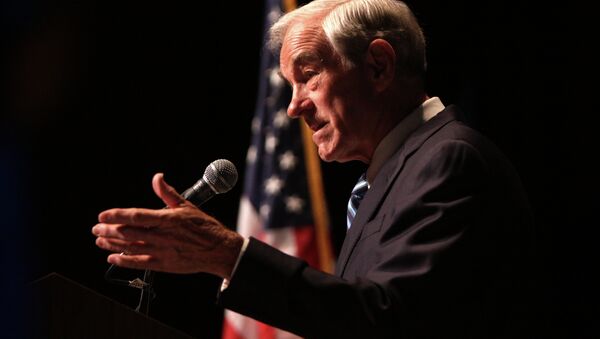

The rising Dollar index, which reached its 12-year highs against the basket of currencies, is not a reason for optimism, warned Ron Paul, a former Republican congressman and two-time US presidential candidate.

"It's not so much that the dollar is a great currency. It's the fact that nothing else is any better. The fundamentals are a disaster. The economy is in bad shape when you have more than half the people hardly making ends meet," Dr. Ron Paul underscored.

According to Dr. Paul, the Federal Reserve's policies facilitated the unprecedented growth of the dollar against other major currencies, not real economic growth.

"We do not have a healthy economy because we do everything to perpetuate debt, increase debt, increase regulations," he noted.

Unfortunately, we cannot predict when exactly the dollar bubble will finally burst, the former congressman underscored, referring to the Global financial crisis of 2007-2008, that was entirely unexpected. "Nobody warned us about that," he remarked bitterly.

"Right now, the markets have tried to correct things since '08 and '09 but the correction has been prohibited. It's just like in the Depression; we prohibited, we delayed the inevitable," Ron Paul stressed.

Ron Paul suggested that the collapse of the dollar and the stock market could be triggered by the Fed's decision to raise interest rates. Remarkably, many experts believe the Fed will propose such a measure later this year.