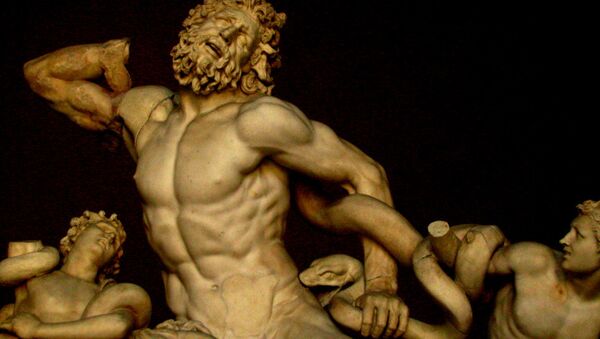

One man hides the money, accused of being part of a conspiracy to force the Greek government to accept the EU austerity reforms in exchange for bailout funds. All the while another man anoints the feet of the European Central Bank (ECB) in the hope of delaying the date by which Greece must pay off its debt.

The financial system and the Greek government are fighting each other — their fate yet to be decided and in the hands of the banking gods.

I spoke of a possible ESM-mediated repayment of ECB's SMP GGBs and some journos report I announced….nonpayment. Astonishing propaganda!

— Yanis Varoufakis (@yanisvaroufakis) May 14, 2015

While the Greek finance minister Yanis Varoufakis urges the European Central Bank to give Athens more time to pay back its debt bonds, members of the Greek government are accusing the country's central bank governor Yannis Stournaras of concealing a stash of emergency cash to pay off $750 million to the International Monetary Fund.

Bank of #Greece's Stournaras tells @ta_nea he isn't resigning despite Syriza pressure & it was he who found IMF payment solution. /via @tzaf

— Yannis Koutsomitis (@YanniKouts) May 14, 2015

It's been reported that many members of the Greek government were oblivious to the existence of the emergency fund amid the drama and discourse of Greece's financial state.

According to a member of the Syriza party, Dimitris Vitsas, "Mr Stournaras did, in fact, come clean, just days before the payment date. But that's not when he found out about the money.

"The account has been sitting around for years and he left the government scrambling in the dark."

In the next few months, Athens is supposed to repay over 6 billion euros to the ECB — but the Greek finance minister Yanis Varoufakis says that the country risks running out of cash within a fortnight if no deal is reached — which is why he's asking for more time from the ECB.

The Greek gov has been flicking Stournaras' ear quite hard today. Would be silly to "resign" him, but some discipline might just do good.

— Yiannis Βaboulias (@YiannisBab) May 14, 2015

Yanis Varoufakis wants the ECB to allow Athens to delay paying 27 billion euros in Greek bonds. The bonds were bought by the ECB in 2010 and 2011.

"It's quite simple, these bonds must be pushing into the future, this is clear also to the ECB," said Varoufakis.

But as the clock keeps ticking — the four-month long deadlock between Greece's left wing Syriza-led government and European Union IMF creditors continues over reforms the government need to agree on in order to receive a final 7.2 billion euros in bailout funds.

Defaulting Could End In Discourse

"If they miss a payment they won't be considered technically in default according to the ratings agency," Harry Colvin, consultant from Longview Economics told Sputnik.

"Even if they miss a payment to the IMF, the ECB won't cut emergency liquidity assistance. They're basically a facility for EU institutions facing a temporary liquidity challenge, and that's what they're arguing for."

Colvin says the ECB will agree and keep providing emergency liquidity assistance even if they miss a payment to the IMF. "If the government agree it's a liquidity challenge, not a sovereignty one, the ECB would be fine".

And the drama is set to continue:

"Even if they miss a payment to the International Monetary Fund, it won't be until after a month following the missed payment that the managing director of the IMF formally reports it to the board. So despite missing a payment — it won't be for a month later that we see any serious ramifications on Greece's position in the Eurozone."

As for the protagonists, Greece's central bank governor Mr Stournaras who supports a tougher fiscal policy has refused to comment on the concealed cash.

Meanwhile, Greek finance minister Yanis Varoufakis who is urging the European Central Bank to give Athens more time to pay back its debt bonds, has been reported saying:

"Never in the history of the European Union project has there been a man more subservient to the tyranny of its creditors."

The next scene on stage in Athens will be a meeting of Eurozone finance ministers on May 25.