“It would be very good that if the two institutions [AAIB and NDB] also have a collective group,” Jalan said.

Jalan doesn't see the two organizations as rivals because they have “different source of funding.”

AIIB is a China-proposed financial institution created primarily to invest in infrastructure projects. AIIB is expected to be launched by the end of 2015. Currently it unites 57 prospective founding nations, including China, Russia, India, the United Kingdom, Australia and Germany.

Membership in the Asian Infrastructure Investment Bank (AIIB) is an opportunity for countries to exchange best practices in infrastructure development, Bimal Jalan said.

"It's not only money but what can be done… Most of them [AIIB members] are developing countries and many of them are in different stages of developing infrastructure, even in urban areas and connectivity between urban and rural areas. We can learn from each other," he said.

Agreed by leaders of the BRICS economies — Brazil, Russia, India, China and South Africa – the NDB will also focus on infrastructure projects in developing countries. The NDB is expected to begin operations July 7, according to Russian Deputy Finance Minister Sergei Storchak.

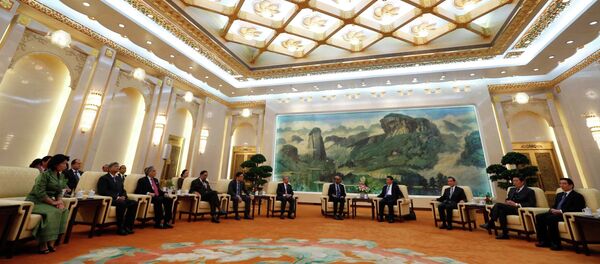

Earlier on Monday, 57 prospective founding nations met in China’s capital of Beijing to sign a legal framework determining each country’s share of voting rights and AIIB’s initial capital. China, India and Russia are the bank’s three major shareholders with 26, 7.5 and 5.9 percent of the votes, respectively.