On top of debt relief, the Fund also called for $67 billion (€60bn) in additional funding for Greece over the next three years to help stabilize the economy, and a 20-year grace period before making debt repayments, further highlighting the country's disastrous financial crisis.

The admission from IMF officials is seen as conceding a point to the current Greek government, headed by Prime Minister Alexis Tsipras and Finance Minister Yanis Varoufakis, who have both said that they will not sign up to new bailout terms unless a significant portion of debt is slashed from their account.

For 5 months now, #Greece has dealt w/unprecedented blackmail to accept recessionary measures. Our people will decide freely. #Greferendum

— Alexis Tsipras (@tsipras_eu) July 2, 2015IMF publishes Greece Debt Sustainability Analysis http://t.co/TlpMVWwqaZ

Senior Syriza officials have praised the comments as justification for their hardline stance against creditors, with Tsipras welcoming the IMF's intervention, despite noting that such a debt write-off proposal had not been tabled to him during negotiations.

Differing Demands Adding Pressure

While the IMF's call for debt relief has been welcomed with open arms in Athens, it is sure to rile senior figures within the Eurozone, who have been staunchly against writing off Greece's astronomical debt.

It is thought that German Chancellor Angela Merkel is one of the most vocal critics of offering Athens debt relief, given that German banks are one of Greece's largest creditors and any form of debt reduction could plunge the sector into financial trouble.

The fact that the IMF went public with their comments also provides an insight into the sometimes-tense relationship between the fund and Eurozone creditors, despite often presenting a united stance in public.

Greek officials and financial analysts have long complained that quarreling between the creditors has been one of the major sticking points during debt for reforms negotiations due to the different demands from the various parties, which Athens claims has made it nearly impossible for all parties to strike a deal.

IMF: Greece needs €50bn more loans in next 3 years IMF: cuts growth forecast from 2.5% to 0%, excl. impact of bank closure/capital controls

— Andrew Neil (@afneil) July 2, 2015

The IMF is thought to be opposed to negotiating reforms on Greek labor and pension issues, however open to reaching some form of agreement on the country's primary surplus, coupled with writing off some of Athens' debt.

However, conversely, the Eurozone — which owns the majority of the Greek debt — is thought to be vehemently against the idea of slashing Greece's debt and negotiating changes to the country's primary surplus, but open to labor and pension reforms.

Sparks Fly as Greferendum Looms

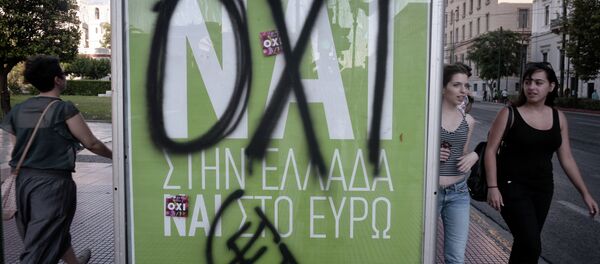

The IMF's call for debt relief has also sparked fresh life into the already vibrant referendum debate about whether Greeks should accept the terms previously offered to their government by the creditors.

While Greek officials have said that the referendum is simply a vote on creditors' proposals, a number of EU officials have been accused of using scare tactics to encourage Greeks to vote 'Yes' on Sunday, by claiming that a 'No' would be a choice between the euro or returning to Greece's former currency — the drachma.

They probably should have designed the #Greferendum ballot paper like this pic.twitter.com/b0KtZSEr1p

— Mathieu von Rohr (@mathieuvonrohr) June 29, 2015

As the campaigning for public support continues, a new row has erupted over the legitimacy of Sunday's referendum, with The Council of State, Greece's top administrative court, due to rule on whether it breaches the country's constitution.

Previous concerns have been raised over the lack of time between the announcement and vote, while other critics have raised concerns over the wording of the referendum, amid claims it is illegitimate.