Four major Russian oil companies have reported astonishing revenue growth in the second quarter of 2015, despite Western sanctions and shrinking oil prices.

The newspaper rationales that the costs of extracting oil and gas in Russia are based on the ruble, which devalues due to falling oil prices, making them less expensive.

On the other hand, the companies’ products are sold in the world market for dollars, not rubles, making their profit margins higher.

Oil and gas production in Russia are very inexpensive from a global perspective, not only because of the ruble’s low value but also because the country already has in place a longstanding energy infrastructure, left over from Soviet times. Therefore, there is not much need to engage in the cost-consuming development of new infrastructure.

There is also a disproportionately low tax burden, which has a delayed reaction to the oil price, it says. Plus, the recently reformed tax system favors exports.

However, the news outlet says that over the medium-term, problems remain in place.

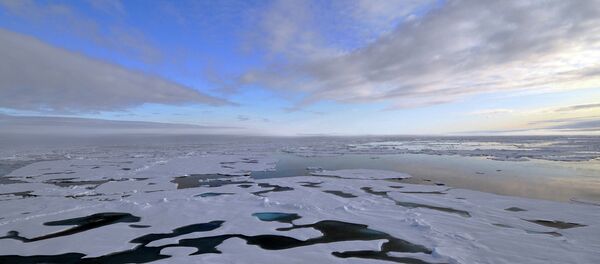

The majority of Russia's oil production transpires at developed mature fields. This is cost-effective, but these fields are gradually running out of oil. The way out is to develop new, remote and inaccessible fields, which, in turn, would entail high expenses.

Due to the sanctions, the companies are cut off from their Western capital markets. In some projects, like the extraction of shale oil, the companies may no longer cooperate with their American partners; the low ruble is not the only culprit.