Kristian Rouz — After the United States and 11 nations of the Pacific Rim drafted the controversial Trans-Pacific Partnership (TPP) agreement on 5 October, the global energy markets posted their best results for months, with Brent crude benchmark touching $53/bbl in London on 9 October, sliding thereafter on concerns of the Chinese slowdown. Nonetheless, the retreat in oil prices is expected to be only temporary this time around as currently there are several major factors indicating a greater demand for energy in the short-term. Amidst mainland China's economic deceleration and Iran's oil shipments in sight, both adding negative pressure on oil prices, upbeat data from the US, the UK and the Eurozone has signaled a demand-side improvement, whilst the TPP draft encouraged investors to buy into energy as the agreement is believed to provide a solid impulse to the newly industrialized nations of Asia-Pacific.

"Stagnant commodity price trends are dampening energy states' economic growth and are eating into economically sensitive revenue sources such as sales and personal income taxes," the international rating agency Fitch observed recently.

Energy firms in the US and Canada have been facing capital outflows as well, causing multiple and continuous sequences of idlings and re-commissions of oil derricks here and there. Meanwhile, corporate debt burdens amassed in the US oil industry, impairing financial performance of both energy giants like Chevron and Exxon Mobil and hundreds of smaller enterprises alike. Consequently, the US oil industry, while readjusting to the changing environment, is also seeking ways to bolster their revenues. The net debt of the US oil and gas companies doubled for $81 bln in year 2010 to $169 bln this June, according to data compiled by FactSet. Further cuts in drilling and exploration investment are to follow shortly, easing the supply-side pressure on the crude price.

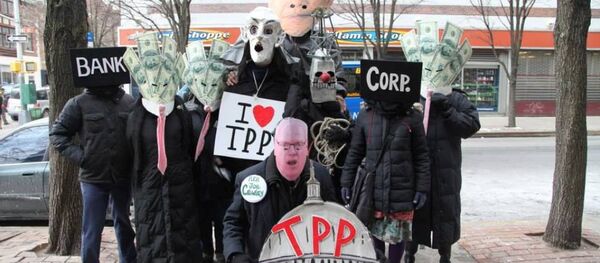

Now, aside from the implosion on the supply side, the demand side looks brighter than earlier this year. The TPP pact, drafted on 5 October, opens significant opportunities to the industrial nations of Asia-Pacific to bolster their exports of manufactured goods. In particular, Japan, Vietnam and Peru are projected to benefit from the pact by increasing their respective presence in the US market, allowing for greater factory gate demand in the former. Oil-producing nations are also enjoying some representation in the TPP draft, with Malaysia and Mexico anticipating an intensified trade in commodity goods with the more industrialized nations. As the exchange in commodity and manufactured goods intensifies, gradually heating up the market, prices are projected to go up, helping US inflation and global commodity prices.

Demand-side revival, possibly provided by the global economic acceleration (albeit within the band of the 'new mediocrity') and the TPP accord, will come to benefit first the non-OPEC oil producers like Russia, Brazil, Norway, Mexico and Oman, as these nations are enjoying a greater flexibility in their own petroleum trade. Whilst the OPEC nations are attempting to negotiate a coordinated coherent effort aimed at boosting prices, the outside oil producers rely on the emerging trade opportunities, both in Asia and North Atlantic.

The UK-based Barclays is expecting significant improvements in the energy market in the longer term, however, the process might happen sooner than expected.

"We expect the group's (of 10 major US-based energy firms) valuation will improve substantially over the next three to four years as the global oil market demand and supply are restored to a tighter balance by late 2017/2018," Barclay's said in a note published Monday.

The following day, the International Energy Agency (IEA) released a report, stressing the lingering oversupply in the oil market likely to last into 2016. However, the IEA noticed the growth in demand for oil. The US Energy Information Administration (EIA) has also been cautious in its recent estimates, expecting an average oil price throughout 2012 at $53-57/bbl of WTI benchmark, with the price peaking in January 2016 at $71/bbl.

Amidst the cautious forecasts, however, US energy speculators have been increasingly active since September. Hedge funds and money managers have been repeatedly cutting their bets on falling oil prices, whilst increasing their net-long positions in WTI oil. Select market participants voiced opinions the market is not as oversupplied as it was believed to be, in particular, in the light of the recent acceleration in the US economy. North American speculators, however, are cutting their bets on the European Brent benchmark, as the Transatlantic Trade and Investment Pact (TTIP) is still in the works, while few investors are expecting significant acceleration in Europe in the mid-term.

Meanwhile, oil production in the US is forecast to slump by 400,000 bpd next year, the biggest decline since 1989 as an aftereffect of the lengthy period of low prices and tax and investment complications. Hence, the markets will hardly be surprised with $80/bbl oil on Christmas eve.