Meanwhile, US treasuries have gained by 2.9 percent. This year’s most stable currency, the Japanese yen, has jumped by 6.5 percent. The MSCI World index, a common benchmark for global stock funds, has dropped by 6.2 percent.

SPDR Gold Shares, the largest gold exchange traded fund in the world, has attracted $4.55 billion of new inflows in 2016, the most among all US-listed exchanged traded funds.

In December, gold prices hit a record low for the last five years. The surge in the beginning of 2016 was due to investors’ concerns over the future of the global economy. In such a context, capital owners see gold as a safety asset.

At the same time, analysts say that gold prices may go down again if the US Federal Reserve moves as quickly as it planned to raise interest rates. This will make other assets more profitable than gold which then generates no yield.

Recently, gold has been high in demand in the global market.

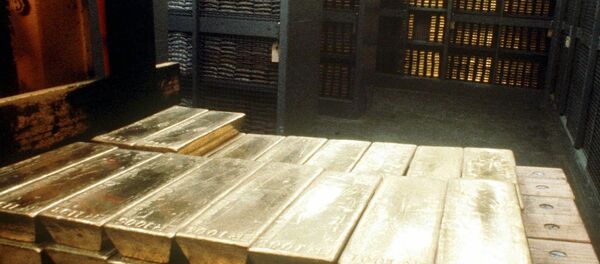

In January, Russia increased its gold reserves by 20 metric tons. Now, Russia’s stock stands at nearly 1,400 tons.

Since 2005, Russia’s gold reserves have nearly quadrupled, the article read, adding that in the last twelve months they had grown by more than 200 tons.

It also noted that there is the only country that is buying gold even more actively – China. Its reserves now stand at nearly 1,600. China ranks fifth globally, after the US, Germany, Italy and France. Russia comes sixth.