“Today the US financial economy is going into a new downward spiral led by debt,” the geopolitical analyst, who is also a strategic risk consultant and lecturer with a degree in politics from Princeton University, writes in his article for the New Eastern Outlook.

The author elaborates that indebted American consumers are the main reason for such a pathetic state of the country’s economy.

He cites the results of a recent study which revealed that in 2015 the average American household had $129,579 in debt — $15,355 of it on high-interest credit cards.

“Total consumer debt today is a staggering $11.91 trillion, almost 70% of GDP. It is even worse than the bare statistics.”

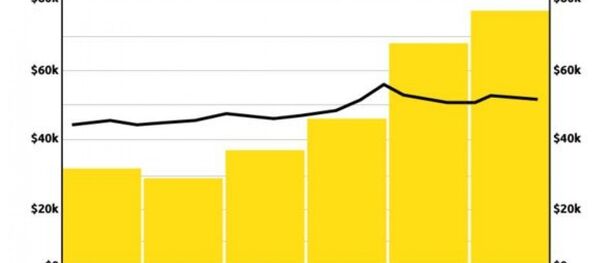

The American household is forced into debt increasingly because the rise in the cost of living has exceeded income growth over the past 12 years.

Median household income has grown 26% since 2003, but household expenses have outpaced it significantly — with medical costs growing by 51% and food and beverage prices increasing by 37% in that same span.

The average US household, the author says, pays a total of $6,658 in interest cost on home, cars, credit card debt per year, 9% from an average household income of $75,591.

There is another source of debt, the geopolitical analyst says, which is “assuming alarming dimension.” And that is student debt, “a new factor that 25 years ago was almost negligible.” Today students must borrow to finance college.

And the statistics are alarming.

“Today total outstanding student loan debt in the US is $1.2 trillion. Only home mortgage debt is higher,” the author says.

“About 40 million Americans hold student loans and about 70% of bachelor’s degree recipients graduate with debt.”

The consequences of such a high number indebted American consumers unable to make their payments are being experienced in many branches of economy.

“A further indicator of the true state of the US debt-bloated economy is the fact that the world’s largest retail group, Walmart, just announced it will close 154 of its giant stores that sell everything from food to garden equipment to toys,” the author notes.

Over the past two years hundreds of America’s giant shopping malls have been abandoned as store chains like J.C. Penney, Kmart, RadioShack and Sears close thousands of outlets.

“With the most severe collapse of oil prices in 13 years, the last remaining job-creating sector of the economy, the oil and gas industry, is rapidly becoming the domino that threatens to topple a mountain of dicey credits and threaten many banks,” F. William Engdahl says.

“Since the deal between the foolish US Secretary of State John Kerry and Saudi King Abdullah in September, 2014 to flood the world with cheap Saudi oil to create a crisis in the Russian ruble amid US sanctions, the worst hit in the unfolding crisis has been the US oil and gas industry, mainly unconventional, costly shale oil and gas,” he elaborates.

They have sold off hundreds of oil fields, eliminated an estimated two hundred fifty thousand jobs and slashed billions of dollars from capital spending and stock dividends, he adds.

With all the above in mind, he concludes, it is no wonder that the “American Hegemon is going bankrupt.”

“Debt is a strategic factor in the existence of any national economy, and has historically been the factor that ruins nations, the United States included,” he finally states.