In an open letter, the economists have called on politicians to come to an agreement to end financial secrecy at this week's anti-corruption summit in London, where officials from 40 countries, the World Bank and the International Monetary Fund (IMF) are expected to be in attendance.

MEDIA RELEASE: Tax havens ‘serve no useful economic purpose’; economists here join 300+ #AntiCorruptionSummit letter https://t.co/v1kzkTGryR

— Oxfam Ireland (@OxfamIreland) May 9, 2016

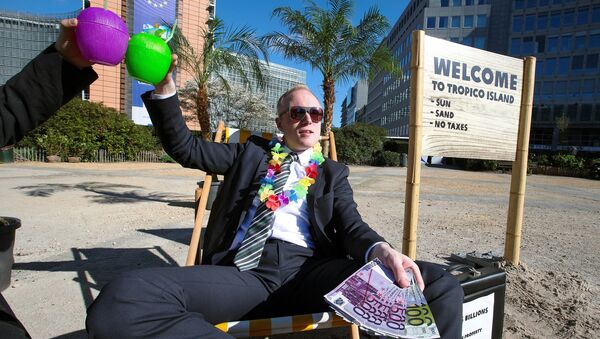

"Territories allowing assets to be hidden in shell companies or which encourage profits to be booked by companies that do no business there are distorting the working of the global economy," the letter says.

In order to break the status quo of financial secrecy, the economists have called on governments to agree on new global rules that would require companies to publicly report taxable activities in every country they operate, and to ensure all territories disclose information about the real owners of companies and trusts.

LuxLeaks, Panama Papers: the hypocrisy of Europe https://t.co/16qKb9hGVv

— Thomas Piketty (@PikettyLeMonde) April 12, 2016

Among the signatories are best-selling economics author Piketty, the 2015 Nobel Prize winner for economics, Angus Deaton, and US economist Jeffrey Sachs, who also acts as a special adviser to UN Secretary-General Ban Ki-Moon.

All Eyes Turn to London

The London summit, which was planned more than a year ago, has taken on greater significance, following the explosive Panama Papers leaks, which revealed a worldwide network of businesses and individuals using offshore trust funds and tax havens to avoid paying tax.

.Don't let the UK Anti-Corruption Summit be another missed opportunity! https://t.co/Dd2mTWhJoF #AntiCorruptionSummit

— Transparency Intl AU (@TIAustralia) May 9, 2016

The event has also taken on increased importance for the British government, with London accused of hypocrisy after calling for greater financial transparency, despite a third of the world's tax havens being either UK overseas territories or crown dependencies.

Critics have taken aim at British Prime Minister David Cameron, saying the Panama Papers have been key in highlighting the UK's failure to persuade its overseas territories to change their current tax havens set-ups.

"Tax havens do not just happen. The British Virgin Islands did not become a tax and secrecy haven through its own efforts," said Jeffrey Sachs, a US economist who is also a special adviser to UN Secretary-General Ban Ki-Moon.

"These havens are the deliberate choice of major governments, especially the United Kingdom and the United States, in partnership with major financial, accounting, and legal institutions that move the money."

Poor countries lose a staggering $170bn to tax havens. YOU can help stop this: https://t.co/0QcuB7kzXc #endtaxhavens pic.twitter.com/d3fOPWGDFo

— Oxfam International (@Oxfam) May 9, 2016

"The abuses are not only shocking, but staring us directly in the face. We didn't need the Panama Papers to know that global tax corruption through the havens is rampant, but we can say that this abusive global system needs to be brought to a rapid end. That is what is meant by good governance under the global commitment to sustainable development," Sachs said.

Negative Precedent

The UK, along with Luxembourg and Ireland, have been accused of setting a negative international precedent in relation to tax issues, with the LuxLeaks scandal of 2014 highlighting many of the sweetheart deals granted to multinational corporations by the tiny European duchy.

Meanwhile the Irish government, which has attracted investment in the country through setting low company tax rates, has also been on the receiving end of criticism from tax experts, who say its practices have led to a race to the bottom on tax competition.

Rich Should Pay Fair Share

With the issue of tax transparency taking on greater global relevance, campaigners say the abolition of tax havens and questionable tax schemes can help tackle global poverty, as it will provide many developing nations with more revenue to invest in many essential health and education programs.

"Millions of the world's poorest people will continue to be the biggest victims of tax dodging until governments act together to tackle tax havens, by introducing public registers of who really owns companies and trusts as well as automatic tax information-sharing between countries," said Winnie Byanyima, Oxfam International's executive director.

The sentiment was backed up by signatories of the open letter, who say the wealthy should pay their fair share in tax.

"Taking on the tax havens will not be easy; there are powerful vested interests that benefit from the status quo. But it was Adam Smith who said that the rich 'should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion'. There is no economic justification for allowing the continuation of tax havens which turn that statement on its head."