Andrew Lo, director of the Laboratory for Financial Engineering at the Massachusetts Institute of Technology, has announced that, "The capability is here," suggesting that, "The biggest hurdle is the cultural barrier. You’ve got a lot of central bankers who are not as open to technology."

The use of computers to do economic modeling is not new, and is an important tool in answering specific questions, but predictions made using computers are often less accurate than that of their flesh and blood counterparts.

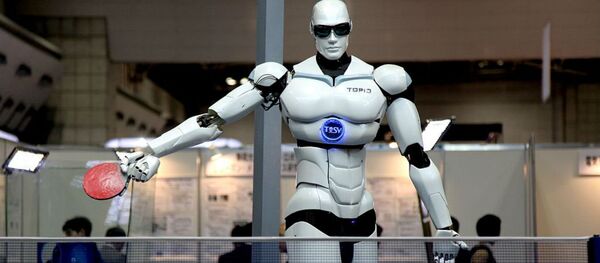

Lo suggests that artificial intelligence, or AI, will bridge the gap, using the process whereby technology learns to do tasks for which it hasn’t been programmed. Called 'machine learning,'the concept is already being applied to perform complex tasks, including classifying DNA sequences, detecting credit-card fraud, information retrieval, marketing, online advertising and stock market analysis.

Michael Feroli, an economist at JPMorgan Chase & Co., believes the technology has promise, saying, "I don’t see why, in principle, you couldn’t have a computer set monetary policy. Having it testify before Congress is another matter."

Paul Robinson, who heads the Bank of England’s Advanced Analytics unit, explained that the goal of a financial AI isn’t to replace human economists, but rather to make more accurate predictions. Robinson believes that this technology will have a significant impact on economic policy, "certainly within five years."

But not everyone feels warm and fuzzy with the idea of having an AI be responsible for decisions that could affect so many, and so profoundly.

David Wilcox, director of the Federal Reserve’s research and statistics division states, somewhat mechanically, "There will remain an irreducible amount of uncertainty that is very large, moreover, the phenomenon of structural change is pervasive in complicated economic systems. For the foreseeable future, the best approach will involve a combination of empirical rigor captured in models, together with human judgment."

University of Pennsylvania computer science professor Michael Kearns disagrees. He believes that although machines aren’t influenced by emotions and reasoning, the process by which humans and technology reach conclusions is very nearly the same. Kearns asserts that information deduced from events past is what makes experience, asking, "And what is experience other than data?"

Questions exist about whether current available data is detailed enough for an AI to produce a reliable forecast. Hal Varian, chief economist at Google, doesn’t believe it is. "The data sets are so small. GDP is released quarterly, so 50 years of data is only 200 observations and only seven recessions," Varian says.

Although Varian understands that data amounts are growing rapidly, and is generally a major advocate for AI, he believes that the technology will need to improve significantly before it can make economic calculations "dramatically better" than traditional economists.