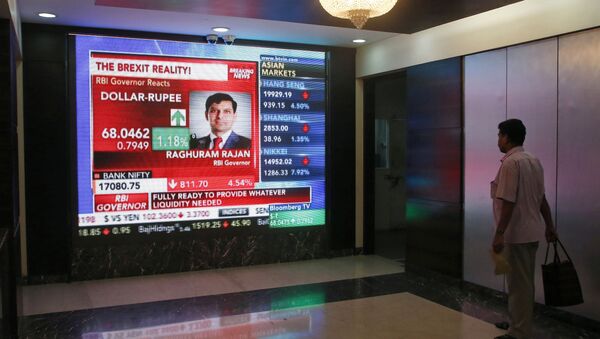

New Delhi (Sputnik) — As news of Brexit broke, Indian stock markets witnessed heavy selling, with Sensex falling more than 1,000 points in early trading. Indian companies with stakes in Britain were the most affected. The Indian currency, the rupee, also witnessed a sharp devaluation trading at 68 against US Dollar. This is the lowest in the last three months.

Since outset of Vajpayee govt in 2004,most events turned as per charts but 4 BREXIT-charts failed.Then no market study is 100% full proof

— Rakesh Bansal (@reachbansal) 24 июня 2016 г.

However, senior economist N R Bhanumurthy of the National Institute of Public Finance and Policy viewed this as a momentary phenomenon and said that Brexit is unlikely to have any long-term impact on the Indian market.

Indian Finance Minister Arun Jaitley said, "We respect the referendum's verdict. As investors look around the world for safe havens in these turbulent times, India stands out both in terms of stability and growth."

India's Central Bank Governor Raghuram Rajan said, "The Indian economy has good fundamentals, low short-term external debt, and sizable foreign reserves. These should stand the country in good stead in the days to come."

We value our multifaceted relationships with both the UK and the EU and will strive to further strengthen these ties in the years ahead

— Vikas Swarup (@MEAIndia) 24 июня 2016 г.

India is currently one of the fastest growing economies with a gross domestic product (GDP) growing at the rate of 7.6%. India expects growth prospects to further improve in the wake of good monsoons.

In 2016, India-Britain bilateral trade was $14.02 billion. Currently, it is estimated that more than 800 Indian companies have huge stakes in Britain.

The Indian government is of the view that Britain remains an entry point to the EU. Tata group has stakes in Britain as it owns Jaguar-Land Rover, Britain's largest carmaker. Brexit means the company will have to pay more taxes which could make its car more expensive in comparison to others. Tata Steel also has a huge stake in the British market.