Kristian Rouz — Carl Icahn, a billionaire business tycoon and investor with broad interests across the tech, real estate, finance, casino, biotech and entertainment industries, said in a recent Bloomberg Markets interview that US stock market is severely overpriced due to the dysfunctional monetary policies practiced by the Federal Reserve. Subsequently, his best suggested investment strategy is minimizing market exposure ahead of the looming shifts in policy and economic structure, or a massive financial meltdown.

"There's certainly good companies. (The market) is way overvalued at 20 times the S&P and I'll tell you why: a lot of it is a result of zero interest rates. It's just what I said. You have zero interest and a lot of buybacks. Money is not going into capital," Icahn told Bloomberg Markets.

The Federal Reserve's ultra-loose monetary policies, initially introduced in 2009 in order to boost lending and real economy investment, have produced significant risks stemming from the side effects of near-zero interest rates. The zero interest rates regime (ZIRP) was intact in the US in 2009-2015 for the Fed fund rates, determining base borrowing costs for the economy. The base rates were lifted off zero in December 2015, resulting in a visible blow to fixed-income and stock markets, with the broader economy slowing to near-1 percent growth in the three consecutive quarters between October 2015 and June 2016.

"Zero interest rates are building huge bubbles," Icahn said. "If you really look at it, the dollar is pretty strong right now, which is going to hurt international earnings. The S&P, they live on international earnings. That's going to be hurt. There's going to be a day of reckoning here."

Corporate earnings in the US have been demonstrating negative dynamics since mid-2015, affecting broader growth and triggering cuts in domestic investment. Besides, low interest rates have all but exhausted their positive effects to domestic investment as well, with the credit money flowing into the higher profitable financial assets rather than the struggling amidst the expansion slowdown real economy.

"We have no capital spending," Icahn explained the negative policy consequences to investment. "Capital spending is going way down. In a society like us, manufacturing is important <…> The last two years, I mean, it's just down four percent in the last quarter which is unheard of when you don't have a recession. OK. Productivity has not grown <…> These are very important things in a capitalistic system."

"I am saying that the middle class — that is why you saw this uprising for Bernie Sanders and you see it for Trump and you see Brexit and you see what's going on in Italy," Icahn said.

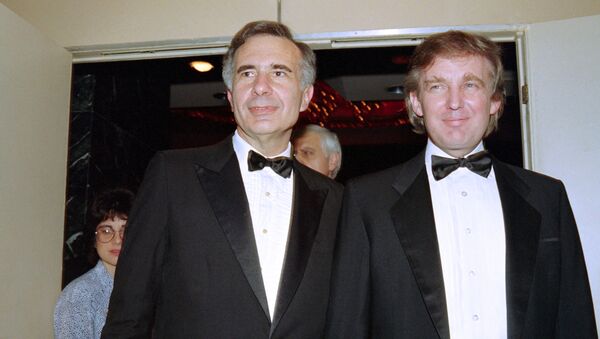

In such circumstances, Icahn Enterprises have cut their market exposure by 149 percent during the past 12 months by hedging against the capital losses in stocks and real economy. Putting his biggest bet on Trump's candidacy for President, Icahn suggested the nominee should focus on his proposed economic reform. The GOP candidate explained his economic plan, "Trumponomics," in late July, resulting in a surge of his nationwide popularity.

"I do believe that Donald has a great shot if he sticks to the positives, not so much to the negatives… about the economy," Icahn said.