Commenting on the event, Xinhua stressed that the renminbi inclusion in the elite currency basket "will help create a more multipolar economic order and advance reforms of the international monetary system."

Citing IMF research the media outlet emphasized that a total of 38 countries currently own assets in renminbi.

"Today the RMB has become the second largest currency for trade financing, the fifth-largest for international payment and the seventh largest reserve currency in the world," the media outlet highlighted.

For her part, Christine Lagarde, Managing Director of the IMF noted in an official statement published on the IMF official website on September 30 that "the expansion of the SDR basket is an important and historic milestone for the SDR, the Fund, China and the international monetary system."

"It is a significant change for the Fund, because it is the first time since the adoption of the euro that a currency is added to the basket," Lagarde stressed.

On Thursday US Treasury Secretary Jack Lew stressed that the renminbi "is still 'quite a ways' from true global reserve currency status," Reuters reported, adding that some China watchers fear that Beijing's "commitment to further market opening… will fade after its diplomatic success."

Still, China's emergence as a new geopolitical player and a global financial center cannot be overestimated.

"China is gradually moving away from its previously held strategy of 'thirdworld-ism' toward that of multilateralism, faintly challenging US hegemony," Shaheli Das, a Doctoral candidate at the Center for East Asian Studies, Jawaharlal Nehru University, suggested in her article for The Diplomat.

The scholar emphasized that Beijing is insisting on global governance reforms, including the restructuring of the Bretton Woods bodies, such as the World Bank and International Monetary Fund.

"In its bid to bring about such reforms, of late China has embarked upon its own process of global institution building. A case in point is the institution of a Silk Road Fund, which seeks to enhance connectivity and trade within the framework of the 21st century Maritime Silk Road and the Silk Road Economic Belt initiative; the BRICS-led New Development Bank; and the Asian Infrastructure Investment Bank (AIIB)," Das underscored.

Over the recent decades China has demonstrated a sustainable economic growth.

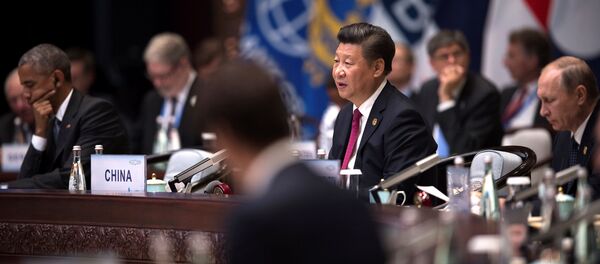

In this context it is logical that during the G20 Summit Beijing and the BRICS nations called upon the IMF to complete the Fifteen General Review of Quotas that would allow the emerging economies to increase voting shares with respect to their real "weight" in the world economy, Panova stressed.

She also recalled Russian President Vladimir Putin's remark made in the course of the September press-conference in Hangzhou.

"Yesterday's instruments, while they have not grown rusty, I hope, no longer produce the desired effects," Putin told journalists, "I am referring to investment, which is subdued, trade, which is not growing, and other dimensions."

Whether the US establishment likes it or not, China is becoming a center of global financial activity, Tom McGregor, Commentator and Editor at CNTV said in his interview with Sputnik, adding that European investors are turning to China.

"It's inevitable that more European financial institutions will expand operations into China, especially Shanghai, which seeks to become the next 'New York of Asia' and a financial capital powerhouse. Shanghai stands poised to rise to greater heights," he stressed.

There are clear preconditions for the emergence of a multi-polar world order, and this politico-economic change seems to be unstoppable.