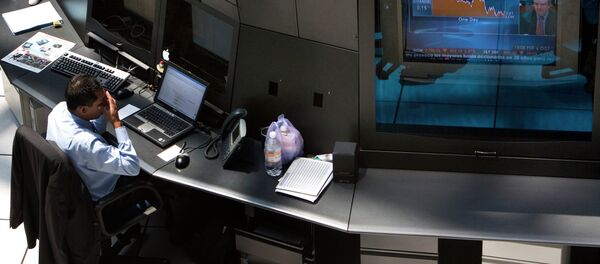

Kristian Rouz – The ongoing decline in global bond valuations, owing to Donald Trump’s election as the US president, has resulted in investors seeking profitable opportunities elsewhere, eyeing the news from the US leadership in transition for clues.

Albeit certain market participants, primarily hedge funds, have warned of the adverse effect of Trump’s election to the emerging markets, the looming re-industrialisation of the US would require a massive amount of commodity goods, and the nascent developments in industrial metals are stirring higher expectations for select overseas economies, including Australia, Chile, Brazil, and Russia.

On the Shanghai Futures exchange, copper has surged some 19pc since Trump’s election, to Australia’s sheer delight, as the island nation is a key industrial metals exporter. Other emerging markets, wobbly somewhat due to the dollar’s appreciation, are eyeing promising opportunities as well, including Chile, the world’s largest copper exporter, Brazil, one of the world’s leading aluminium producers, and Russia, boasting substantial volumes of steel and nickel exports.

"Positive sentiment is wavering with investors re-evaluating the implications of a Trump presidency," ANZ Bank said in a note.

Not all this, however, means the US will substantially expand imports of industrial metals, but gains in this commodity type prices are a sign of a global economic acceleration, prompted by the erasure of international bond markets capitalisation. For instance, mainland China has boosted spending on fixed assets despite the lingering sluggishness in manufacturing, resulting in an additional upward pressure on metals.

"Yields will continue to rise over the next year," Hiroki Shimazu of the Tokyo branch of MCP Asset Management said. "The fundamentals are very strong, particularly in the U.S. There are some signs of higher inflation pressures. Trump is pushing this phenomenon."

Since the 2000s, mainland China has taken the place of the US in many emerging markets’ balance sheets, and with the Chinese economy slowing, a wide spectrum of developing or transitional economies have been feeling the pain. However, the Trump-proposed renegotiation of the existing trade deals and the looming conclusion of the new ones could be the turning point.

"For many countries around the world, China is now the biggest trading partner, so this kind of tit-for-tat trade protectionism with China will dampen the atmosphere for the international trading community," Prof. Yorizumi Watanabe of Japan’s Keio University said. "That is no good for Japan or anyone else."

The question is, what international trade partners the Trump administration would consider best for US economic interests. With his protectionist drive, Trump would likely be opposed to trade cooperation with the established manufacturing leaders, such as Japan, mainland China or the Eurozone, who are immediate competitors to the US in the global market. Nations like Australia, Brazil, and Russia might be a likelier bet, particularly so in the wake of speculation of the looming trade wars between the US and mainland China.

"My guess is there will be some negotiations or renegotiations, but we will avoid the most extreme outcomes, though the long-term tendency is toward increased protectionism," Joseph Incalcaterra of the UK bank HSBC said.