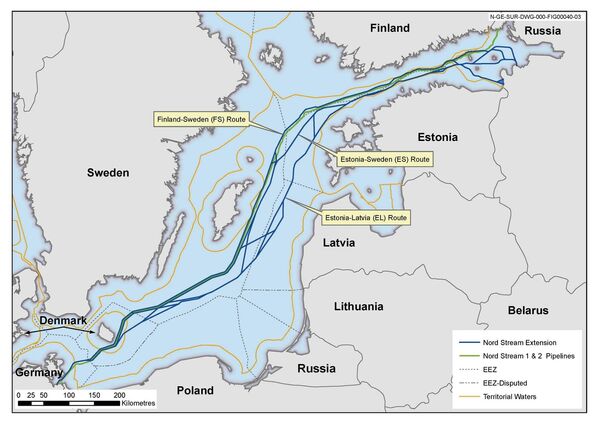

In an interview for Russian media ahead of his visit to Moscow earlier this week, German Foreign Minister Sigmar Gabriel said that Germany would support Nord Stream II, a proposed offshore natural gas pipeline stretching from Russia to Germany through the Baltic Sea, but only if it gets assurances from Moscow that it would preserve its gas transit agreements with Ukraine.

"We need Nord Stream II, but we also need the reliability of Ukrainian gas pipelines, and the reliability of energy supplies to countries such as Slovakia, the Czech Republic and Poland," Gabriel said. "I sense that our Russian partners are quite prepared for that," he added.

By all accounts, the foreign minister's remarks were aimed at quelling growing fears in Kiev that it may be permanently deprived of its status as a transit country for Russian energy supplies to Europe, a lucrative position which brings an estimated $2 billion in to Kiev's coffers every year.

According to the Russian company, Nord Stream II's benefits include what is effectively a guarantee that transit states will not be able to take politically-motivated measures to blackmail Russia or Western European customers by simply turn off the taps. Gazprom has had a series of disputes with Ukraine over many years over the use of its pipeline network, with Kiev repeatedly threatening to shut off transit to Europe and demanding that Moscow offer it reduced prices for gas in exchange.

In 2015, Kiev stopped buying gas from Russia altogether, factually ending its price disputes with Gazprom. Instead, it has decided to import gas from European countries, at a cost of over 20% more than it would have paid for the Russian gas. The absurdity of that situation is highlighted by the fact that the 'European' gas Kiev buys consists mostly of Russian supplies pumped into Europe and then sold back to Ukraine at marked up prices.

Nevertheless, Kiev remains interested in preserving the estimated $2 billion it receives via transit fees. Ukrainian officials and lawmakers have warned that the loss of the country's transit status would turn it into a "logistical backwater." Ukraine's current transit contract with Gazprom ends in 2019.

Russian political and economic analysts have their own perspective on the implications of Gabriel's remarks. In an interview for Expert.ru, market analyst Kirill Yakovenko explained that Berlin's apparent decision to tie Ukraine's transit nation status to Nord Stream II was predictable, and associated with political factors, not economic ones. The requirement, he noted, is based on the continued, slow-moving effort to engage Kiev in European integration. Following Washington's recent moves to distance the US from Ukraine, Brussels is now the sole remaining patron and investor in Ukraine's present authorities.

An economic element was also present, Yakovenko said. Brussels, according to the analyst, is fully aware that an end to Ukraine's transit status would only increase its dependence on Western economic assistance. The IMF, he said, is already the last major foreign entity willing to loan Kiev money via its tranche loans, and the EU and the US are the largest donors to the IMF.

Ultimately, Yakovenko suggested that even if Berlin takes a firm stand on preserving Kiev's transit status, and Moscow refuses the demands, the political energy to try to prevent Nord Stream II's implementation will gradually exhaust itself, particularly as Europe's faith in Ukraine continues to fall. A 1-2 year delay would be perfectly tolerable for such an ambitious project, the analyst noted, particularly given the complex financial and legal framework that must first be developed to implement it.

Last week, Nord Stream II project financial director Paul Corcoran told RIA Novosti that a deal to attract funds for the construction of the pipeline may be reached by the middle of 2018, with 70% of the financing coming from external funds, including banks and other institutions. This, Corcoran recall, was the same model employed to fund the first Nord Stream pipeline in 2011.

Also last week, Nord Stream II chief commercial officer Reinhard Ontyd said that the project expects to get an EU construction permit in the first quarter of 2018. On Wednesday, Wintershall CEO Mario Mehren indicated that a funding model for the project may be completed by mid-2017.