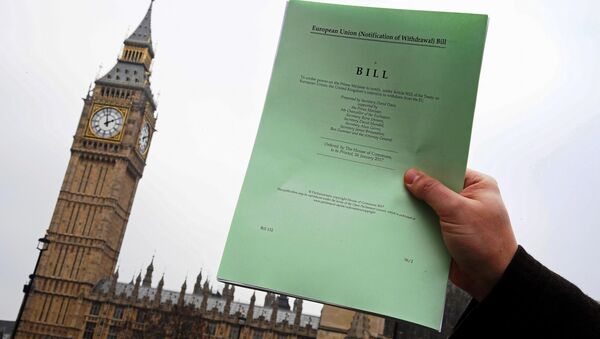

Kristian Rouz – As the UK is approaching the March deadline set by Prime Minister Theresa May to trigger the Article 50 negotiations, which means the nation’s effective withdrawal from the European Union, the British economy is bracing for a greater degree of uncertainty.

While certain sectors have demonstrated buoyant expansion after the Brexit referendum on June 23 last year, most prominently, manufacturing, the consumer-oriented areas of the economy have been affected by the pound’s devaluation and are exposed to Brexit’s downside risks.

The Article 50 separation clause might be initiated as early as this week, and the most likely outcome of the commenced UK-EU divorce for the British economy would hardly be quite dramatic. However, the downside pressure on the pound’s FX rate might impair consumer sentiment and further spur inflation, the British financials might suffer lower revenues from their services due to the Article 50-inflicting market anxiety. Meanwhile, UK manufacturing will likely remain the key winner in the entire Brexit affair, and the prospect of the UK achieving a sustainable foreign trade surplus looks more realistic.

The British pound has devalued by roughly 18pc against the basket of its major peers since the Brexit vote on June 23, 2016, pushing the UK inflation up to the Bank of England’s (BoE) 2-percent target, affecting consumer confidence and, indirectly, helping domestic loan issuance in the low-interest-rate environment.

Simultaneously, the UK’s main stock index, FTSE 100, has gained 16pc since the June 23 referendum, as riskier assets increased in value as higher-yielding, while the pound’s slump helped the UK’s investment appeal to foreign investors.

The macroeconomic signals since the referendum have mostly been modestly positive, which is particularly important due to the abundance of gloomy predictions regarding the Brexit risks. After the BoE cut its rates in August to 0.25pc, credit issuance surged across the UK by early this year, and in February the UK home prices posted a robust rebound. The real estate market typically reflects the investor perception of the longer-term economic prospects, but February’s increase of 0.6pc to an average national home price of £297,832 was fairly moderate, albeit the quickest in twelve months.

“Can consumers borrow even more?” Erik Britton of Fathom Consulting said. “Of course they can. That was the big error of judgment that ultimately triggered 2008-09. Would that be a good thing? No, it makes the crisis to come even bigger.”

Once the May cabinet triggers the Article 50, these fundamentals will likely change in accordance with the existing trends, and the consensus market expectations are slower growth, higher unemployment and higher inflation, thoroughly controlled by the monetary authorities. Yearly growth could dip below 2pc by 2018, whilst the unemployment, currently below 5pc, could go up to 5.5pc, and inflation, overshooting the 2-percent target by roughly 1pc, would be subsequently curbed by the BoE hikes in interest rates.

A more optimistic scenario, favoured by the Brexit proponents, suggests the surge of inflation above 4pc would spur domestic growth up to 3.5-4pc year-on-year by 2018, whilst the unemployment would dip below 4pc, pushing salaries and wages higher and further brightening consumer outlook.

Marc Carney, Governor of the BoE, said last month that higher inflation, gains in business investment and the resulting stronger growth would support the case for base interest rate hikes, allowing to normalise the monetary conditions in a quicker0growth environment, benefiting the economy to a greater extent. This, however, would only be possible if the trends in the UK economy prevalent in the second half of 2016, would extend into the next two years.

The most pessimistic observers expect the inflation to drop back to near-zero, along with growth, with unemployment rising to 6pc, mainly due to the decline in household consumption, undermined by the pound’s devaluation. Consumption drives some 79pc of the UK economy, and visible threats to consumer confidence could prove quite hazardous. Business investment could also decline in the UK due to the anxiety produced by the troubled divorce with the EU.

“There may be many Article 50-related news headlines in the coming weeks but we believe that a lot of the negativity around Brexit-related economic data weakness is already in the price,” Morgan Stanley analysts wrote, suggesting the more dramatic scenarios are a less likely probability than the more down-to-earth ‘get through it’ case.