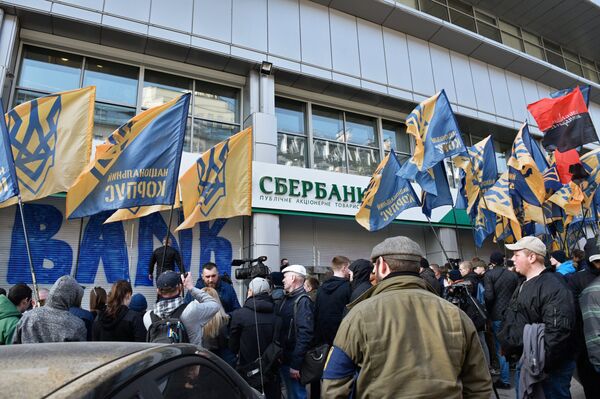

On Thursday, President Petro Poroshenko approved sanctions against the subsidiaries of 5 Russian banks, including Sberbank, VTB, BM-Bank (owned by VTB Group), Prominvestbank (a Vnesheconombank subsidiary) and VS Bank (a subsidiary of Sberbank).

Moscow has conveyed its concern with the situation unfolding around Russian banks' subsidiaries in Ukraine, saying that the activity contravenes international law. Russia is prepared to take all legitimate measures to protect the banks if necessary, presidential spokesman Dmitri Peskov said Thursday.

Russian officials and economists have also warned that Kiev's actions are making Ukraine's already investment-starved business climate even worse. Experts have pointed out that Russian banks account for about 10% of Ukraine's total market in banking services, with sanctions threatening to affect the entire sector, with knock-on effects for the economy as a whole. Four of Ukraine's 15 largest commercial banks are subsidiaries of Russian banks.

Speaking to Radio Sputnik about the implications of the sanctions, Nikita Maslennikov, senior fellow at the Institute of Contemporary Development, said that Kiev's shortsighted policy will only end up harming Ukraine itself in the end.

The economist emphasized that "today, the five [sanctioned] banks are among the healthiest and most efficient part of the financial and banking system of Ukraine." Effectively, he noted, "Ukraine is cutting the 'financial tree branch' on which it sits."

At the same time, the intent of the sanctions are "very clear," according to Maslennikov. Their purpose is "to cut financial communications between subsidiaries and their parent companies. It's as if they want to say 'Please, invest as much money as you like from Russia into Ukraine, but taking it back? That's a no-no.'"

Maslennikov indicated that some of his colleagues believe that the groundwork is being laid for the liquidation and nationalization of these banks' assets. Other experts have already pointed out that Ukrainian oligarchs with connections to the government may be given first dibs on these assets. "But what will the Ukrainian side achieve by doing so?" Maslennikov asked. "Trying to understand the intricacies of Ukrainian politicians' motivations is a rather dreary task," the expert noted.

According to the economist, one possible consequence of the sanctions may be problems for ordinary Ukrainians who have savings in the Russian banks' subsidiaries –and depositors in general. The figures speak for themselves. Sberbank alone has about 11.4 billion hryvnia (equivalent to about $425 million) in depositors' savings in its coffers, and that's not even counting commercial entities' funds, which amount to 7.4 billion hryvnia ($276 million).

"In a situation where Ukraine's credit banking system is already fairly fragile, one can only sympathize with those who fall under these millstones. Because if a run on Sberbank starts, then a domino effect – the flight of depositors from other banks, will be guaranteed. Therefore, Kiev would have done better to think long and hard and then think some more before imposing sanctions," Maslennikov concluded.