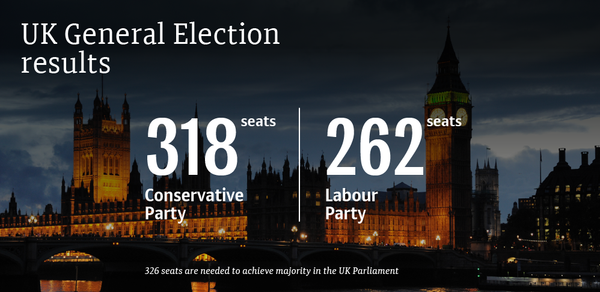

Kristian Rouz — After the UK general election erased the Conservative Party's majority in the Parliament, the British economy is facing stronger headwinds due to the rising uncertainty in the Brexit process. Prime Minister Theresa May still has solid chances to form a new majority together with Ulster's Democratic Unionist Party (DUP), thus staying on course to lead the nation through the divorce with the European Union.

However, a slowdown in manufacturing and construction, along with the dismal growth in salaries and wages and the rising inflation, might impair the UK's growth outlook.

In April, UK manufacturing and construction slowed down, marring the 2Q17 broader growth projections. Since the Brexit vote last year, a robust expansion in these two sectors had allowed to offset the challenges of the plunging pound sterling's FX rate and lower household disposable incomes. How, however, the outlook for the broader GDP expansion looks more uncertain.

UK manufacturing rose by just 0.2 percent in April, and so did broader industrial sector, which includes mining and utilities, according to a report by the Office for National Statistics (ONS). UK construction declined by 1.6 percent that same month as a result of weaker fixed investment in real estate development.

Manufacturing was mainly hit by the rebound in the pound's FX rate, affecting the British exports, whilst construction took a blow from the pre-election uncertainty, hampering investment. Now that the UK's political reality has barely changed after the election, as long as the Tories are able to form the government with the DUP, investment is poised to rebound, but manufacturing might still struggle.

"This was despite purchasing managers' index surveys suggesting that April had seen an improvement in momentum," Liz Martins of HSBC said. "While we still think GDP growth will be stronger in the second quarter than the first quarter's 0.2 percent, these data suggest the improvement may not be as big as indicated."

The UK's foreign trade balance has still improved in April with trade deficit steadily narrowing, despite the pound's rebound against its major peers. But this mainly happened because of the decreased imports, whilst exports were suppressed by the pound's recovery.

UK exports remained unchanged at £49.8 bln in April, whilst imports dropped to £51.9 bln in April from £53.7 bln the previous month, narrowing the deficit gap to just £2.1bln.

The UK economy's quarter-on-quarter expansion in expected at 0.3 percent in 2Q17 compared to 0.2 percent in Q1, and then to remain flat at 0.3 percent per quarter throughout the rest of the year. In 1Q18, however, the UK GDP is poised to accelerate to 0.4 percent quarter-on-quarter growth.

"The economy is going to continue to grow at sub-par levels," Jagjit Chadha of the National Institute of Economic and Social Research (NIESR) said. "We haven't had any growth in real wages, we haven't had any growth in productivity in 10 years, and the anxiety that's causing households is what we're seeing reflected in the vote."

The British manufacturers are calling on the government to intensify their effort to boost labor productivity rather than relying on the national currency's fluctuations in supporting the domestic industries.

The government must "fix the foundations of the UK economy and our productivity problem," Carolyn Fairbairn, Director-General of the Confederation of British Industry said.

The pound, however, declined again on Friday after a rebound earlier this year, as the election results undermined the strength of the British national currency. It now stands at $1.27 compared to the average $1.30 in the past several months, but still above $1.20 seen late last year, when the pound's devaluation greatly helped the British manufacturing and exports.

"Looking ahead, there is clearly a risk that… election result causes growth to weaken towards the end of the second quarter," Ruth Gregory of Capital Economics said. "This is unlikely to spell disaster since the economy has proved pretty resilient to political uncertainty in the recent past."

At the same time, longer-term fundamentals indicate the UK economy is still on track to expand further, and April's slowdown might have been only a reflection of the pre-election uncertainty. The Foreign trade deficit, although still at £2.1 in April, almost halved from March's £3.9 bln.

Standard & Poor's Global Ratings said that the results of the UK election would have no near-term effect on the UK's investment appeal and credit ratings because the decreased predictability of the governmental policies has already been taken into account when PM May called for a snap election in April.

Moreover, given now the Tories will have to coordinate their policies with Ulster's DUP, a ‘hard Brexit' scenario is unlikely — Northern Ireland voted to ‘Remain' in the Brexit referendum last year, and in order to ensure the stability of the parliamentary majority, the Conservative Party will be more cautious in their approach to the Brexit process.

Whilst the uncertainty in the British economy is still rife, the worst times might have passed, with the inflation projected to stabilize, and broader GDP expansion steadily gaining momentum. In the absence of political shocks expected in the near-to-medium-term, the economy will be greatly dependent on the Tories' ability to maintain a stable working relationship with the DUP within the new cabinet.