Last year, Europe toppled the American market as the main destination for Chinese overseas acquisitions. Dmitry Tratas, a financial expert and stock market analyst, pointed out that one of the reasons was Washington’s economic policy towards China.

Speaking with Sputnik China, Tratas suggested that the US government and its regulators have been increasingly creating obstacles for Chinese investment coming into the US market.

"Trade relations between the US and China have long been tense. They are partners but in fact Washington has repeatedly accused Beijing of dumping, unfair competition, protectionism etc.," the expert said.

Commenting further on the focus of Chinese investors on Europe, he explained it with the fact that European economies are more liberal towards foreign investment than the US.

"I think that control [over foreign investment] in Europe is not as strict as that of the US government. But Chinese companies also feel pressure in the European market. However, this pressure is rather about the access of Chinese goods on the European market, but not about mergers and acquisitions (M&A) deals," Tratas underscored.

"Since August 11, 2015, the yuan exchange rate began falling, and as a result, many Chinese companies decided to focus on overseas operations. Moreover, investment in the domestic banking sector has contracted, pushing many companies to invest in foreign assets. Finally, the overseas investment activities of Chinese companies are part of their efforts to internationalize their development and optimize their assets at a global level," Zhang told Sputnik China.

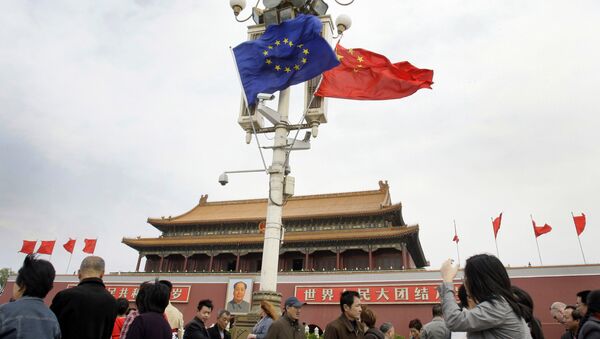

China’s direct foreign investment in Europe reached $121.4 billion, according to a study by the Mercator Institute for China Studies (MERICS).

As for the "Big Three" European economies, China wants to invest not only in developed economies but also in politically leading nations. In turn, Northern Europe is also an economically stable and attractive business region, which also has influence on political decisions in Europe. As for Southern Europe, there are higher economic risks, but high risks potentially mean high gains. Moreover, China also wants to strengthen its political positions in the region.

According to Vladislav Belov, an expert on Germany and deputy director of the Institute for European Studies at the Russian Academy of Sciences, the 2016 boom of Chinese money in the European market was not accidental.

"It was a plan China had long been working on, and it was the peak of China’s investment activity. Last year, Chinese company did what they had been preparing for. This is why a decline is already expected this year," Belov said.