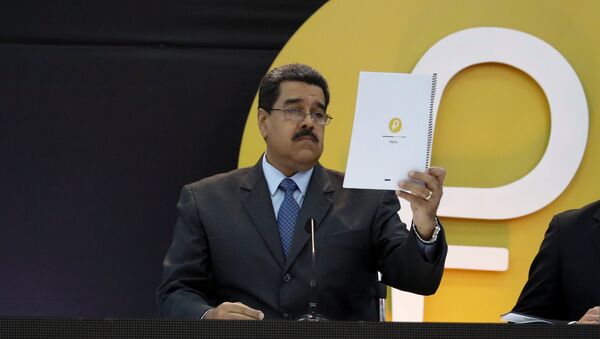

Sputnik: With the recent introduction of the Venezuelan Petro, is this really a way of decentralizing a money source to enact a monetary transaction, getting around supposed sanctions from the USA? How successful on the face of it will could this strategy be for Venezuela and will other countries like Iran, North Korea, and maybe even Russia follow suit, what are your thoughts and feelings on that question?

Krzystof Piech: I will start from the broader trends that we've seen on the technological markets, I believe that this year will be a very important year for any national currency, especially the stable coins, the coins that will be stable in value, and actually this is the problem of Venezuela, with an inflation rate of over 6,000% last year. During the previous 12 months, the country really needed stabilization. However, the concept that Venezuela has introduced, the Petro, is not the concept that would follow the guidelines or the consensus among blockchain, especially how the cryptocurrency should look like, first of all, a true cryptocurrency should be decentralized. This time with the Venezuelan case we have a situation where the Perto is actually very centralized and so this is one of the greatest risks that is connected with the coin, there's no guarantee that one day the Venezuelan government will switch off the cryptocurrency, this is the threat of it. Another threat is the reserve that is backing the cryptocurreny, while the cryptocurrency reserves are still controlled by the Venezuelan government there are actually no legal guarantees that the Petro is backed by anything, there's actually a big risk connected with that project, we can say — ok, this is the first such project in the world so maybe the next one will be better and the rest of the world will learn from these mistakes, my comments are connected to the future risks of that project at the moment.

Sputnik: Now the introduction of this cryptocurrency boasts to promote well-being, bringing power closer to the people, but you can't buy it with the Venezuelan Bolivar, so, therefore, asking the question, it's not really a cryptocurrency at all; it's just a way of raising hard currency externally due to the grave economic conditions prevailing in Venezuela at the moment and further preventing the country from accessing the international markets. What's your specific feeling on the currency then?

Krzystof Piech: I agree that the Venezuela experiment is not decentralized, it's not to bring the cryptocurrency, the new money to the people to use freely, but rather to enter the international market, especially, as we know from the mass media, the government wanted to attract the capital from Arab countries, so we can see that experiment from the point of view of trying to overcome the sanctions imposed by most countries, especially the United States, and we'll see if that will be any success. It's too early to talk about that, it's too early to say, moreover, I didn't mention, there's some technological threat, I mean that the technology that the blockchain system is based on.

For more information listen to this edition of Weekend Special with Krzystof Piech.

The views and opinions expressed in this article do not necessarily reflect those of Sputnik.