On October 31, 2008, at the dawn of the global financial crisis, a shadowy individual or collective known as Satoshi Nakamoto published a white paper called "Bitcoin: A Peer-to-Peer Electronic Cash System" on the metzdowd.com cryptography mailing list, outlining the principles for a new digital currency which wouldn't depend on any existing banking institution or government oversight. Several months later, in January 2009, Nakamoto released the first bitcoin software and issued the first 50 units of the currency.

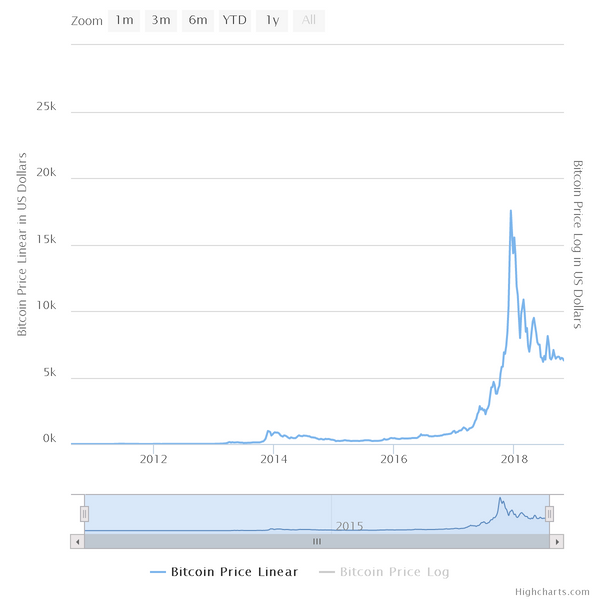

Seeing little use and valued at less than $1 US well into 2011, the currency enjoyed its first exponential jump in value in 2013, when the price of a single coin grew to nearly $1,000 before sliding back down to as little as $230 in 2015 and 2016. In late 2017, the cryptocurrency exploded again, this time up to dizzying highs of over $20,000, as mainstream investors looking to get rich quick began scrambling to cash in on the digital currency craze.

On January 17, the currency collapsed in what has since been remembered in the cryptocurrency industry as Black Tuesday, crashing to $9,600, and shaving off several thousand dollars more since then. Throughout 2018, the digital currency rose and then fell several times, settling at about $6,300 as of late October.

Bitcoin Basics

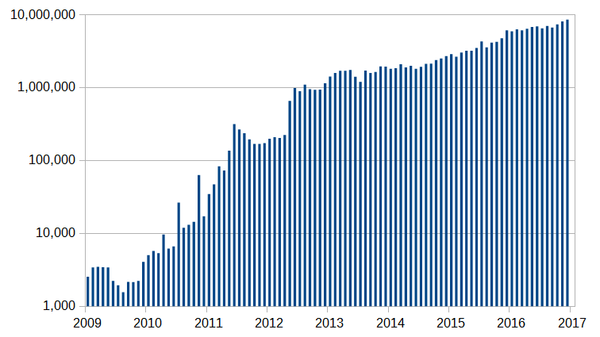

Baked into bitcoin is the principle of a limited number of coins – only 21 million can be digitally mined, meaning that unlike paper money, which can be printed indefinitely, bitcoin shouldn't suffer inflation. But the principle of scarcity also means that mining, which takes place by computers solving a series of complex mathematical problems, becomes more and more difficult and subsequently needs more and more computational power to achieve. It's estimated that 17.3 million bitcoins have been mined as of mid-2018, and that with the increasingly complex computations required for mining, only a single bitcoin will be mined between 2100 and 2140,

Bitcoin's rise was facilitated by a series of milestones, with bitcoin enthusiast Laszlo Hanyecz believed to have made the first real-world transaction using the currency by buying two Papa John's pizzas from a fellow enthusiast in May 2010 for 10,000 bitcoins. Fast forward eight years, and Hanyecz would have ended up paying the equivalent over $63 million for those pies. Ouch!

Product of Its Time

Confidence in the 'secure' digital currency suffered a setback after 25,000 bitcoins were stolen from an electronic wallet of a veteran miner in 2011, with further instances of hacking temporarily denting bitcoin's reputation. However, with new interest pouring in, mining growing, and the currency beginning to win more and more acceptance from real world businesses, hacking fears proved insufficient to stop its rise, particularly as the global financial crisis led many investors to search for alternatives to traditional financial instruments and stores of value.

As Alpari Investments analyst Veselin Petkov explained, "in the period between 2008 and 2012, distrust in the actions of central banks increased significantly among market players. The reason for this was the introduction of a colossal amount of new money into the global economy. Therefore, a growing interest appeared in creating a currency that wasn't centralized. It was at this time that Bitcoin emerged as an alternative to fiat money dependent on the monetary decisions of central banks."

Gradually, more and more countries began recognizing that bitcoin existed, although many also remained hesitant to treat it as an actual currency. In April 2017, Japan began regulating cryptocurrency exchanges operating in Japan under the Payment Services Act, essentially assigning bitcoins the status of currency.

Road to a Bubble

Enjoying with growing public recognition, expectations that technical limitations of scalability would work themselves out somehow, and begrudging tolerance for if not acceptance from governments, bitcoin was ready for its autumn 2017 spike. In the first week of December alone, the digital currency jumped to over $16,000 and a total capitalization of $270 billion, becoming one of the world's top five most-traded currencies. By mid-December, bitcoin futures began trading on the Chicago Board Options Exchange.

"Against the background of the strong climb in bitcoin's value in 2017, a large number of non-professional investors joined the market," Petkov recalled. "They simply bought the currency after reading stories in the media and forums about people getting rich using the digital currency. Furthermore, they didn't have a good understanding of what cryptocurrency actually was, and no knowledge of the scaling problem. All of this provoked the boom in the market and led to bitcoin becoming strongly overbought."

By late December, with bitcoin priced at $20,000 per coin, investment experts, economists and the heads of central banks began speaking about an overheating market and imminent collapse of an artificial bubble. The pessimists proved correct, and by January, the capitalization of the cryptocurrency market as a whole collapsed from $830 billion to $431 billion in the space of less than two weeks.

Calm Before the Next Storm?

In recent months, prices have hovered in the $6,500-$7,000 mark, with about 300,000-400,000 transactions processed per day, according to Petkov's estimates. In the analyst's view, only a market signal about a long-awaited solution to the scaling problem, such as activation of the Lightning Network protocol, can lead to renewed interest and growth in the cryptocurrency as an investment.