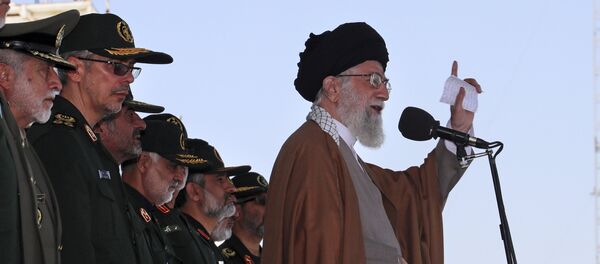

Kristian Rouz — The Supreme Leader of Iran is calling for policies aimed at boosting the exchange rate of the national currency, citing the concerns of weakening purchasing power amid the rising costs of imported goods. The Ayatollah has reportedly 'ordered' the Iranian central bank to implement policies to support the rial, while also protecting the Islamic Republic's economy amid the crippling US sanctions.

READ MORE: Iran's Intel Chief Accuses Israel, US of Supporting Terror on Iranian Territory

Hemmati didn't specify which policies the Ayatollah is favouring in order to support the national currency. The rial, for its part, has lost some 65 percent of its value this year amid expectations that Iran's oil exports could drop to near-zero in the coming weeks.

This Iranian economy has been facing mounting international pressure since the US re-imposed its 'toughest ever' sanctions against the Islamic Republic in early November.

Although the EU, Russia, and China have since vowed to protect their business ties with Iran, policymakers in Tehran have been concerned with the lack of progress in establishing alternative methods of settlement with Iran's business partners in Europe and Asia.

However, Iran's central bank governor said he would use all the firepower he has at hand to deliver on his promise to the Ayatollah.

"The central bank and the banking system will use all of their managerial power and expertise to fulfil the Leader's goals," Hemmati said, as cited by IRNA.

The Iranian economy, meanwhile, is facing some structural shortcomings at home as well. Iran's GDP slowed to 1.8 percent in the second quarter of this year — during that period, the Trump administration in the US announced it was withdrawing from the 2015 nuclear deal with Iran.

The Iranian economy was growing as fast as 16.5 percent year-on-year in 4Q16, but growth had since slowed to only 2.4 percent a year later. Some experts say that slowdown was not connected to any US sanctions whatsoever, but rather stemmed from the lack of investment and Iran's excessive reliance on foreign trade.

Since the US re-imposed its sanctions, the Iranian cabinet has introduced plans to boost infrastructure spending to create jobs, but the central bank's monetary policy response has so far been subdued — hence the elevated volatility of the rial.

"The Central Bank of Iran will do its best to reinforce the rial and would back Iranian banks in this regard," Governor Hemmati announced. "Banking facilities should be paid to production units with a higher level of productivity."

READ MORE: Iran Accuses US of Transferring Daesh Militants to Afghanistan

An additional challenge the central bank is facing — aside of the international sanctions and economic weakness at home — is the lack of hard currencies at home. Iranian citizens have been intensively buying dollars, including on the black market, to safeguard their savings — contributing to the rial's weakness.

However, the EU has yet to establish practical mechanisms of settlements with Iran, and could face sanctions from the US as well. Top EU diplomat Federica Mogherini has pledged to support and protect EU-Iranian business ties, but it has yet to be seen what steps will be implemented in practice.

As of now, however, the Iranian rial could be in for a modest resurgence, backed by the nation's reserves — but the fate of the Iranian economy largely depends on structural reforms at home and the Islamic Republic's diplomacy in Europe and Asia.