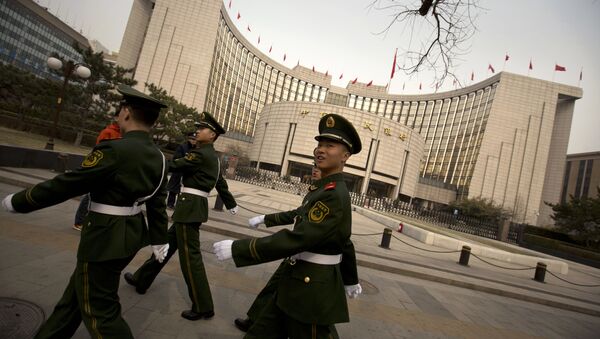

Kristian Rouz — A top People's Bank of China (PBOC) official says the nation will not resort to monetary stimulus alone to support economic growth next year, albeit the accommodative measures could be significant. He said the PBOC could introduce additional cuts to reserve ratio requirements (RRR's) for commercial banks, while possible interest rate cuts remain undecided.

READ MORE: Russia, China Can Ink Deal on National Currencies Payments by End of Year — Bank

In a statement Tuesday, PBOC adviser Sheng Songcheng admitted China is facing a mounting external pressure and structural hurdles at home, which will both weigh on the nation's GDP growth rate next year. Sheng said the central bank's approach to monetary policies will remain gradual in order to avoid speculative bubbles and other shocks to macroeconomic stability.

"Monetary policy will remain prudent and won't be a ‘flood'", Sheng said, according to China's state media. "Otherwise, funds will likely flow into the property sector again".

This comes as real estate prices remain elevated across the majority of China's metropolitan areas, and the government in Beijing has pledged to ramp up its push to resolve the affordability concerns. Chinese authorities have repeatedly stressed their policy of "home for living, not speculation" will be one of their main priorities next year.

Last week, the PBOC also announced that it would launch a special medium-term lending scheme, providing businesses with money liquidity for certain specific purposes, providing China's private sector with a new source of expansion.

READ MORE: China's GDP Growth in Q3 2018 Lowers to 6.5% Amid Trade Row With US

Overall, the Chinese government says it will intensify its support for private-sector enterprises to support job creation, factory output, and exports.

In a separate statement this week, China's State Council confirmed that the government will introduce additional tax cuts next year, along with a quicker review process for IPOs and refi transactions for Chinese firms.

For his part, Sheng also said China would maintain a stable and predictable exchange rate of the renminbi against the dollar. This despite that a weaker renminbi would boost China's competitiveness in the international market, but it would come to the dismay of the US, with which China is currently conducting momentous talks on a comprehensive trade agreement.

"The key threshold of seven (renminbi) per dollar is very important. If the yuan weakens past that crucial point, the cost of stabilising the exchange rate will be greater", Sheng said.

Additionally, the State Council said that all companies — private and state-controlled, as well as domestic and foreign — must be treated equally in China's internal market. Officials believe this would attract additional capital into China, while also supporting business activity at home.

The Chinese government also said it would firmly protect property rights and privately-held assets of commercial enterprises — in a bid to reassure domestic and foreign investors of a business-friendly environment in China.