The US dollar, which marks its 235th birthday on 6 June, has been reigning supreme as the main global reserve currency. A spate of analysts have weighed in on the reasons for the persistent dominance of the “greenback”, while mulling the chances of digital currencies in helping countries wean themselves of the US-dollar dominated financial system.

US Dollar and Global Financial

The dollar currently occupies a dominant position in the international financial system, with more than 50 percent of the total gold and foreign exchange reserves stored in dollar assets.

About 90 percent of foreign exchange transactions are carried out in dollars, and some 65 percent of international debt obligations are registered in them, estimates Elena Belyaeva, an analyst with “Freedom Finance” Investment Company.

More than two-thirds of the total number of banknotes issued by the US Federal Reserve (worth nearly $700 billion) are in circulation outside of the US.

According to Valery Vaisberg, director of the analytical department of "REGION" Investment Group, there are several reasons for this.

“There is the economic dominance of the United States, including as a result of two world wars in Europe; and the presence of a very capacious and diverse financial and stock markets in terms of instrumentation," he said.

Advisor to the General Director of the company “Opening Broker, and associate professor of the Russian Presidential Academy of National Economy and Public Administration under the President of the Russian Federation (RANEPA) Sergey Khestanov points to a potent combination of dollar liquidity, low and predictable inflation and popularity with all suppliers and consumers.

“Even the euro cannot yet compete with the dollar in international payments,” he adds.

The dollar has an advantage among many currencies due to low inflation (in the US it has been hovering at about 2 percent annually since 1981), as well as the absence of federal debt defaults since 1933 (excluding a short-term technical default in 1979), notes Belyaeva, of "Freedom Finance".

However, any dominance is fraught with pressure and breeds a reciprocal desire to wean oneself from such dollar dependence.

Over the past 20 years, the United States has steadily increased sanctions pressure, limiting the possibility of dollar transactions for those perceived as “transgressors”, says Weisberg of "REGION" Investment Group.

Political factors, such as a confrontation with the United States have become the main driving force behind efforts to remove the shackles of dollar dependence, claim experts.

The difficulty of dodging the dollar is connected, on the one hand, with the fact that the financial markets in the United States are still the largest and most saturated, and not all instruments in other national currencies have the proper level of liquidity (for example, the euro), says Weisberg.

The analyst adds that for this to be achieved on a global scale, there must be international consensus, similar to the Bretton Woods system of monetary management, establishing the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement.

And finally, there must be a willingness for a particular Central Bank to take on part of the burden of the US Federal Reserve to ensure financial processes.

Thus, experts summarize that lack of a comparable alternative makes it difficult to abandon the dollar.

The History of the “Greenback”

The first US Dollar, as it is known today, was printed in 1914 upon the creation of the Federal Reserve Bank.

Seven years after the dollar was recognized as the official currency of the United States in 1792, it was found that one troy ounce of gold is equivalent to 19.3 dollars.

However, the United States did not possess a gold reserve to ensure the entire volume of issued money, so the national currency exchange rate for gold had to be gradually reduced.

In 1834, a troy ounce of yellow metal was already worth $ 20.67 (a total spike of 7.1 per cent in 42 years).

The current live gold price in USD per troy ounce stands at $1,708.75.

World’s Reserve Currency

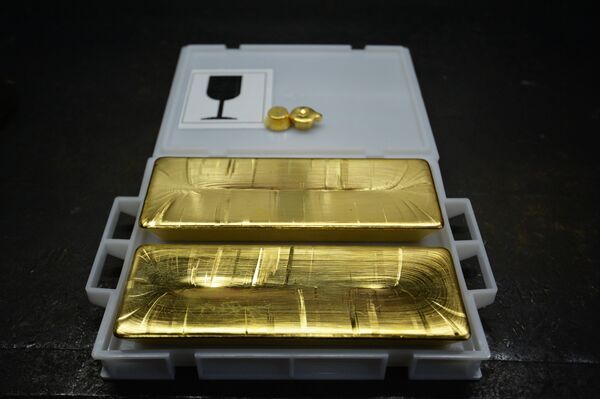

As a result of the Bretton Woods Agreement in 1944, the US dollar was officially crowned the world’s reserve currency, backed by the world’s largest gold reserves.

Accordingly, instead of gold reserves, other countries accumulated reserves of US dollars. As they required a place to store their dollars, countries began buying US Treasury securities, which they considered to be a safe haven for their money.

The Bretton Woods Agreement linked the value of gold to the dollar in the ratio of 35 per troy ounce. However, development of financial markets, crises and inflation took their toll.

In addition, by the beginning of the 1970s, having economically rebooted from World War II, France and Germany exchanged a significant part of their dollar assets into gold stored in the US Fort Knox, reducing the US gold reserve from 22 thousand to 8 thousand tons.

As a result, the 37th President of the United States, Richard Nixon, introduced in 1971 a temporary ban on converting the dollar into gold at the official exchange rate for central banks in other countries.

Thus, after almost 30 years, in 1973, a transition began from Bretton Woods with its fixed exchange rates to floating rates.

In 1976 the Jamaican currency system became operational, and remains such to this day. According to the new rules, the gold standard pegging currencies to gold was scrapped. Central Banks can now sell and buy gold at market prices.

Officially recognized reserve currencies are the US dollar, pound sterling, Swiss franc, Japanese yen, German mark, French franc (after 2000 the mark and franc were converted into euros).

However, the global financial crisis, which began in 2008 with the bankruptcy of the legendary Lehman Brothers, raised the question of the need to change the Jamaican currency system. In this context, experts have been debating the possibility of a global alternative to the dollar.

This first became tangible at the end of the first decade of the 21st century with the advent of Blockchain and the first most popular digital currency, Bitcoin.

Perhaps, Blockchain technologies will be able to breathe fresh life into the long-mulled idea of replacing the dollar with an alternative, says Yelena Belyaeva, of "Freedom Finance".

"Now the main trend is digital currencies, and a new international financial system could potentially be based on them, supplanting the current Jamaican currency system, where the dollar remains all-dominant," concluded Valery Vaisberg, director of the analytical department of "REGION" Investment Group.