Regulators for the state of New York said on Tuesday that a penalty of $150 million has been imposed on Deutsche Bank “for significant compliance failures” and negligence over the companies dealing with accused child sex trafficker and convicted pedophile Jeffrey Epstein, alongside two client banks.

According to the New York State Department of Financial Services, the bank “failed to properly monitor account activity conducted on behalf of the registered sex offender despite ample” public information regarding previous criminal misconduct by Mr. Epstein.

The department said that due to the bank’s oversight failure regarding Epstein, the “bank processed hundreds of transactions totaling millions of dollars that, at the very least, should have prompted additional scrutiny in light of Mr. Epstein’s history".

Epstein's “periodic suspicious cash withdrawals — in total, more than $800,000 over approximately four years", were also observed according to the financial regulatory body.

New York DFS has published its investigative findings on Jeffrey Epstein’s relationship with Deutsche Bank.

— southpaw (@nycsouthpaw) July 7, 2020

DB has agreed to pay a $150 million penalty for “significant compliance failures.”

Press release: https://t.co/HxdUXOoqho

Consent order: https://t.co/RMJKKsXlhE pic.twitter.com/QMcRUlnIGx

In total, the German company dealt with over 40 accounts related to Epstein, involved people, and other entities. The transactions include payments to individuals who have been accused publicly of being involved with the billionaire's sexual abuse of young women.

Settlement payments amounting to $7 million and law firm payments of up to $6 million were made “for what appear to have been the legal expenses of Mr. Epstein and his co-conspirators,” the department said.

Payments were also made “to Russian models, payments for women’s school tuition, hotel and rent expenses, and (consistent with public allegations of prior wrongdoing) payments directly to numerous women with Eastern European surnames”, the department revealed.

Claiming to be the first enforcement action by a regulator to come down on a financial organisation for its relationship with the deceased criminal, the consent order also includes accusations of not monitoring correspondent dealings with Danske Bank Estonia and FBME Bank.

“Banks are the first line of defense with respect to preventing the facilitation of crime through the financial system, and it is fundamental that banks tailor the monitoring of their customers’ activity based upon the types of risk that are posed by a particular customer,” Superintendent of Financial Services Linda Lacewell said in a statement.

A spokesman for Deutsche Bank said that the company acknowledged the "error of onboarding Epstein in 2013 and the weaknesses in our processes, and have learnt from our mistakes and shortcomings".

He went on to say that immediately following Epstein’s arrest due to child sex trafficking charges in July 2019, the bank “contacted law enforcement and offered our full assistance with their investigation".

"We have been fully transparent and have addressed these matters with our regulator, adjusted our risk tolerance and systematically tackled the issues,” the spokesman added.

Deutsche Bank maintained a relationship with Epstein and related individuals between August 2013 until December 2018. The bank ended its dealings with him following a series of articles published in the Miami Herald about a federal nonprosecution deal that Epstein obtained in 2008 in Florida.

The 66-year old Epstein died last August in mysterious circumstances while being held in a federal jail in Manhattan. Authorities ruled the death a suicide after being denied bail.

He was charged with child sex trafficking as well as conspiracy to commit child sex trafficking. The investor has been accused of being involved with former President Bill Clinton, current President Donald Trump, the UK's Prince Andrew and other high profile figures.

Epstein was also a registered sex offender after pleading guilty in Florida state to 2008, including obtaining sexual services from an underage girl - for which he served 13 months in jail.

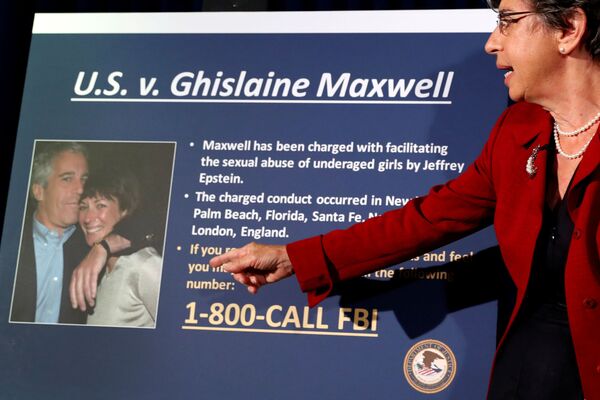

The news follows the arrest of alleged procurer and former girlfriend Ghislaine Maxwell earlier this month on federal charges while staying at a $1 million accommodation in New Hampshire.

She is currently held in a federal jail in Brooklyn awaiting a decision on her being granted bail. Prosecutors call her an extreme flight risk.

Her appearance in Manhattan federal court is set to take place on 14 July.