Oil prices have gained around 1% amid the news of oil rigs in the Gulf of Mexico, responsible for around 17% of American crude output, being evacuated due to approaching Hurricane Delta. The latter is forecast to become a Category 3 storm, with wind speeds of 120 mph (193 kilometres per hour) and make landfall on 9 October.

American WTI gained 1.48% by 10:00 GMT reaching $40.45 per barrel, while Brent spiked by 1.89% up to $42.62 on the same day, when the evacuation of 183 oil platforms in the Gulf was announced. The measures are set to disrupt around 80% of the current oil extraction rate, depriving the global market of 1.65 million barrels per day, the US Bureau of Safety and Environmental Enforcement stated.

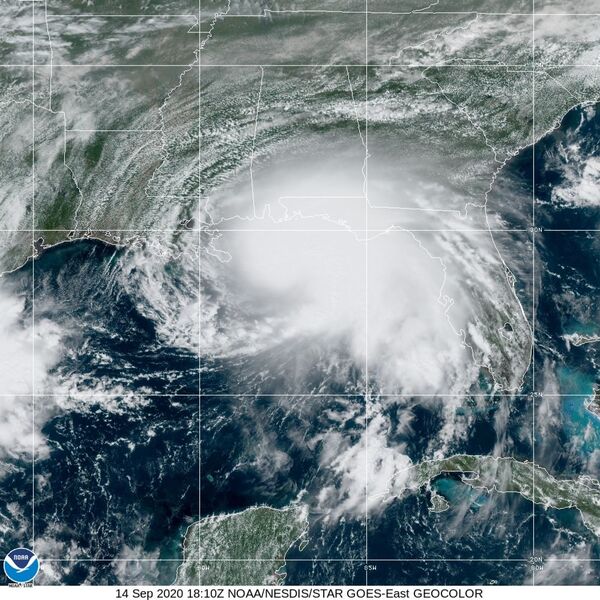

This is not the first time this year that oil production in the Gulf of Mexico has been paused over inclement weather. In September, the approach of Category 2 Hurricane Sally, which ripped through parts of Alabama and Florida, caused production delays. According to estimates by Reuters, hurricanes and storms have resulted in $9 billion in losses for oil rig operators in the Gulf of Mexico this year.

Has Effect of Stalemate in US Stimulus Package Talks Worn Off?

The impact of the ongoing evacuation was also apparently enough to overcome the news of US President Donald Trump cutting short talks with Democrats on a new stimulus package on 6 October. The said stimulus was supposed to support the American economy – one of the biggest consumers of oil in the world. The impact of the abrupt halt to the talks was purportedly behind the drop in crude prices on 7 October, when black gold lost between 1.6% and 1.8% in single day trading.

So far, the Trump administration has shown no signs of restarting talks, instead offering Democrats to either adopt a series of standalone bills enjoying bipartisan support, or wait until after the 3 November election results are clear.