On 8 October, US Tax Court Judge David Gustafson issued an opinion ruling that the IRS's Whistleblower Office (WBO) had "abused its discretion" in trying to dismiss "specific credible documentation" put forward by Doyle and Moynihan thus allowing the case against the Clintons' charities to go on.

Investigators Doyle and Moynihan Raised the Red Flag

Although the judge's opinion does not contain the target's name, one might immediately guess that it pertains to "The Clinton Foundation", based on publicly available evidence and common knowledge, notes Wall Street analyst Charles Ortel who has been looking into the charity's alleged fraud for several years.

"Since March 2015, I have been patiently explaining that the Bill, Hillary & Chelsea Clinton Foundation must attempt to correct all of their historical filings going back to inception in 1997," says Ortel. "As I progressed in my work, I came to learn that the false and materially misleading public filings are the least of problems for this supposed charity. Under US law, only validly organised and operated organisations are allowed, normally, to obtain and retain exemption from taxes. The record is clear, and the IRS must understand by now that no Clinton 'charity' is an organisation."

In August 2017, independent expert forensic investigators Doyle and Moynihan filed whistleblower submissions concerning the Clintons' charity with the IRS. However, in November 2018 they got a preliminary denial to their claim from the agency.

On 13 December 2018, the independent investigators testified before the House Oversight and Government Reform Committee, shedding light on the Clinton Foundation's purported wrongdoings. They stated that having amassed approximately 100 exhibits in excess of 6,000 pages, they came to the conclusion that the charity did not operate as a tax-exempt 501(c)(3) organisation; made material misrepresentations to the IRS about its operations and entities; and acted as a foreign agent thus making its charitable tax-exempt protection void.

Given all of the above, the whistleblowers suggested that the Clinton Foundation owes between $400 million and $2.5 billion in taxes and informed US lawmakers at that time that if the IRS refuses to consider their case they would appeal to the US Tax Court.

What's Behind the IRS' Seeming Unwillingness to Chase the Clintons?

"I think it is disappointing that the IRS would initially reject their whistleblower submission, and that the IRS Commissioner would argue for a summary dismissal before the Tax Court," Ortel points out. "But thank goodness the judge took the time required to evaluate evidence and evolution of the case as carefully as he seems to have done".

Touching upon the IRS' handling of the case, the judge detailed mistakes in the filing of specific forms by the IRS' Criminal Investigation (CI) division and omissions in its conclusions.

"Prompted by petitioners’ allegations – explicit and detailed, with names, dates, and locations – the WBO’s email put a single direct question to CI: 'Can you please confirm that IRS CI is not working with these [whistleblowers] on any investigation with these [target] entities?' CI’s reply was a non-answer that looks like it may have been a deliberate evasion: 'The claim was appropriately declined by criminal investigation'. But was CI 'working with' petitioners or not? CI did not say", Gustafson's opinion reads.

Besides this, in 2018 the CI "had to be asked three times to complete its Form 11369 for this case, giving 'unacceptable' responses to the WBO and grousing that it’s 'somebody else’s job'", the judge pointed out.

Commenting on the IRS's seeming unwillingness to instrumentalise the evidence collected by the whistleblowers in order to investigate the Clinton Foundation's alleged fraud, Ortel suggests that "the IRS, to date, has given passes to the Clintons, in part, because persons there gained useful leverage, possibly, and in part because the Clinton charity scandals touch the Bush family in that two Bush foundations partnered with supposed Clinton charities that Bush family lawyers should have known were frauds."

"After years of stalling and abusing discretion to consider this matter, I hope the IRS will get back into the business of protecting the public from those who would lie under oath repeatedly and deceptively claim to run 'charities'", Ortel says.

Clouds Have Grown Thicker on the Clintons' Horizon

It is symbolic that the Clinton Foundation has been brought into the spotlight ahead of the 2020 election, according to the Wall Street analyst.

"We are in the closing weeks before elections on 3 November 2020", he says. "In 2016, candidate Trump called out the Clinton Foundation and also called out the Deep State. Now, Clinton frauds, and conspiracies to obstruct their investigation must be exposed, and co-conspirators brought to justice".

On 24 September, The New York Times unveiled that US Attorney John Durham, appointed by Attorney General William Barr to look into the handling of the Trump-Russia investigation, also sought information about the FBI's Clinton Foundation probe.

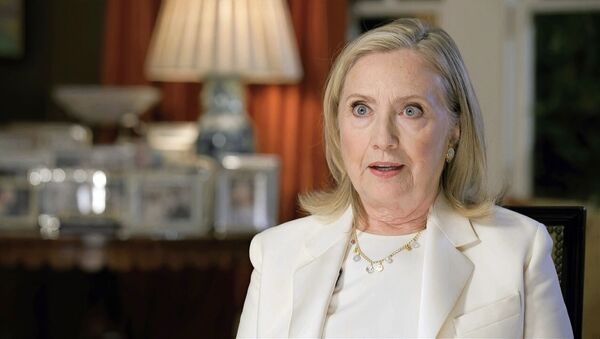

Several days later, Director of National Intelligence John Ratcliffe wrote a letter to American lawmakers unveiling an alleged plan by Hillary Clinton and her aides to accuse Donald Trump of non-existent ties with Russia in order to divert the public opinion from her email scandal.

American conservative pundits and watchdogs have long suspected that while serving as the US secretary of state, Hillary Clinton used the family's foundation as a "laundromat" in a broader "pay-to-play" scheme and used her unprotected private server in order to evade the Freedom of Information Act (FOIA).

"I think the IRS should assess taxes, fines, and penalty interest against co-conspirators in this corrupt criminal scheme," Ortel insists. "Because so many wealthy persons are centrally involved, the IRS can potentially collect large sums just at a time when the government needs money to reduce operating deficits and accumulated debts."

"Whether President Trump and others act before the looming election or wait, I am confident these whistleblowers and other concerned citizens will carry on to the bitter end", the Wall Street analyst concludes.