The life of a Miami resident, David T Hines, recently took a turn for the better after he got his hands on $3.9 million – an impressive sum, especially in the light of the economic slowdown caused by the pandemic. The happy 29-year-old millionaire did not hesitate to spend $318,000 of his unexpected fortune on a newly minted 2020 Lamborghini Huracan sports car.

There was only one problem – the $3.9 million, which he had suddenly got, were the ill-gotten gains of his fraud scheme to rip off the US coronavirus relief fund. Hines submitted applications for nearly $4 million in Paycheck Protection Program (PPP) loans – a programme introduced under 2020 CARES Act and designed to help businesses survive the pandemic.

The enterprising young man filed applications for PPP on behalf of several different companies making numerous "false and misleading statements" about how he intends to spend this money on the payroll for the employees.

In fact, Hines never spent a dime of the received funds on payrolls or any other valid purpose under the CARES act, such as paying interest on mortgages, rent and utilities. Instead, he planned to spend all of it on his personal needs, starting with buying the luxurious sports car. Unfortunately for Hines, the plan did not go down well with the Department of Justice's Fraud Section – an office which is responsible for detecting and uncovering fraud schemes involving the coronavirus relief fund, as it has in 70 other cases since the introduction of the CARES Act.

The DoJ has already seized the car and unspent funds from Hines' accounts. The man himself already pleaded guilty on an account of wire fraud and is to be sentenced on 14 April. It is unclear from the DoJ's report when Hines acquired the funds and when the Fraud Section uncovered the violation.

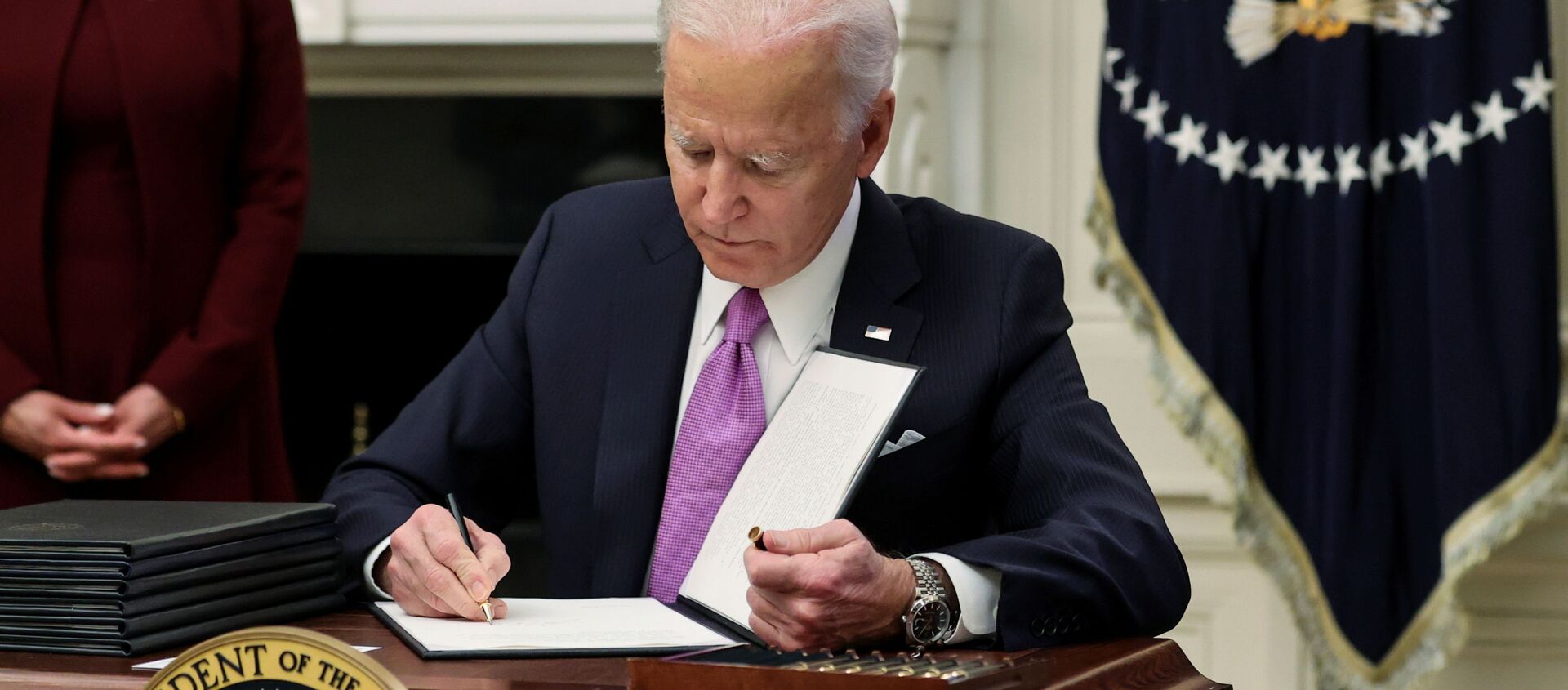

Hines' case became public as Democrats started pushing for the relief programme to be extended under the CARES Act first introduced in March 2020. The part of the programme dealing with the PPPs has received a total of $933 billion in funding. PPP loans are provided to businesses to solve their present financial needs and charge interest of less than 1 percent. However, both principal and interest are waivable should the business spend the funds appropriately and allocate a certain portion of it toward payrolls for employees.