Larry Summers, the former World Bank chief economist, Clinton-era treasury secretary, and Obama-era director of the National Economic Council, has made some dire predictions for the US economy’s future, describing the current macroeconomic policy as the “least responsible” he’s seen since the early 1980s and suggesting the US may be headed for a "stagflationary" crisis.

“The full stimulus that was contemplated has passed. People have declared that it’s a new era in ways that suggest that large fiscal policy will continue for a long time to come…The fed has stuck to its guns on no rate hikes for years and years and is continuing to grow its balance sheet. So it seems to me that what was kindling is now igniting, and I am much more worried that we’ll have either inflation or we will have a pretty dramatic fiscal-monetary collision,” Summers said, speaking to Bloomberg Wall Street Week.

“I think this is the least responsible macroeconomic policies we’ve had in the last 40 years. I think fundamentally it’s driven by intransigence on the Democratic left, and intransigence and completely unreasonable behaviour in the whole of the Republican Party that’s driven us to the kind of political deals that we’re seeing,” the economist added.

Summers explained that he sees a one in three chance of accelerating inflation over the next several years, putting the country in a “stagflationary situation,” i.e. a scenario in which inflation is high, economic growth slows, and unemployment remains high. The last time the US suffered from large-scale stagflation was during the presidencies of Gerald Ford and Jimmy Carter, with neither able to take the country out of the crisis.

Summers also believes that there’s only about a one in three shot that the Fed and Treasury get the desired-after results of rapid growth from its policies, with the growth smoothing out inflation and unemployment. “But there are more risks in this moment that macroeconomic policy itself will cause grave consequences than I can remember. There have been terribly serious moments in the past, but then macroeconomic policy was trying to stabilise things. Now there’s the real risk that macroeconomic policy will be very much destabilising,” he warned.

Stimulus Straw That Broke the Camel’s Back?

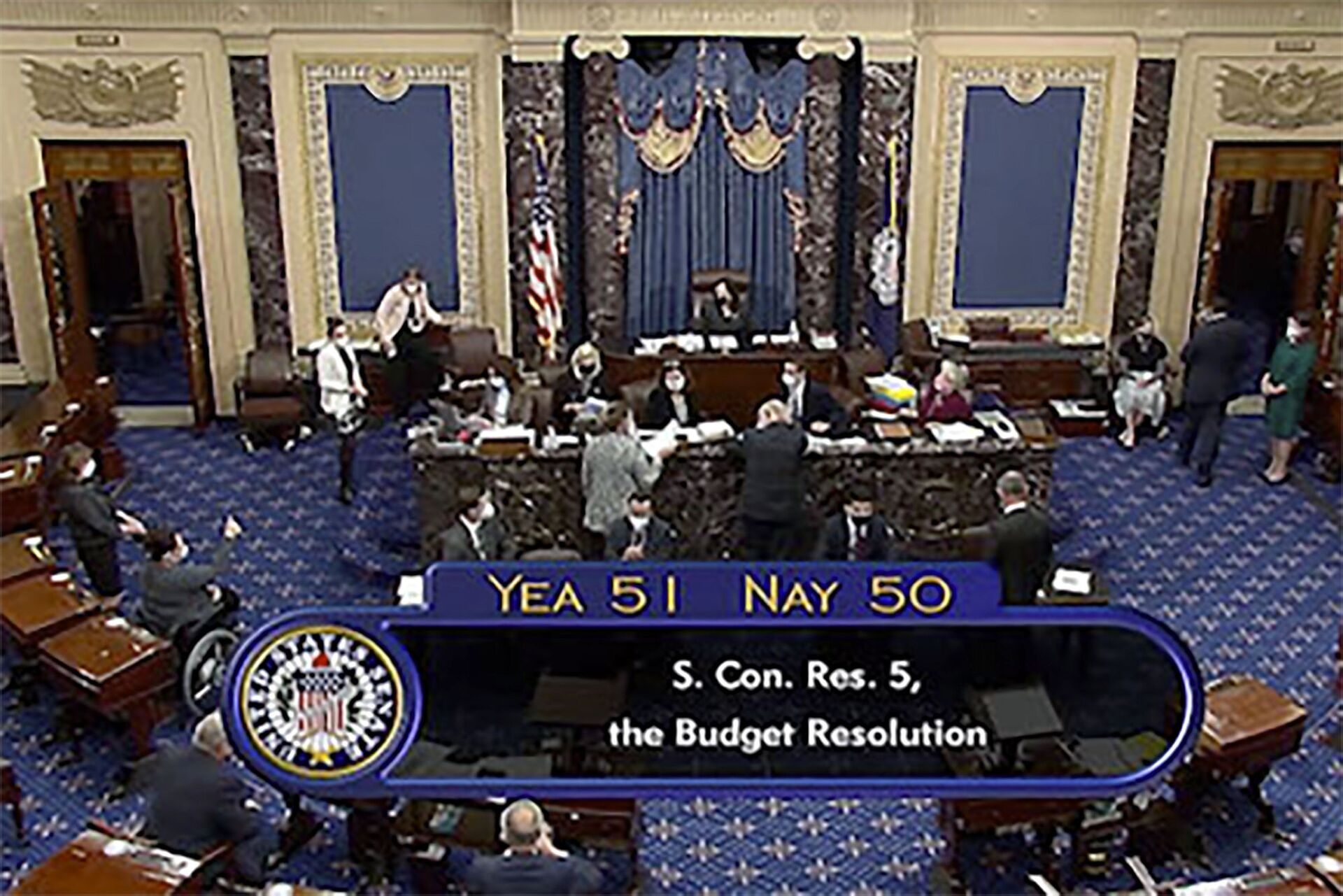

Congress recently passed $1.9 trillion in additional stimulus to try to stop the economic bleeding caused by the 2020 coronavirus crisis, with the package including one-time $1,400 relief checks, additional monies for state and local governments, unemployment benefits and other measures, including billions for vaccines and testing, subsidies to businesses, tax breaks, etc.

The United States has now pumped over $6 trillion into Covid relief, piling on to America’s gargantuan $28 trillion debt. Federal debt passed the 100 percent of GDP mark in the spring of 2020. Fitch Ratings expects federal debt to reach over 109 percent of GDP by the end of 2021, with general government debt expected to reach 127 percent of GDP during the same period, and surpass 130 percent by 2023. Combined government, business and household debt surpassed over 250 percent of GDP last year, before the impact of the coronavirus crisis was fully felt.