JPMorgan Chase chief Jamie Dimon expects the US economy to grow steadily, with moderate increases in inflation and interest rates, thanks to excess savings, mass vaccination and the possibility of huge infrastructure investment, he wrote in a letter to bank shareholders published on Wednesday.

“I have little doubt that with excess savings, new stimulus savings, huge deficit spending, more [quantitative easing], a new potential infrastructure bill, a successful vaccine and euphoria around the end of the pandemic, the US economy will likely boom,” he predicted, adding that growth may last till 2023.

According to Dimon, it will depend on “the quality, effectiveness and sustainability of the infrastructure and other government investments” that should be “spent wisely” and with “extraordinary discipline.”

Dimon also commented on US President Joe Biden’s controversial $2.3 trillion infrastructure plan, called reckless by some in the GOP, as the plan goes far beyond infrastructure, including 'green' economy and educational initiatives, while money needed to modernize roads, bridges, ports, airports, underground water systems and broadband is comparatively far less.

Agreeing that the US infrastructure needs significant investment to boost economic output and “create many new jobs with competitive salaries and spur workforce innovation,” the JPMorgan CEO stressed that spending trillions of dollars on projects with little economic return would have little financial investment value.

“Building ineffective 'bridges to nowhere' while temporarily creating jobs is actually a huge value destructor," Dimon wrote, suggesting that, "this kind of waste would ultimately undermine Americans’ faith in our system”.

Siding with big American companies which oppose the US administration’s plan to finance the bill by increasing corporate taxes, Dimon wrote that this would undermine US companies’ competitiveness abroad and economic recovery as “the retention and reinvestment by businesses of capital in the US is ultimately the primary driver of productivity and growth.”

He advocated instead individual tax rates and deductions that clearly benefit high earners and the wealthy.

“Unfortunately, taxes that minimize damage to growth would involve taxing high incomes. The wealthy are less likely to complain about taxes if the money is actually used to help the less fortunate or help build a better country,” he offered.

At the same time, some aspects may slow down the economic boost, including higher inflation, Dimon said in an interview with The Wall Street Journal. This could cause an increase in the short-term interest rate, which could have negative impact on investment activity, particularly among the wealthiest.

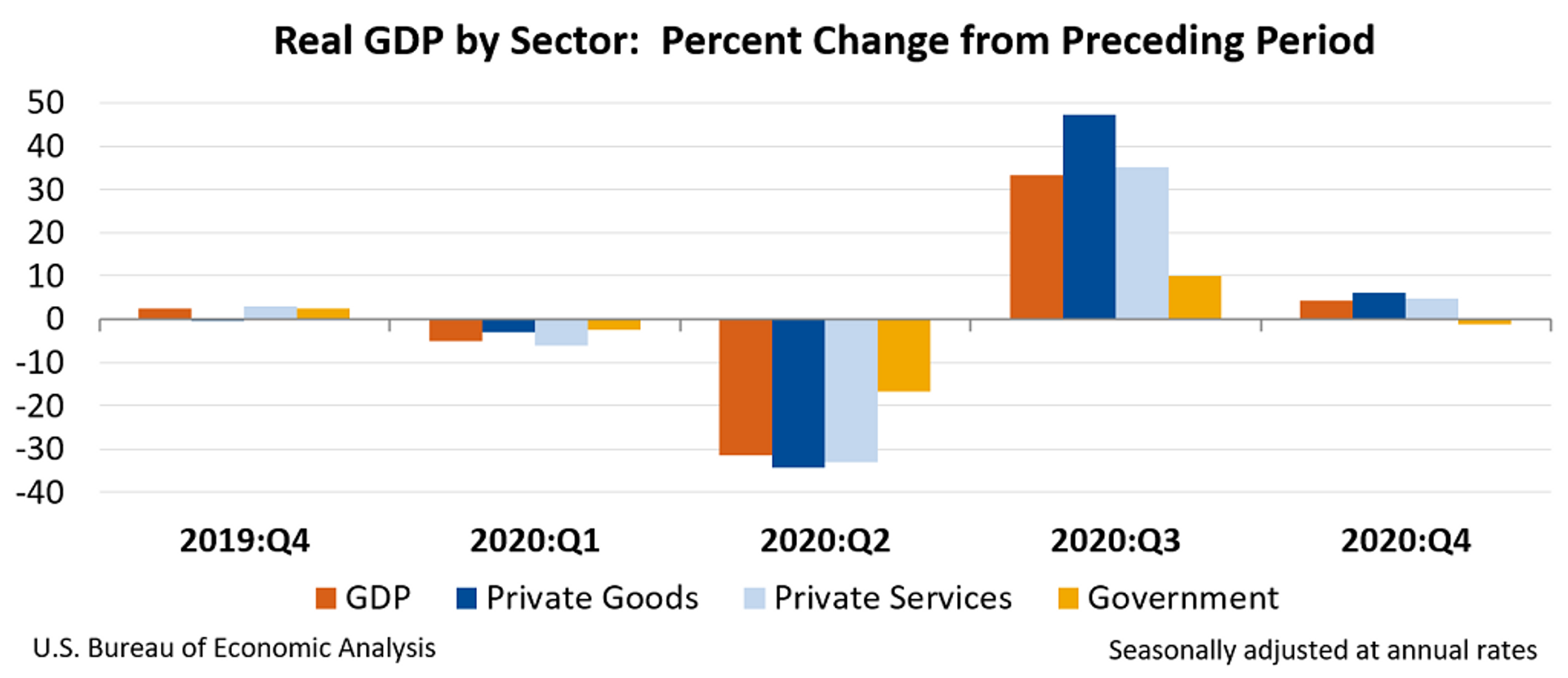

Dimon's new forecast is significantly better than his expectations a year ago, when he warned bank shareholders about the onset of a " a bad recession " and the risk of a 35 percent fall in US GDP during the second quarter of 2020.

The US Economy And Global Pandemic

For the first time since the Great Depression of the early 20th century, the US economy has faced significant declines due to the coronavirus pandemic, as businesses closed and much of the global commercial activities were frozen by lockdown restrictions.

The US GDP has undergone a significant decline, by 33.4 percent during the period from July to September 2020, according to the US Bureau of Economic Analytics. On results of the first quarter of this year, the indicator showed growth of 8.4 percent.

As Bloomberg Economics reported, some parts of the economy have reached or surpassed prepandemic levels, including retail sales volume. At the same time, while some sectors, such as entertainment and hospitality venues, remain under restriction, the amount of allowance applications exceeds almost three times prepandemic rates.

Regarding the nearest prospects for the American economy, some experts suggest that economic recovery will go faster than initially expected, without excluding the possibility of an inflation growth of up to 2.4 percent, instead of the forecast two percent.

The highest amount of fiscal controversy surrounds Biden’s budget policy, including the 1.9 trillion COVID-19 relief bill and the plan for the huge infrastructure layout. The latest stimulus bill helps to regain prepandemic figures by mid-year, but, according to the OECD Economic Outlook, so much spending must produce side effects, including inflation and possible budgetary shortfalls of up to 15 percent of GDP.

In addition, an increase in government spending entails a growth in US debt. To date, the ratio of US federal debt to the GDP is 107.6 percent and experts believe that figure will increase.