https://sputnikglobe.com/20211107/india-should-rationalise-taxes-as-oil-and-gas-prices-may-rise-further-before-2025-expert-says-1090531778.html

India Should Rationalise Taxes as Oil and Gas Prices May Rise Further Before 2025, Expert Says

India Should Rationalise Taxes as Oil and Gas Prices May Rise Further Before 2025, Expert Says

Sputnik International

India's oil demand is projected to jump 10 million barrels per day by 2030 from its current consumption of 5.05 million per day. As Indian fuel retailers have... 07.11.2021, Sputnik International

2021-11-07T10:04+0000

2021-11-07T10:04+0000

2022-12-07T10:14+0000

saudi arabia

arctic

china

opec

yamal lng

energy

oil

crude oil

https://cdn1.img.sputnikglobe.com/img/07e5/0a/1b/1090234572_0:214:3072:1942_1920x0_80_0_0_350c1ba8306e80e865bc2b8ea3b15bf6.jpg

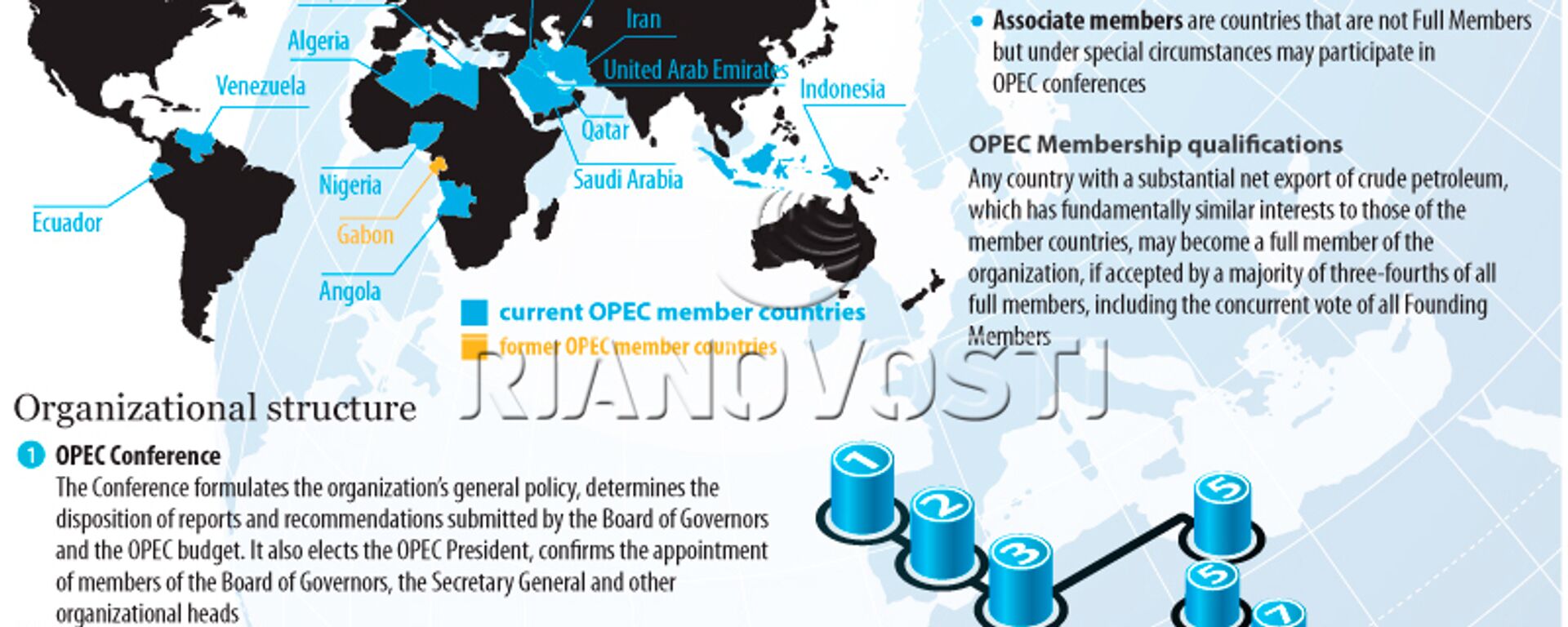

For the past few years, India has been diversifying its energy sources to curb the dependency on OPEC (Organization of the Petroleum Exporting Countries). OPEC countries provide 71% of crude oil, 58% of LPG, 33% of LNG, and 45% of petroleum products consumed by India. During the 5th OPEC-India Energy Dialogue on 29 October, Hardeep Singh Puri, India's Minister of Oil and Gas, raised the "issue of energy market volatility" and "current high energy prices and in that context underlined the importance of seeking market stability for the benefit of producers and consumers".Sputnik spoke with Narendra Taneja, Ia prominent Indian energy expert, on a range of issues involving the higher cost of oil and gas imports and strategies to deal with fast-changing scenarios in West Asia.Sputnik: India received its first LNG cargo from Russia last month, and reportedly it was the cheapest purchase by India from any client in the world. Has diversification of energy purchases started paying off for India?Narendra Taneja: Well, diversification is part of a well-meditated strategy because depending on one geography or region for the supply of a commodity as crucial as natural gas is risky in terms of energy security. Russia has vast gas reserves and, therefore, will be a significant supplier in years and decades to come. India and Russia have always enjoyed good energy ties.Sputnik: Indian ministers have been urging oil producer countries to bring down their product prices for consumer countries. Why are these oil-producing countries not paying heed to demand?Narendra Taneja: There could be many reasons, but the cartelisation in the form of OPEC and OPEC Plus empowers them disproportionately vis a vis large importers of oil such as India. Greed also plays a big role. Most oil exporters also know that the share of oil in the global energy mix will begin to fall rapidly in ten years or so. They, therefore, want to monetise their oil as fast as possible.Sputnik: Media reports are claiming India and China will jointly make efforts to pressurise OPEC not to inflate prices artificially. Do you think this kind of collaboration will work, especially given changing strategic environments?Narendra Taneja: India's dependence on oil imports is much higher than China's. Moreover, China's response so far on any such multilateral move has not been sufficiently enthusiastic.Sputnik: India stopped oil imports from Iran after the US imposed strict sanctions against Tehran. On the other hand, China keeps importing energy resources from Iran. Shouldn't India take a similar approach and resume Iranian oil imports?Narendra Taneja: Iran is a critical friend and partner in oil and gas. But India has to balance its oil relations with Iran in other contexts too at the same time, including New Delhi's long-term strategic ties with the United States and the West. Each country has its own perspectives and strategies on sensitive international issues.Sputnik: What should India's strategies be to bring down import costs and provide somewhat cheaper fuel to its citizens, who are currently reeling amid record prices?Narendra Taneja: Well, we have to invest more in renewables and nuclear power to bring down our dependency on imported oil and gas. My sense is oil and gas prices may go further up between now and 2025. India should therefore rationalise the taxes on petroleum products and invest more in domestic oil and gas exploration and production.

https://sputnikglobe.com/20180614/india-china-plan-counter-opec-1065398632.html

saudi arabia

arctic

china

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2021

Rishikesh Kumar

https://cdn1.img.sputnikglobe.com/img/07e4/08/04/1080055820_0:0:388:389_100x100_80_0_0_40018ee210946d65d49ffba4f4c008e1.jpg

Rishikesh Kumar

https://cdn1.img.sputnikglobe.com/img/07e4/08/04/1080055820_0:0:388:389_100x100_80_0_0_40018ee210946d65d49ffba4f4c008e1.jpg

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Rishikesh Kumar

https://cdn1.img.sputnikglobe.com/img/07e4/08/04/1080055820_0:0:388:389_100x100_80_0_0_40018ee210946d65d49ffba4f4c008e1.jpg

saudi arabia, arctic, china, opec, yamal lng, energy, oil, crude oil

saudi arabia, arctic, china, opec, yamal lng, energy, oil, crude oil

India Should Rationalise Taxes as Oil and Gas Prices May Rise Further Before 2025, Expert Says

10:04 GMT 07.11.2021 (Updated: 10:14 GMT 07.12.2022) India's oil demand is projected to jump 10 million barrels per day by 2030 from its current consumption of 5.05 million per day. As Indian fuel retailers have been selling petrol and diesel at record prices, the Narendra Modi government has either blamed the OPEC nations or skirted responsibility, saying oil refiners determine the fuel prices.

For the past few years, India has been diversifying its energy sources to curb the dependency on OPEC (

Organization of the Petroleum Exporting Countries). OPEC countries provide 71% of crude oil, 58% of LPG, 33% of LNG, and 45% of petroleum products consumed by India. During the 5th OPEC-India Energy Dialogue on 29 October, Hardeep Singh Puri, India's Minister of Oil and Gas, raised the "issue of energy market volatility" and "current high energy prices and in that context underlined the importance of seeking market stability for the benefit of producers and consumers".

Sputnik spoke with Narendra Taneja, Ia prominent Indian energy expert, on a range of issues involving the higher cost of oil and gas imports and strategies to deal with fast-changing scenarios in West Asia.

Sputnik: India received its first LNG cargo from Russia last month, and reportedly it was the cheapest purchase by India from any client in the world. Has diversification of energy purchases started paying off for India?

Narendra Taneja: Well, diversification is part of a well-meditated strategy because depending on one geography or region for the supply of a commodity as crucial as natural gas is risky in terms of energy security. Russia has vast gas reserves and, therefore, will be a

significant supplier in years and decades to come. India and Russia have always enjoyed good energy ties.

Sputnik: Indian ministers have been urging oil producer countries to bring down their product prices for consumer countries. Why are these oil-producing countries not paying heed to demand?

Narendra Taneja: There could be many reasons, but the

cartelisation in the form of OPEC and OPEC Plus empowers them disproportionately vis a vis large importers of oil such as India. Greed also plays a big role. Most oil exporters also know that the share of oil in the global energy mix will begin to fall rapidly in ten years or so. They, therefore, want to monetise their oil as fast as possible.

Sputnik: Media reports are claiming India and China will jointly make efforts to pressurise OPEC not to inflate prices artificially. Do you think this kind of collaboration will work, especially given changing strategic environments?

Narendra Taneja: India's dependence on oil imports is much higher than China's. Moreover, China's response so far on any such multilateral move has not been sufficiently enthusiastic.

Sputnik: India stopped oil imports from Iran after the US imposed strict sanctions against Tehran. On the other hand, China keeps importing energy resources from Iran. Shouldn't India take a similar approach and resume Iranian oil imports?

Narendra Taneja: Iran is a critical friend and

partner in oil and gas. But India has to balance its oil relations with Iran in other contexts too at the same time, including New Delhi's long-term strategic ties with the United States and the West. Each country has its own perspectives and strategies on sensitive international issues.

Once Iran's second-biggest oil customer, India had stopped crude purchases in May 2019 after the Trump administration ended economic sanction waivers for some countries, including India. However, the Narendra Modi government maintains that "New Delhi's relations with Tehran stand on their own footing and are independent of its relations with third countries."

As per the Indian government data, Iraq was India's biggest oil supplier, followed by Saudi Arabia and the UAE in financial year 2020-21.

Sputnik: What should India's strategies be to bring down import costs and provide somewhat cheaper fuel to its citizens, who are currently reeling amid record prices?

Narendra Taneja: Well, we have to invest more in renewables and nuclear power to bring down our dependency on imported oil and gas. My sense is oil and gas prices may go further up between now and 2025. India should therefore rationalise the taxes on petroleum products and invest more in domestic oil and gas exploration and production.