Sen. Warren Pledges to Oppose Biden's Nomination of Jerome Powell for Second Term as Fed Chair

17:08 GMT 22.11.2021 (Updated: 13:26 GMT 06.08.2022)

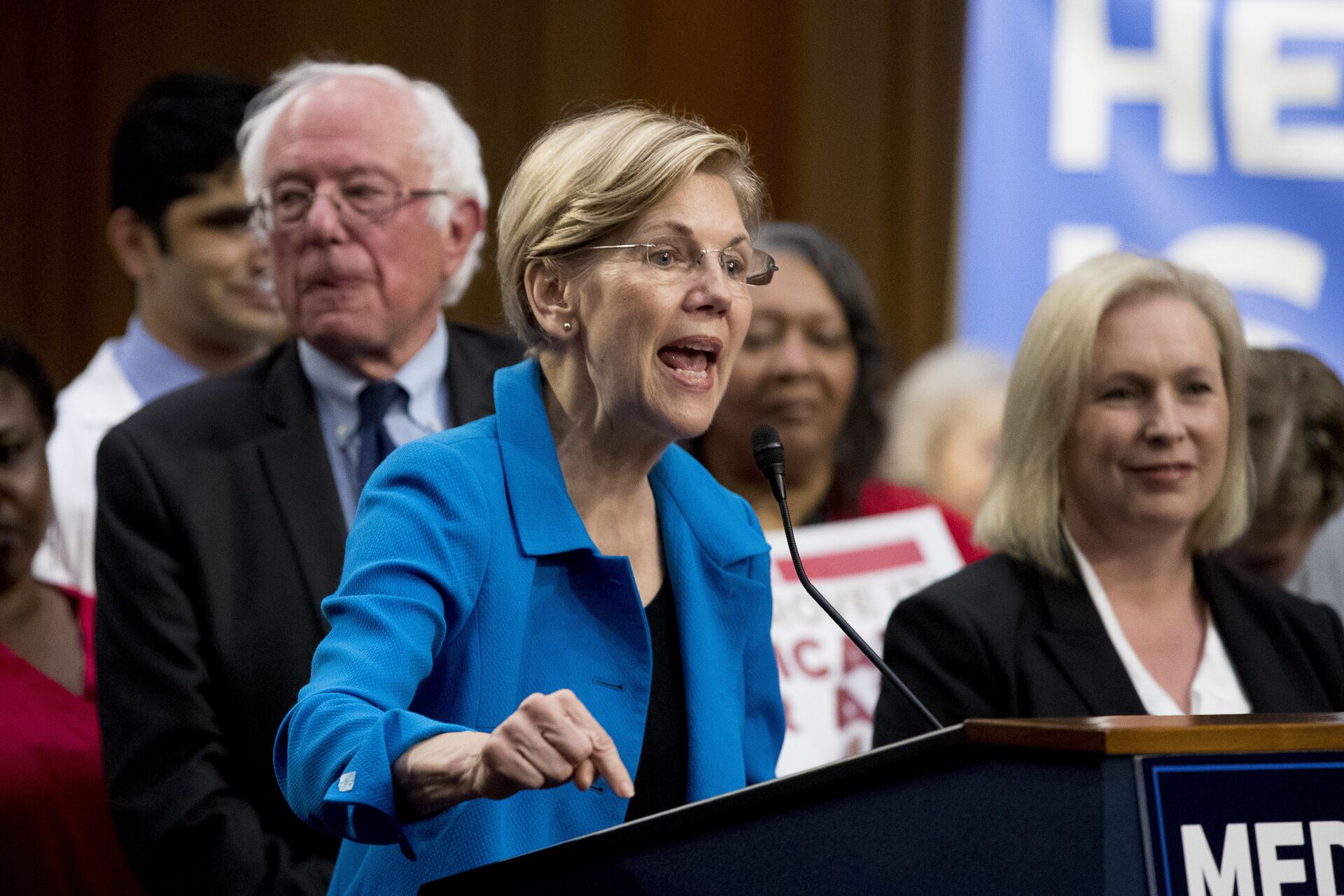

© AP Photo / Susan Walsh

Subscribe

The Fed has traditionally used currency inflation as the primary determinant of its fiscal policy, but amid the lockdown-induced economic malaise last year, Chairman Jerome Powell abandoned that principle in an attempt to prop up the country's struggling employment numbers, causing the worst devaluing of the US currency in 30 years.

Following US President Joe Biden's Monday nomination of Powell to serve a second term as Chairman of the Federal Reserve, US Senator Elizabeth Warren (D-MA) has said she will oppose the move, which requires Senate confirmation.

Warren said on Monday afternoon that she would not support Powell, the present chair of the country's central bank, serving a second four-year term in the position. However, she did give her blessing to Biden's nomination for the Fed's vice chairman, Lael Brainard, a former Treasury Secretary who also sits on the Fed's Board of Governors.

In a Monday news release announcing his nominations, Biden praised Powell for "decisive action ... to cushion the impact of the pandemic and get America’s economy back on track" and Brainard, one of the country's leading macroeconomists, for playing "a key leadership role at the Federal Reserve, working with Powell to help power our country’s robust economic recovery."

"Powell and Brainard share the Administration’s focus on ensuring that economic growth broadly benefits all workers," Biden said. "That’s why they oversaw a landmark re-evaluation of the Federal Reserve’s objectives to refocus its mission on the needs of workers of all backgrounds. And they’ve advanced key priorities that the President shares, like addressing the financial risks posed by climate change, and staying ahead of emerging risks to our financial system."

"I'm confident that Chair Powell and Dr. Brainard's focus on keeping inflation low, prices stable and delivering full employment will make our economy stronger than ever before," Biden said.

Warren Opposes 'Dangerous' Powell

However, Warren sharply dissented from the president's assessment, saying in a statement that "it's no secret" she opposes Powell remaining at the head of the Fed.

"Powell's failures on regulation, climate, and ethics make the still-vacant position of Vice Chair of Supervision critically important. This position must be filled by a strong regulator with a proven track record of tough and effective enforcement - and it needs to be done quickly," the Massachusetts senator said.

"American taxpayers have bailed out large financial institutions enough times. It's the job of the Federal Reserve to ensure large financial institutions do not put our economy at risk," she added. "As we move forward, I will use every oversight tool within reach to make sure that the Federal Reserve works for American families and not Wall Street."

In a Senate Banking Committee hearing September, Warren told Powell he was a "dangerous man," claiming he'd weakened the country's banking system and done little to ensure that another collapse like that in 2008 happens again. The Massachusetts lawmaker was instrumental in creating the Consumer Finance Protection Bureau in the aftermath of that collapse as a new regulatory agency also aimed at preventing a repeat.

“Your record gives me grave concerns," Warren said to Powell. "Over and over, you have acted to make our banking system less safe, and that makes you a dangerous man to head up the Fed."

Powell has led the Federal Reserve, which sets the nation's monetary policy independently of the rest of the government and acts as a "bank for banks," since February 2018. He was nominated by then-US President Donald Trump, with whom he had a stormy relationship after Trump attempted to pressure the Fed to keep interest rates low for political reasons.

Warren voted against Powell's nomination then, as well. She was joined by 12 other senators, including US Vice President Kamala Harris, who at the time was a US senator representing California.

Keeping Inflation From 'Becoming Entrenched'

Under Powell's leadership, the Fed has abandoned its typical focus on controlling inflation, or the devaluing of the currency, over fears that over-vigilance would hurt attempts to reduce unemployment. The two phenomena are often seen as divergent, with lower unemployment tending to cause inflation. However, Powell warned in August 2020, several months into the COVID-19 pandemic and its associated lockdown, that "inflation that is persistently too low can pose serious risks to the economy."

Earlier this month, with inflation hitting 6.2% - its highest since 1990 - Powell sought to dissuade economic fears, telling the Fed's Board of Governors on November 3 that higher inflation reflected "factors that are expected to be transitory."

Later on Monday afternoon, Powell and Brainard said they were committed to preventing inflation from "becoming entrenched," and that the US economy carries "the promise of a return to maximum employment."

"The unprecedented reopening of the economy, along with the continuing effects of the pandemic, led to supply and demand imbalances, bottlenecks, and a burst of inflation," Powell said. "We know that high inflation takes a toll on families, especially those less able to meet the higher costs of essentials like food, housing and transportation. We will use our tools both to support the economy - a strong labor market - and to prevent higher inflation from becoming entrenched."