https://sputnikglobe.com/20220202/india-gives-crypto-green-light-with-central-bank-digital-currency-tax-on-income-says-wazirx-boss-1092656261.html

India Gives Crypto Green Light With Central Bank Digital Currency, Tax on Income, Says WazirX Boss

India Gives Crypto Green Light With Central Bank Digital Currency, Tax on Income, Says WazirX Boss

Sputnik International

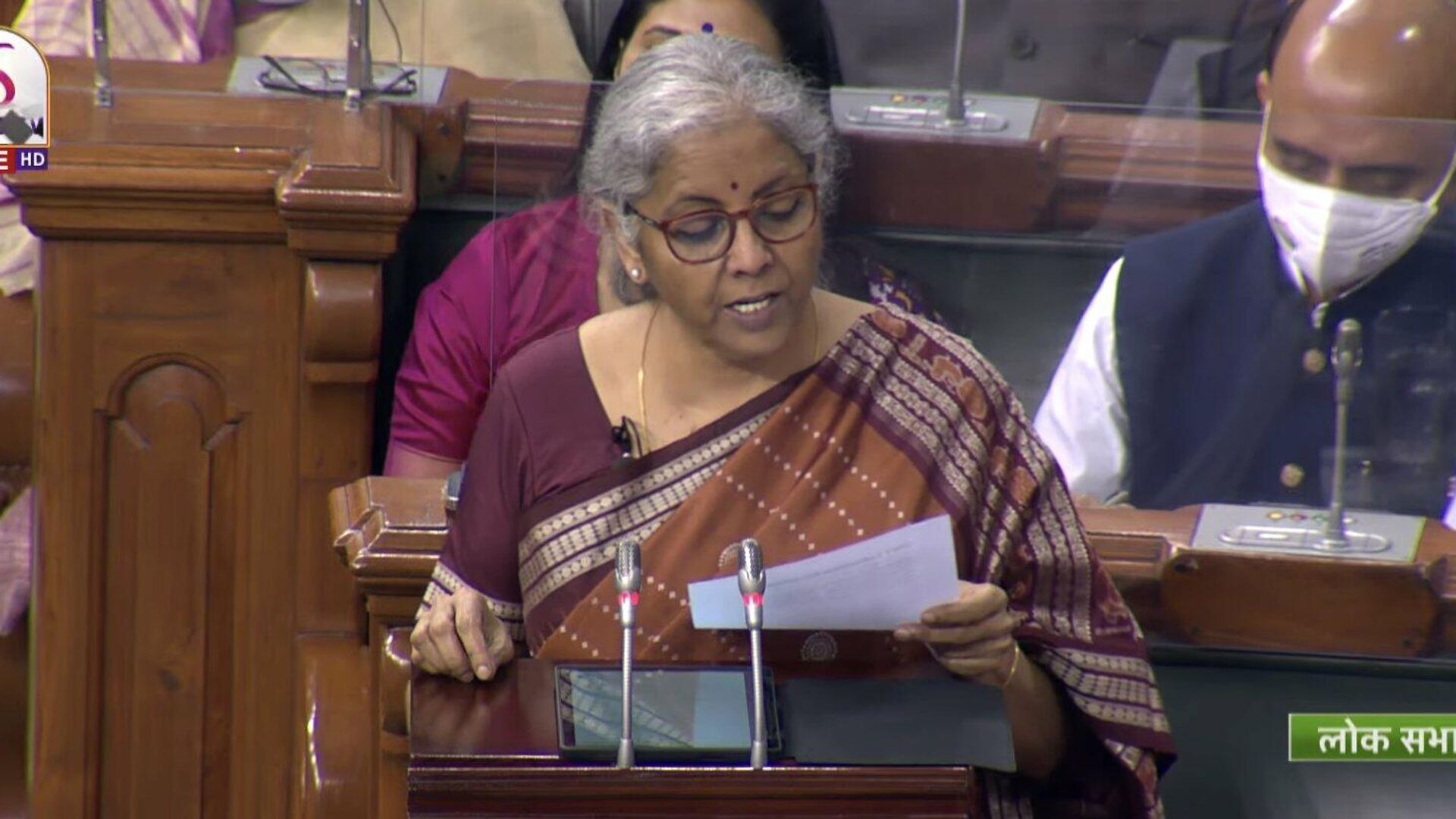

India's finance minister Nirmala Sitharaman on Tuesday presented the federal budget of $529 billion, focusing primarily on infrastructure and the digital... 02.02.2022, Sputnik International

2022-02-02T13:43+0000

2022-02-02T13:43+0000

2023-03-05T11:00+0000

virtual currency

china

digital currency

bitcoin

us federal reserve

crypto market

cryptocurrencies

cryptocurrency exchange

yuan

https://cdn1.img.sputnikglobe.com/img/07e6/02/01/1092656440_86:0:1558:828_1920x0_80_0_0_abd1c87bb904af3c8a87d8007aa69d63.jpg

India’s crypto sector has welcomed as "a progressive step" the announcement that the central bank is launching its own digital currency and introducing a tax on crypto investors, with experts in the subject saying that this will pave the way for crypto adoption and put the country in the vanguard of innovation.Nischal Shetty, founder of WazirX - one of the country’s largest cryptocurrency exchanges - expressed the hope that these announcements will remove all ambiguity related to crypto-assets.Presenting the country's annual budget in the Lok Saba or lower house of parliament on Tuesday, Sitharaman said that the size and frequency of transactions in virtual digital assets have made it imperative to introduce a specific tax regime.“For taxation of virtual digital assets, I propose to provide that any income from transfer of any virtual digital asset shall be taxed at the rate of 30 percent,” Sitharaman stated. The WazirX founder said it is also exciting that Sitharaman is referring to crypto as a virtual digital class since this is the first step to recognising crypto as an emerging asset class.“Most people, in particular corporates, who have been sitting on the sidelines because of uncertainty will now be able to participate in crypto. Overall, it’s a positive move for the industry,” WazirX founder underlined.India will launch the central bank digital currency in the financial year 2022-23, starting this April, to usher in cheaper, more efficient currency management.The Indian government’s bold steps of embracing digital currency have come against the backdrop of the multi-cities Central Bank Digital Currency trials by China. At the same time, the central banks of Switzerland and France already last December judged the first cross-border trial of CBDC payments involving digital euros and Swiss francs a success.The US Federal Reserve and Bank of England are also looking into launching a digital currency in their respective economies.

china

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

Rishikesh Kumar

https://cdn1.img.sputnikglobe.com/img/07e4/08/04/1080055820_0:0:388:389_100x100_80_0_0_40018ee210946d65d49ffba4f4c008e1.jpg

Rishikesh Kumar

https://cdn1.img.sputnikglobe.com/img/07e4/08/04/1080055820_0:0:388:389_100x100_80_0_0_40018ee210946d65d49ffba4f4c008e1.jpg

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Rishikesh Kumar

https://cdn1.img.sputnikglobe.com/img/07e4/08/04/1080055820_0:0:388:389_100x100_80_0_0_40018ee210946d65d49ffba4f4c008e1.jpg

virtual currency, china, digital currency, bitcoin, us federal reserve, crypto market, cryptocurrencies, cryptocurrency exchange, yuan

virtual currency, china, digital currency, bitcoin, us federal reserve, crypto market, cryptocurrencies, cryptocurrency exchange, yuan

India Gives Crypto Green Light With Central Bank Digital Currency, Tax on Income, Says WazirX Boss

13:43 GMT 02.02.2022 (Updated: 11:00 GMT 05.03.2023) India's finance minister Nirmala Sitharaman on Tuesday presented the federal budget of $529 billion, focusing primarily on infrastructure and the digital economy. The government announced a flat 30 percent tax on crypto income. The Reserve Bank of India will also issue digital currency based on blockchain in the next few weeks.

India’s crypto sector has welcomed as "a progressive step" the announcement that the central bank is launching its own digital currency and introducing a tax on crypto investors, with experts in the subject saying that this will pave the way for crypto adoption and put the country in the vanguard of innovation.

Nischal Shetty,

founder of WazirX - one of the country’s largest cryptocurrency exchanges - expressed the hope that these announcements will remove all ambiguity related to crypto-assets.

“It’s a huge relief to see that our government is adopting the progressive stance of going ahead in the direction of innovation. By bringing in taxation, the government legitimises the industry to a large extent.”

Nischal Shetty

CEO, WazirX

Presenting the country's annual budget in the Lok Saba or lower house of parliament on Tuesday, Sitharaman said that the size and frequency of transactions in virtual digital assets have made it imperative to introduce a specific tax regime.

“For taxation of virtual digital assets, I propose to provide that any income from transfer of any virtual digital asset shall be taxed at the rate of 30 percent,” Sitharaman stated.

The WazirX founder said it is also exciting that Sitharaman is referring to crypto as a virtual digital class since this is the first step to recognising crypto as an emerging asset class.

“Most people, in particular corporates, who have been sitting on the sidelines because of uncertainty will now be able to participate in crypto. Overall, it’s a positive move for the industry,” WazirX founder underlined.

India will launch the central bank digital currency in the financial year 2022-23, starting this April, to usher in cheaper, more efficient currency management.

“The Digital Rupee using blockchain technology will lead to stable, efficient, regulated payments and settlements and lowered transaction cost. This initiative is expected to boost the digital economy and reduce leakages by lowering dependency on cash,” Rajosik Banerjee, head of financial risk management at KPMG India, said.

The Indian government’s bold steps of embracing digital currency have come against the backdrop of the multi-cities

Central Bank Digital Currency trials by China.

At the same time, the central banks of Switzerland and France already last December judged the first cross-border trial of CBDC payments involving digital euros and Swiss francs a success.

The

US Federal Reserve and Bank of England are also looking into launching a digital currency in their respective economies.