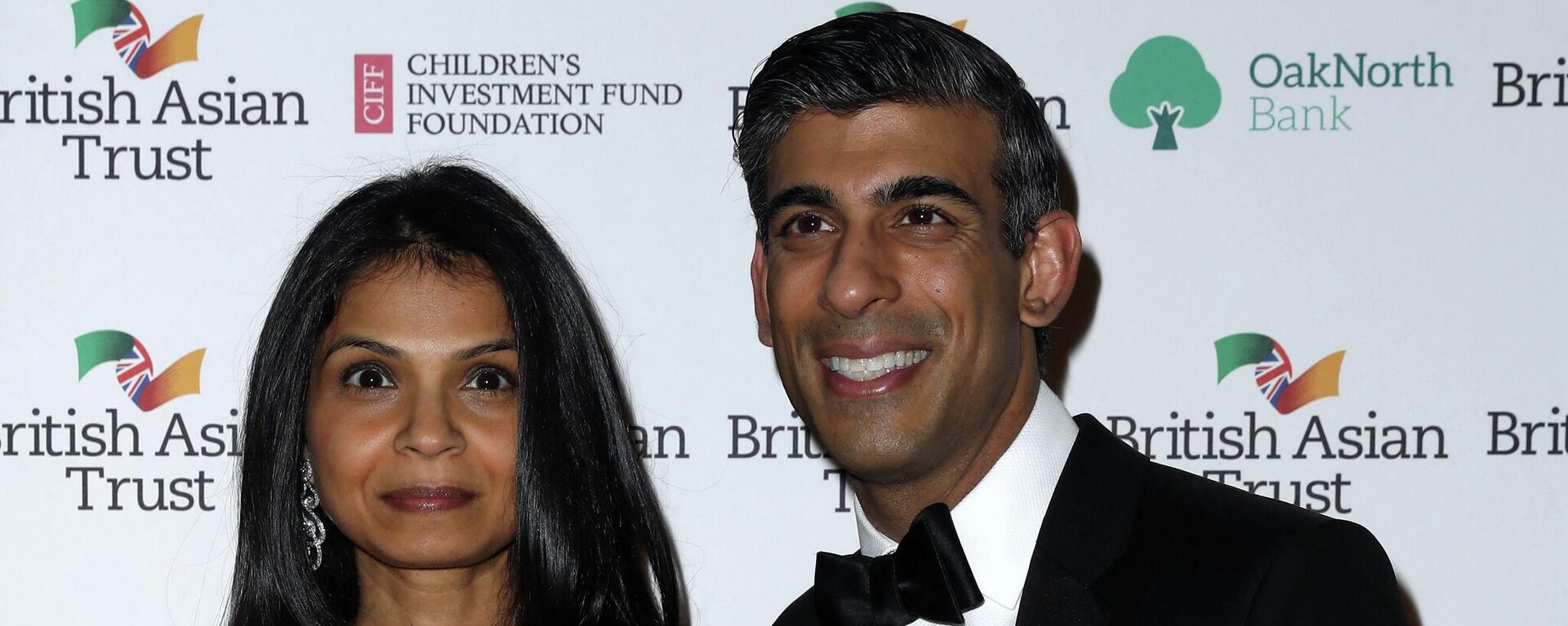

Rishi Sunak Was Reportedly ‘Listed' in Tax Haven as 'Trust Beneficiary’ Relating to Wife’s Finances

07:02 GMT 09.04.2022 (Updated: 15:18 GMT 28.05.2023)

© AFP 2023 / JUSTIN TALLIS

Subscribe

UK Chancellor Rishi Sunak saw popularity ratings drop after his Spring Statement in March, when critics questioned whether he was doing enough to address the cost of living crisis. He has also been under pressure over his family’s tax affairs since it was reported that his multi-millionaire wife benefited from tax-reducing non-domiciled status.

Urgent answers are being demanded from Rishi Sunak after it was reported that he was listed as a beneficiary of tax haven trusts created to manage his wife’s business affairs.

Sunak, who became Chancellor in February 2020 that year, was setting taxes in the UK while noted in documents related to Akshata Murty’s wealthy family, according to sources cited by The Independent.

The UK Chancellor’s wife, who married Rishi Sunak in 2009, and is said to have moved to the UK in 2015, is the daughter of the billionaire founder of the Indian-headquartered company Infosys, worth approximately £690m, in which she holds a 0.9% stake.

Trusts in the British Virgin Islands and Cayman Islands had accordingly been set up to help manage the tax and business affairs of Murty’s family, and in a number of them, Sunak was listed as a beneficiary, according to people familiar with the woman’s financial affairs.

The revelation that Rishi Sunak had been listed as a beneficiary of tax haven trusts is “extremely serious”, said Pat McFadden, Labour’s shadow chief Treasury secretary.

“We need urgent answers from the chancellor as to why he has been linked to a tax haven. We need full transparency about this and the other stories about the chancellor emerging over the past 24 hours,” said McFadden.

A spokesperson for Rishi Sunak said they “did not recognise” the claims that the Chancellor had been listed as beneficiary in tax havens. There has not been an official comment from Ms Murty.

Chancellor Facing Pressure

The UK Chancellor has been in the cross hairs since March, when critics pummelled him after he delivered the Spring Statement. He was branded a “fiscal illusionist” at the time for pledging tax cuts while driving up the overall levy burden amid a cost of living crisis.

After reports on Wednesday that his wife had non-domiciled status, fresh focus has been directed on the Chancellor’s personal wealth.

A person registered as non-domiciled with HM Revenue and Customs (HMRC) is a tax resident in the United Kingdom, but does not have to pay UK tax on income and capital gains earned overseas unless they bring their money into the country.

Akshata Murty, whose family business is worth £3.5bn, potentially avoided up to £20m in UK taxes over a period of seven and a half years, when she is estimated to have received 5.4bn Indian rupees (£54.5m) in dividends from the tech company, according to cited public data.

Such dividends would require a UK resident taxpayer to pay a 38.1% tax (which rose to 39.35% from 6 April).

Furthermore, according to the outlet’s sources, Murty had set up a trust to perpetuate some of the non-dom status benefits beyond the 15-year limit. Under current law, Akshata Murty would be automatically deemed domiciled after living in the country for 15 years.

In the wake of the revelation, the UK Labour Party urged the Chancellor “in the vital public interest” to provide clarity on whether he had benefited from his wife’s status.

“Akshata Murty is a citizen of India, the country of her birth and parents’ home. India does not allow its citizens to hold the citizenship of another country simultaneously. So, according to British law, Ms Murty is treated as non-domiciled for UK tax purposes. She has always and will continue to pay UK taxes on all her UK income,” said a spokeswoman for Murty.

However, on Friday, Akshata Murty announced she would now be paying UK taxes on all her worldwide income, to avoid her financial arrangements becoming a “distraction” for her Chancellor husband.

More questions were raised amid reports that having become Chancellor in February 2020, Sunak had held a green card until around October 2021.

Green card holders are obligated to pay US tax on their worldwide income.

"Rishi Sunak had a green card when he lived and worked in the US," said the Chancellor’s spokeswoman on Friday in response to the reports.

It was added he had used his green card for travel purposes on his first US trip in a government capacity in 2021, after which he returned it.

“Rishi Sunak followed all guidance and continued to file US tax returns, but specifically as a non-resident, in full compliance with the law. All laws and rules have been followed and full taxes have been paid where required in the duration he held his green card,” clarified the spokeswoman.

All these revelations, coming amidst rising inflation, national insurance contributions (NICs) and soaring energy bills have been driving down the already plummeting popularity of the Chancellor with voters. It has now sunk to an all-time low against the backdrop of a cost-of-living crisis, show polls.

Labour leader Sir Keir Starmer accused Rishi Sunak of “breathtaking hypocrisy” for raising taxes while his wife “benefits” from non-dom status. The Labour party, the Lib Dems and the SNP have all urged the chancellor to provide further details of their financial affairs, as well as clarifying the extent to which he may have benefited personally.