https://sputnikglobe.com/20220420/long-ukraine-crisis-could-sink-us-efforts-to-stabilize-oil-prices-ex-texas-regulator-believes-1094918880.html

Long Ukraine Crisis Could Sink US Efforts to Stabilize Oil Prices, Ex-Texas Regulator Believes

Long Ukraine Crisis Could Sink US Efforts to Stabilize Oil Prices, Ex-Texas Regulator Believes

Sputnik International

WASHINGTON (Sputnik) - US President Joe Biden's plan to use emergency petroleum reserves to stabilize energy markets could backfire and send oil prices... 20.04.2022, Sputnik International

2022-04-20T16:14+0000

2022-04-20T16:14+0000

2022-12-19T13:51+0000

us

business

oil

oil prices

https://cdn1.img.sputnikglobe.com/img/07e6/04/04/1094482814_0:98:2464:1484_1920x0_80_0_0_22aa77cc03eb20d7c9e073ac3b945a91.jpg

US President Joe Biden announced at the end of March that his administration will release one million barrels of oil daily from the Strategic Petroleum Reserve (SPR) for the next six months. During this time period, the US and its partners combined plan to release a total of 240 million barrels of oil to the global market.Meanwhile, he added, as the SPR release keeps the price of oil down, US producers are not producing more oil."Then when it works out that yes, sure enough, the Russians aren't backing out of Ukraine, this thing is not going anywhere, now we have already spent our Strategic Petroleum Reserve reserves and now the price of oil goes even higher," Sitton said.Sitton, a former member of the Texas Railroad Commission, the oil regulator in the United States' top oil-producing state, predicts a fairly long stalemate with Russia, which means US sanctions could remain in place for a long time.Sitton gives Biden credit for using the SPR wisely to provide stability during unrest and a meaningful impact on prices.Crude benchmarks did come down more than 10 percent after Biden announced the SPR release at the end of March. The indexes dropped below the $100 mark by mid-April before rising again with Brent now trading at around $108 per barrel and WTI at $102, as of Tuesday.Sitton suggested that the SPR could serve as a method to balance the global oil market while supply routes and chains are reorganized following the disruption.Biden Blames US Oil, Gas Companies for Hike in Gazoline PricesWhen Biden first announced his plan to rally allies and partners to impose wide-ranging sanctions on Russia, he warned that it could hurt Americans as well, but would do everything in his power to ease the pain.However, when it came to Americans’ pain at the pump, the US president accused oil giants of price gouging and at fault for the dramatic rise in gas costs, which have risen by as much as 80 percent under the Biden administration.The national average price of gas rose to a record high of $4.33 per gallon last month after Washington and its allies imposed a wide range of sanctions on Moscow, including a US ban on Russian oil imports. The national average has remained relatively high, sitting at $4.10 per gallon as of Tuesday, according to AAA.Sitton described Biden's statements targeting the oil industry as "classic political maneuvering."There is obvious evidence that the price hike is 100 percent supply and demand related, induced by the novel coronavirus pandemic and government shutdowns, Sitton said, noting that oil prices went to negative $37 a barrel during that period."When some of these oil companies lost more money in 2020 than they had made in the previous three years, no one was lining up to help them," Sitton said. "No one was talking about how they were dealing with a tough market situation but boy, they make some money on the upside dealing with a different type of market situation and Biden is quick to throw them under the bus. I find that just pathetic."The United States does not have enough oil in large part due to green initiatives and Democrat's anti-oil and gas policies, Sitton said.

https://sputnikglobe.com/20220405/americans-scramble-to-survive-inflation-gas-price-spike-as-experts-predict-worse-to-come-1094486124.html

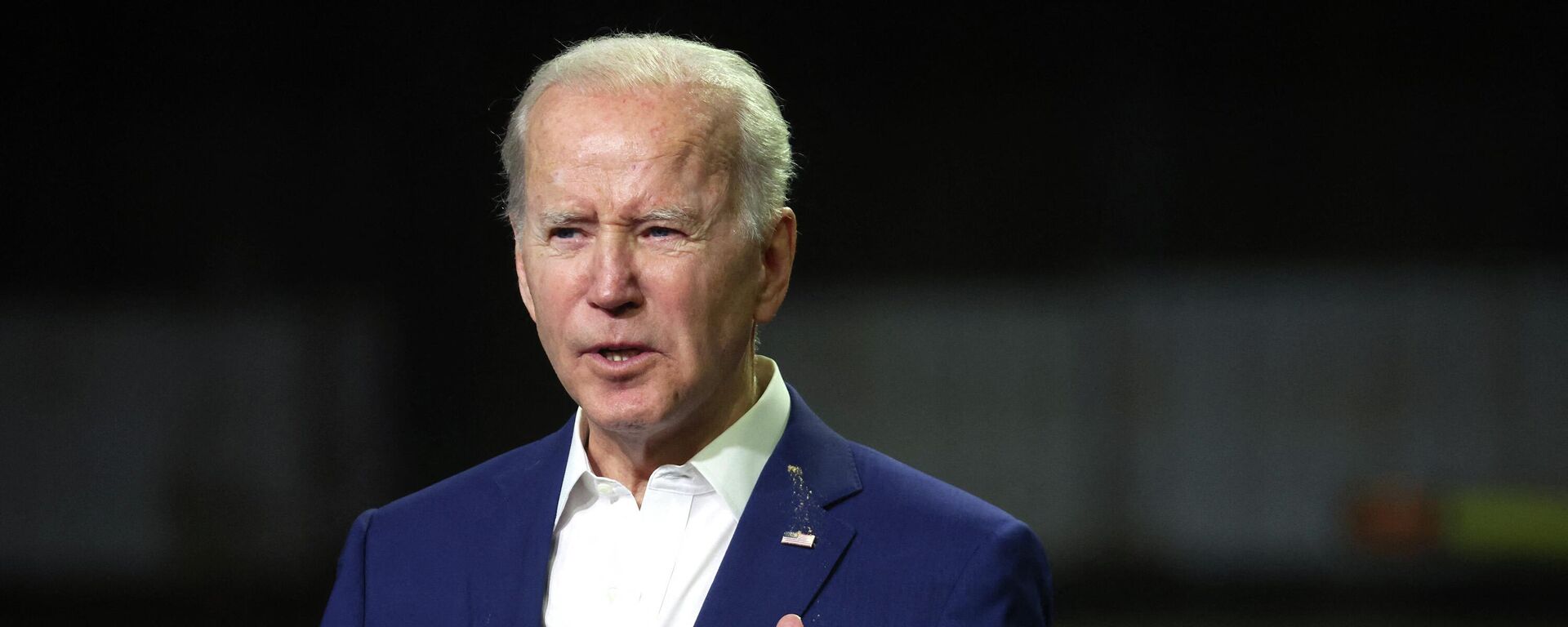

https://sputnikglobe.com/20220410/trump-says-biden-sent-gas-prices-soaring-long-before-ukraine-crisis-1094628960.html

https://sputnikglobe.com/20220417/joe-bidens-restrictive-energy-policies-will-compound-problem-amid-crisis-warns-oil--gas-exec-1094833764.html

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

us, business, oil, oil prices

us, business, oil, oil prices

Long Ukraine Crisis Could Sink US Efforts to Stabilize Oil Prices, Ex-Texas Regulator Believes

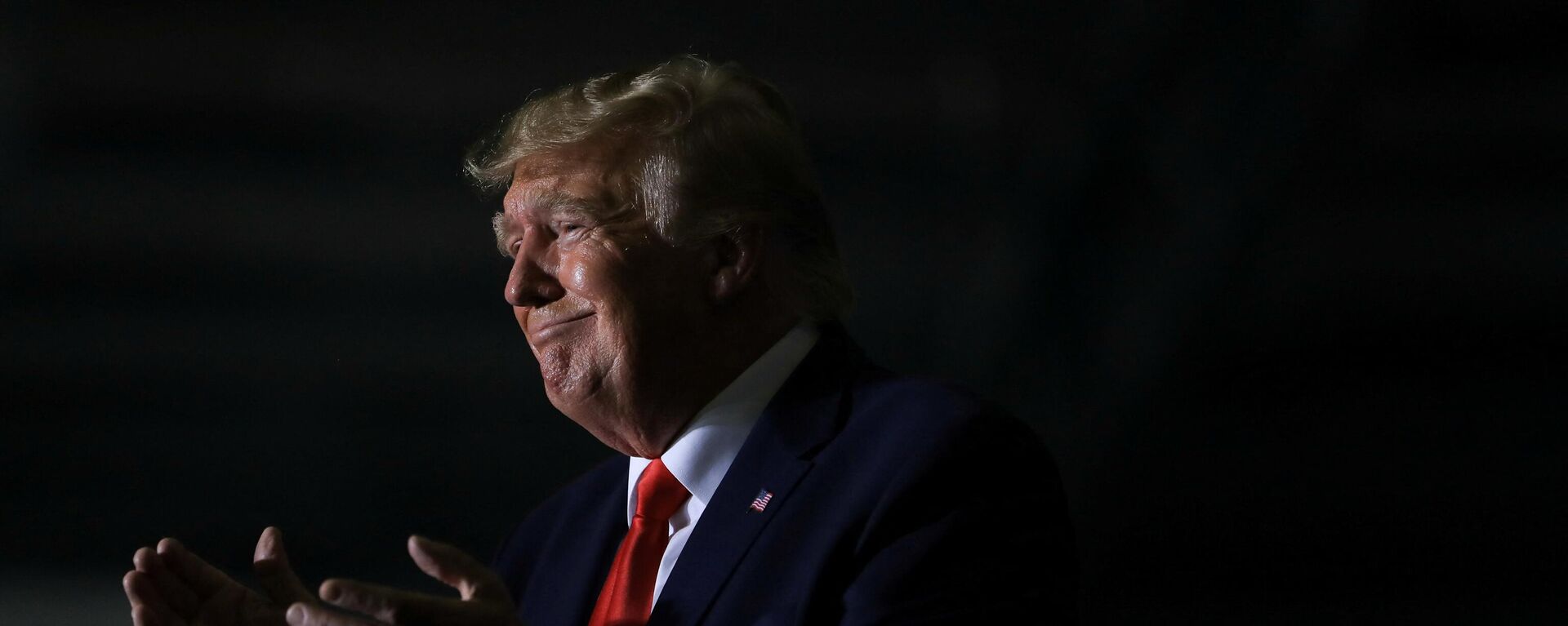

16:14 GMT 20.04.2022 (Updated: 13:51 GMT 19.12.2022) WASHINGTON (Sputnik) - US President Joe Biden's plan to use emergency petroleum reserves to stabilize energy markets could backfire and send oil prices skyrocketing if the conflict in Ukraine lasts more than six months, former Texas oil regulator Ryan Sitton told Sputnik.

US President Joe Biden announced at the end of March that his

administration will release one million barrels of oil daily from the Strategic Petroleum Reserve (SPR) for the next six months. During this time period, the US and its partners combined plan to release a total of 240 million barrels of oil to the global market.

"The risk in all this is if you use the Strategic Petroleum Reserve as a major bridge between this disruptive event and at the end of say six months it doesn't show any sign of improving, then what have you done? Well, I put a bunch of oil on the market and that lowered the price of oil, which means oil producers are less likely to invest in new oil wells," Sitton said.

Meanwhile, he added, as the SPR release keeps the price of oil down, US producers are not producing more oil.

"Then when it works out that yes, sure enough, the Russians aren't backing out of Ukraine, this thing is not going anywhere, now

we have already spent our Strategic Petroleum Reserve reserves and now the price of oil goes even higher," Sitton said.

Sitton, a former member of the Texas Railroad Commission, the oil regulator in the United States' top oil-producing state, predicts a fairly long stalemate with Russia, which means

US sanctions could remain in place for a long time.

"There's gonna be a lot of repositioning of oil balances in oil markets," Sitton said. "Where do we get heavy oil from? And that may very well take longer than the Strategic Petroleum Reserve can bridge."

Sitton gives Biden credit for

using the SPR wisely to provide stability during unrest and a meaningful impact on prices.

Crude benchmarks did come down more than 10 percent after Biden announced the SPR release at the end of March. The indexes dropped below the $100 mark by mid-April before rising again with Brent now trading at around $108 per barrel and WTI at $102, as of Tuesday.

Sitton suggested that the SPR could serve as a method to balance the global oil market while supply routes and chains are reorganized following the disruption.

Biden Blames US Oil, Gas Companies for Hike in Gazoline Prices

When Biden first announced his plan to rally allies and partners to impose wide-ranging sanctions on Russia, he warned that it could hurt Americans as well, but

would do everything in his power to ease the pain.

However, when it came to Americans’ pain at the pump, the US president accused oil giants of price gouging and at fault for the dramatic rise in gas costs, which have risen by as much as 80 percent under the Biden administration.

The national average price of gas rose to a record high of $4.33 per gallon last month after Washington and its allies imposed a wide range of sanctions on Moscow, including a US ban on Russian oil imports. The national average has remained relatively high, sitting at $4.10 per gallon as of Tuesday, according to AAA.

Sitton described Biden's statements targeting the oil industry as "classic political maneuvering."

"When the price of energy is going up, [US voters] they don't like what they're paying at the pump, the economy is slowing down, it's got a lot of both primary and secondary negative impacts, and those voters are going to

vote differently in the polls," Sitton said. "So the classic political lever to pull is to blame the oil companies, to say it's all their fault."

There is obvious evidence that the price hike is 100 percent supply and demand related, induced by the novel coronavirus pandemic and government shutdowns, Sitton said, noting that oil prices went to negative $37 a barrel during that period.

"When some of these oil companies lost more money in 2020 than they had made in the previous three years, no one was lining up to help them," Sitton said. "No one was talking about how they were dealing with a tough market situation but boy, they make some money on the upside dealing with a different type of market situation and Biden is quick to throw them under the bus. I find that just pathetic."

The United States does not have enough oil in large part due to green initiatives and Democrat's anti-oil and gas policies, Sitton said.