https://sputnikglobe.com/20220509/hollywood-lawyer-reportedly-footed-over-2-mln-of-sugar-brother-hunter-bidens-overdue-tax-bill-1095373361.html

Hollywood Lawyer Reportedly Footed Over $2 Mln of ‘Sugar Brother’ Hunter Biden’s Overdue Tax Bill

Hollywood Lawyer Reportedly Footed Over $2 Mln of ‘Sugar Brother’ Hunter Biden’s Overdue Tax Bill

Sputnik International

Hunter Biden confirmed a long-running federal investigation into his "tax affairs” in December 2020, shortly after his father Joe Biden won the presidency. The... 09.05.2022, Sputnik International

2022-05-09T14:40+0000

2022-05-09T14:40+0000

2022-05-09T14:54+0000

hunter biden

joe biden

taxes

https://cdn1.img.sputnikglobe.com/img/07e6/03/1d/1094292013_0:33:1293:760_1920x0_80_0_0_600bd68d11a0db2a3999cf41dd4a108c.jpg

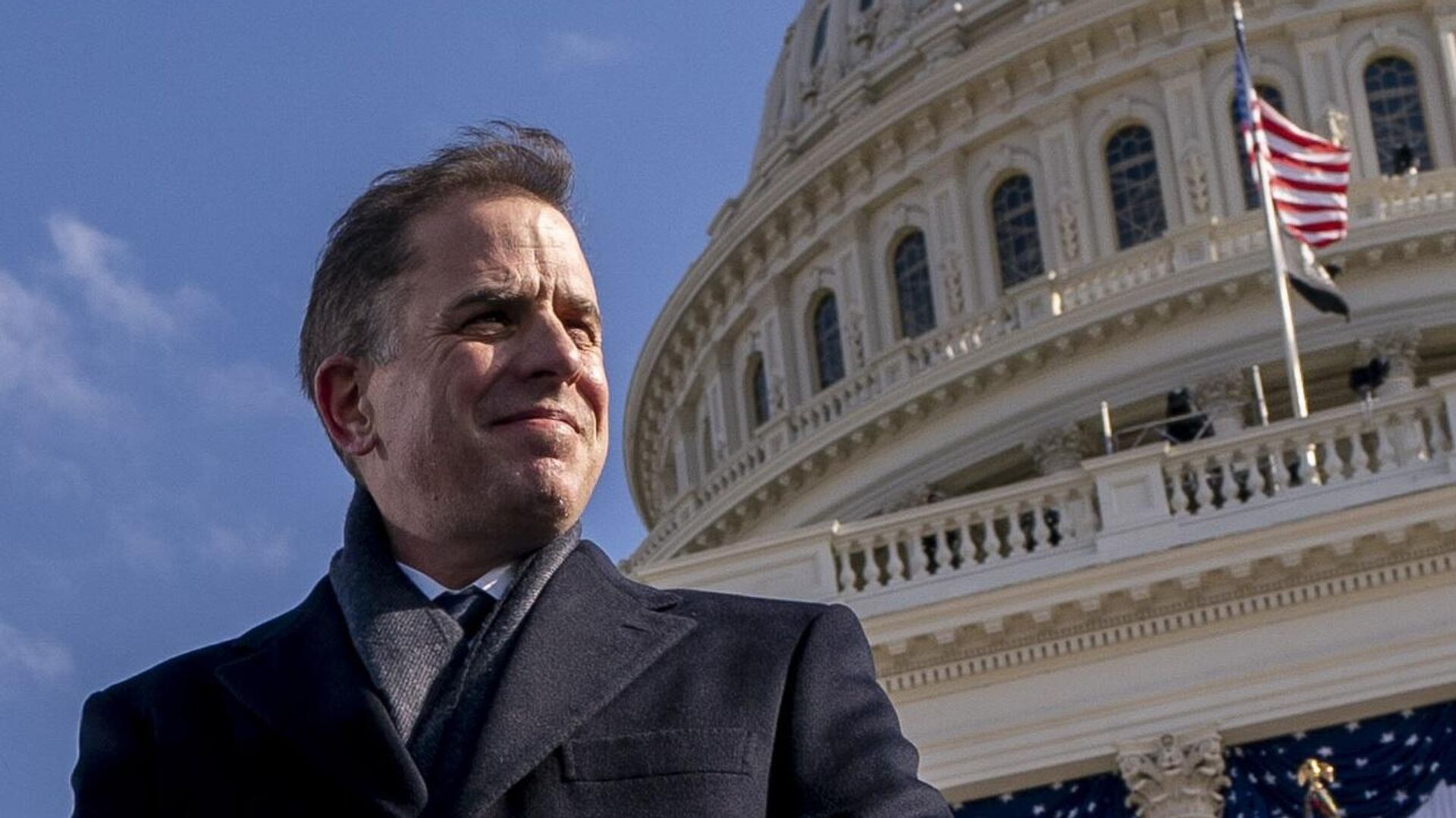

A high-powered Hollywood attorney paid off over $2 million of Hunter Biden’s overdue taxes, the New York Post reported.Kevin Morris, an attorney known for representing the co-creators of the animated satire “South Park” in their $550 million licensing deal, footed a tax bill for the son of the current POTUS that was more than twice what was previously reported, according to a source cited by the Post.Furthermore, Morris, dubbed Hunter Biden’s latest “sugar brother” by insiders, has ostensibly been bankrolling the 52-year-old's rent and daily expenses, besides helping him structure sales of his artwork.According to Hunter Biden's New York-based attorney Christopher Clark, cited by CBS News, Morris, who won a Tony award as a co-producer of the hit musical "Book of Mormon", is serving his client as a “trusted adviser”.Morris' office reportedly added that the lawyer was honing a “legal and media strategy” for Hunter Biden.Kevin Morris, a founding member of the firm Morris Yorn Barnes Levine in Los Angeles, where he no longer works, boasts an impressive A-list of Hollywood celebrities as clients, including Matthew McConaughey, Scarlett Johansson, Ellen DeGeneres, Liam Hemsworth, and Chris Rock.Hunter’s Delinquent TaxesAn investigation into Hunter Biden for tax crimes began in 2018. It is believed to have been kept under wraps by US Attorney David Weiss, with neither search warrants nor grand jury subpoenas issued so as not to “alert the public to the existence of the case in the middle of a presidential election”, Politico reported in 2021.However, in October 2020, towards the end of the presidential race, the NY Post exclusively revealed that a hard drive holding the contents of Hunter Biden’s laptop that he abandoned at a Delaware repair shop included a cache of emails shedding light on how he purportedly peddled access to his father in his overseas business dealings.Furthermore, the contents of Hunter Biden’s laptop appeared to link his then-candidate father to his “shady” foreign business ventures in China and with Ukrainian energy company Burisma. From 2014 to 2019, Hunter Biden served on the energy firm’s board and was reportedly paid about $50,000 a month.The emails in question revealed that the younger Biden had introduced a top Burisma executive to his father, then vice president in the Barack Obama administration, less than a year before the elder Biden admittedly pressured Ukrainian officials into firing a prosecutor who was investigating the company, probed for corruption in the past.Hunter Biden finally revealed on 9 December 2020 in a statement released by his father’s presidential transition office that he was under federal investigation for possible tax fraud, with a report saying the Justice Department was also examining his overseas business dealings in China and Ukraine.While the NYT, as well as other mainstream media sources, dismissed the original NY Post story on Hunter Biden’s laptop as “unsubstantiated”, echoing claims of a Russian “disinformation campaign” made by a host of former US intelligence officials, in its 16 March report, the outlet made an unexpected admission.Reporting on the ongoing federal probe into Hunter Biden's delinquent tax bills, the NYT said that when looking into the younger Biden's business dealings, certain emails, scrutinised by prosecutors, were obtained from "a cache of files that appears to have come from a laptop abandoned by Mr Biden in a Delaware repair shop".Moreover, "the email and others in the cache were authenticated by people familiar with them and with the investigation".In the year after he disclosed the federal probe into his “tax affairs” in late 2020, Hunter Biden paid off a significant tax liability, The New York Times reported.The outlet added that the up-to-date tax bill could make it more difficult for prosecutors to convict Hunter Biden. If it were up to tax prosecutors, the publication claimed, they would typically argue that paying an overdue balance would not impact a fraud case. However, a judge and jury were deemed as likely to display more sympathy toward someone who had paid their bill.

https://sputnikglobe.com/20220508/republican-lawmaker-plans-to-investigate-hunter-bidens-business-affairs-potus-involvement-1095350695.html

https://sputnikglobe.com/20220507/hunter-biden-was-drunk-when-he-brought-me-his-laptop-from-hell-repair-shop-owner-recalls-1095336778.html

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

hunter biden, joe biden, taxes

hunter biden, joe biden, taxes

Hollywood Lawyer Reportedly Footed Over $2 Mln of ‘Sugar Brother’ Hunter Biden’s Overdue Tax Bill

14:40 GMT 09.05.2022 (Updated: 14:54 GMT 09.05.2022) Hunter Biden confirmed a long-running federal investigation into his "tax affairs” in December 2020, shortly after his father Joe Biden won the presidency. The Republicans have since vowed that if they win back a majority in the House and Senate in the 2022 midterms, Hunter Biden will be summoned before a hearing over his business dealings.

A high-powered Hollywood attorney paid off over $2 million of Hunter Biden’s

overdue taxes, the New York Post reported.

Kevin Morris, an attorney known for representing the co-creators of the animated satire “South Park” in their $550 million licensing deal, footed a tax bill for the son of the current POTUS that was more than twice what was previously reported, according to a source cited by the Post.

Furthermore, Morris, dubbed Hunter Biden’s latest “sugar brother” by insiders, has ostensibly been bankrolling the 52-year-old's rent and daily expenses, besides helping him structure sales of his artwork.

According to Hunter Biden's New York-based attorney Christopher Clark, cited by CBS News, Morris, who won a Tony award as a co-producer of the hit musical "Book of Mormon", is serving his client as a “trusted adviser”.

Morris' office reportedly added that the lawyer was honing a “legal and media strategy” for Hunter Biden.

Kevin Morris, a founding member of the firm Morris Yorn Barnes Levine in Los Angeles, where he no longer works, boasts an impressive A-list of Hollywood celebrities as clients, including Matthew McConaughey, Scarlett Johansson, Ellen DeGeneres, Liam Hemsworth, and Chris Rock.

Hunter’s Delinquent Taxes

An investigation into Hunter Biden for tax crimes began in 2018. It is believed to have been kept under wraps by US Attorney David Weiss, with neither search warrants nor grand jury subpoenas issued so as not to “alert the public to the existence of the case in the middle of a presidential election”, Politico reported in 2021.

However, in October 2020, towards the end of the presidential race, the NY Post exclusively revealed that a hard drive holding the contents of Hunter Biden’s laptop that he abandoned at a Delaware repair shop included a cache of emails shedding light on how he purportedly peddled access to his father in his overseas business dealings.

Furthermore, the contents of Hunter Biden’s laptop appeared to link his then-candidate father to his “shady” foreign business ventures in China and with Ukrainian energy company Burisma. From 2014 to 2019, Hunter Biden served on the energy firm’s board and was reportedly paid about $50,000 a month.

The

emails in question revealed that the younger Biden had introduced a top Burisma executive to his father, then vice president in the Barack Obama administration, less than a year before the elder Biden admittedly pressured Ukrainian officials into firing a prosecutor who was investigating the company, probed for corruption in the past.

Hunter Biden finally revealed on 9 December 2020 in a statement released by his father’s presidential transition office that he was under federal investigation for possible tax fraud, with a report saying the Justice Department was also examining his overseas business dealings in China and Ukraine.

“I take this matter very seriously but I am confident that a professional and objective review of these matters will demonstrate that I handled my affairs legally and appropriately, including with the benefit of professional tax advisors”, Hunter Biden stated.

While the NYT, as well as other mainstream media sources, dismissed the original NY Post story on Hunter Biden’s laptop as “unsubstantiated”, echoing claims of a Russian “disinformation campaign” made by a host of former US intelligence officials, in its 16 March report, the outlet made an unexpected admission.

Reporting on the ongoing federal probe into Hunter Biden's delinquent

tax bills, the NYT said that when looking into the younger Biden's business dealings, certain emails, scrutinised by prosecutors, were obtained from "a cache of files that appears to have come from a laptop abandoned by Mr Biden in a Delaware repair shop".

Moreover, "the email and others in the cache were authenticated by people familiar with them and with the investigation".

In the year after he disclosed the federal probe into his “tax affairs” in late 2020, Hunter Biden paid off a significant tax liability, The New York Times reported.

The outlet added that the up-to-date tax bill could make it more difficult for prosecutors to convict

Hunter Biden. If it were up to tax prosecutors, the publication claimed, they would typically argue that paying an overdue balance would not impact a fraud case. However, a judge and jury were deemed as likely to display more sympathy toward someone who had paid their bill.