https://sputnikglobe.com/20220723/bird-down-1097716458.html

Bird Down

Bird Down

Sputnik International

Shares of Twitter closed up some 0.8% on Friday as the tech company reported second quarter revenue results that failed to meet analyst estimates on earnings... 23.07.2022, Sputnik International

2022-07-23T04:05+0000

2022-07-23T04:05+0000

2023-04-14T12:56+0000

ted rall

sputnik cartoons

acquisition

elon musk

x (formerly twitter)

https://cdn1.img.sputnikglobe.com/img/07e6/07/17/1097715398_0:207:1200:882_1920x0_80_0_0_895089a9e2a0548269e8ae1b91aa2964.jpg

Twitter reported its biggest revenue miss to-date on July 22, with total revenue – including subscriptions – coming in at $1.18 billion, well under Wall Street analysts’ expectations of $1.32 billion (-$0.14 billion).The social media company’s advertising revenue rose 2%, to about $1.08 billion, failing to meet market expectations of $1.22 billion (-$0.14 billion).Twitter will not be holding its usual conference call with analysts to discuss the quarterly results, nor will it be providing forward-looking guidance for the upcoming third quarter.

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

ted rall, sputnik cartoons, acquisition, elon musk, x (formerly twitter)

ted rall, sputnik cartoons, acquisition, elon musk, x (formerly twitter)

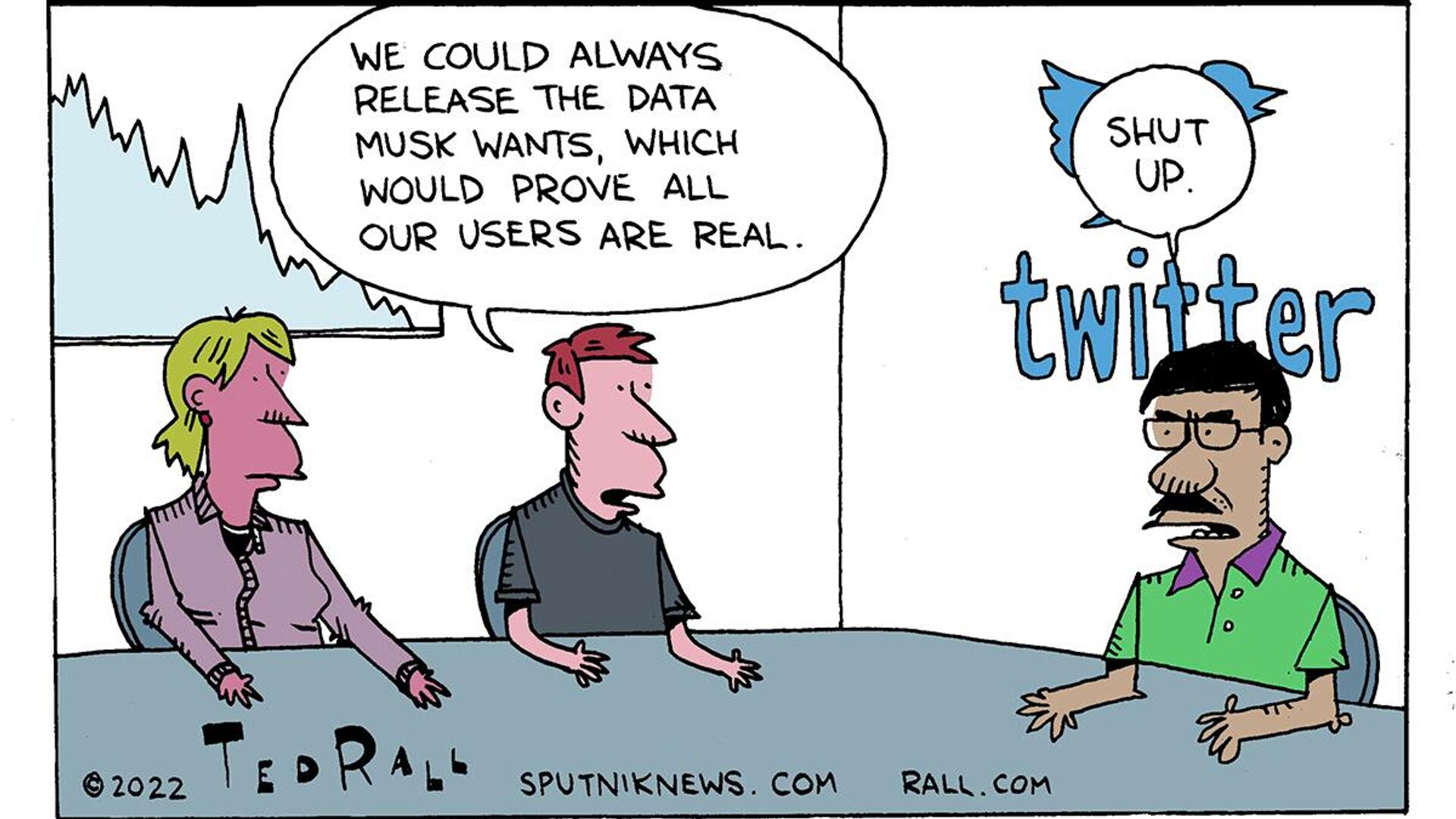

Bird Down

04:05 GMT 23.07.2022 (Updated: 12:56 GMT 14.04.2023) Shares of Twitter closed up some 0.8% on Friday as the tech company reported second quarter revenue results that failed to meet analyst estimates on earnings, revenue, and user growth with the platform. The company attributed the company’s performance to the “pending acquisition by an entity affiliated with Elon Musk.”

Twitter reported its biggest revenue miss to-date on July 22, with total revenue – including subscriptions – coming in at $1.18 billion, well under Wall Street analysts’ expectations of $1.32 billion (-$0.14 billion).

The social media company’s advertising revenue rose 2%, to about $1.08 billion, failing to meet market expectations of $1.22 billion (-$0.14 billion).

"Twitter is now in the unenviable position of convincing advertisers that its ad business is solid regardless of how its court battle with Musk ends, and its Q2 earnings show that the platform has its work cut it out for it to do that," Jasmine Enberg, principal analyst at research firm Insider Intelligence,

told Reuters.

Twitter will not be holding its usual conference call with analysts to discuss the quarterly results, nor will it be providing forward-looking guidance for the upcoming third quarter.