https://sputnikglobe.com/20220827/student-loan-debt-relief-may-be-taxed-in-over-a-dozen-states-1100048303.html

Student Loan Debt Relief May be Taxed in Over a Dozen States

Student Loan Debt Relief May be Taxed in Over a Dozen States

Sputnik International

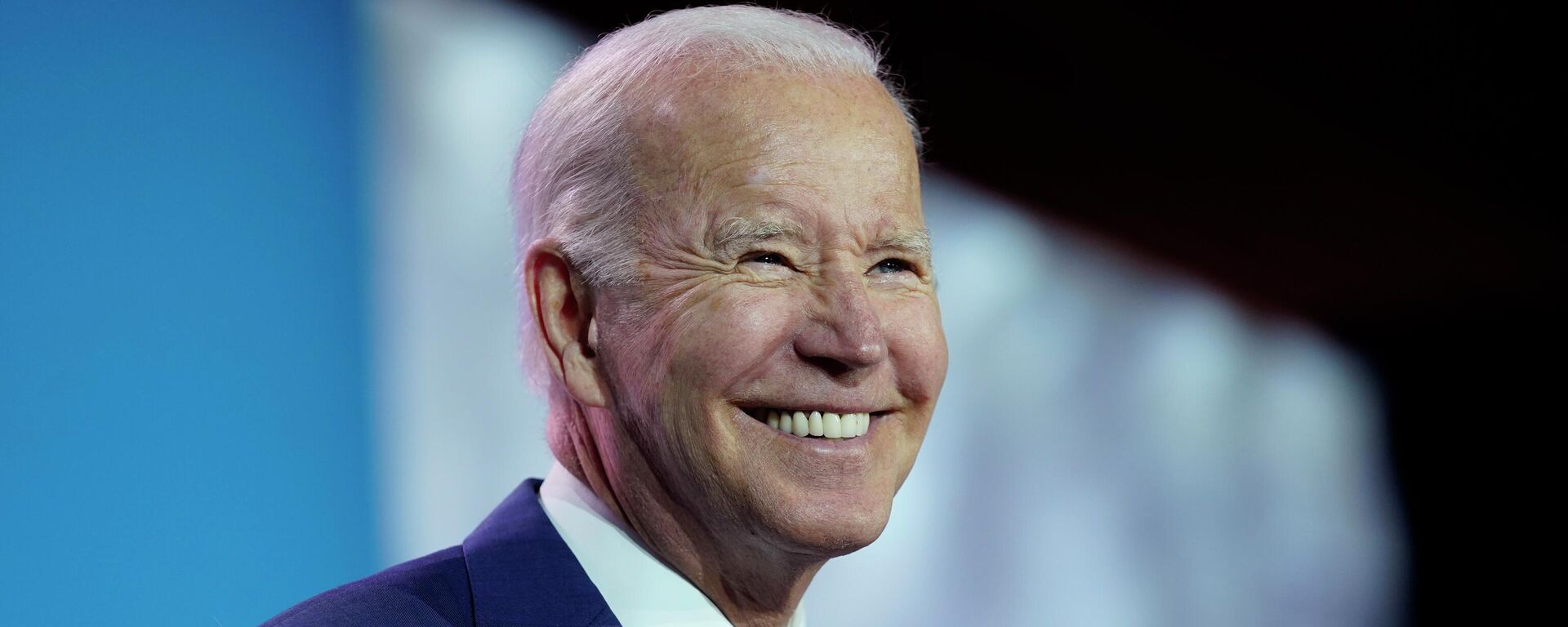

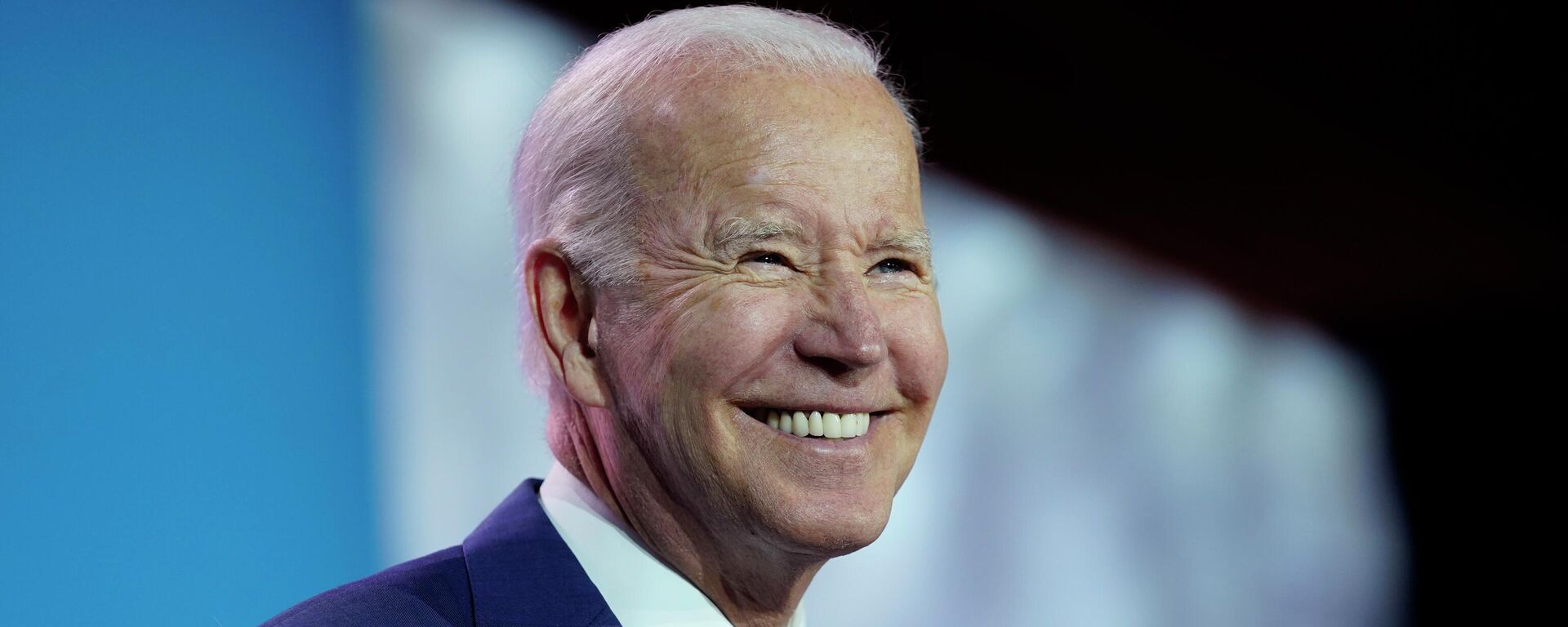

On Wednesday, President Biden announced student loan forgiveness, wiping out $10,000 in debt for borrowers making less than $125,000 a year or $250,000 for... 27.08.2022, Sputnik International

2022-08-27T00:34+0000

2022-08-27T00:34+0000

2022-08-27T00:34+0000

americas

student debt

student loans

taxes

us

https://cdn1.img.sputnikglobe.com/img/07e6/08/1a/1100020053_0:212:3072:1940_1920x0_80_0_0_b580afbb6e37e61e0e74eb5a2eed071e.jpg

Borrowers who had their student loan debt forgiven may end up having that money taxed as income in as many as 13 states, according to Jared Walczak, vice president of state projects at the Tax Foundation.According to his analysis, borrowers could face a maximum tax liability of roughly $300 to $1,100 next year.The states that may end up taxing student loan debt include Arkansas, Hawaii, Idaho, Kentucky, Massachusetts, Minnesota, Mississippi, New York, Pennsylvania, South Carolina, Virginia, West Virginia, and Wisconsin.The American Rescue Plan of 2021 specified that federal student debt forgiveness would not be taxed at the federal level. That also applies to Biden’s recent student loan debt forgiveness.However, while many states mirror the federal tax code to define what is taxable, some states create their own tax code while others mirror the federal tax code but they have to be updated as federal guidelines change.The state laws are not specific to student debt, but rather canceled debt in general, which is usually taxable. Walczak tells CNBC that the state systems are a “patchwork of approaches” and that makes it difficult to predict which states will tax student loan debt when the time comes.States could, he says, write legislation before the year is out to fix the system, but they will have to act fast. Alternatively, some states could rely on administrative guidance or regulatory rulings.“This is not a niche issue that only affects a few people,” Walczak told CNBC. “It affects a very large number of people and hopefully, there will be clarity provided on it.”

https://sputnikglobe.com/20220825/details-on-bidens-student-debt-forgiveness-and-how-it-compares-to-his-campaign-promises-1099965653.html

americas

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

student debt, student loans, taxes, us

student debt, student loans, taxes, us

Student Loan Debt Relief May be Taxed in Over a Dozen States

On Wednesday, President Biden announced student loan forgiveness, wiping out $10,000 in debt for borrowers making less than $125,000 a year or $250,000 for married couples, which can increase up to $20,000 a year for Pell Grant recipients.

Borrowers who had their student loan debt forgiven may end up having that money taxed as income in as many as 13 states,

according to Jared Walczak, vice president of state projects at the Tax Foundation.

According to his analysis, borrowers could face a maximum tax liability of roughly $300 to $1,100 next year.

The states that may end up taxing student loan debt include Arkansas, Hawaii, Idaho, Kentucky, Massachusetts, Minnesota, Mississippi, New York, Pennsylvania, South Carolina, Virginia, West Virginia, and Wisconsin.

25 August 2022, 01:15 GMT

The American Rescue Plan of 2021 specified that federal student debt forgiveness would not be taxed at the federal level. That also applies to Biden’s recent student loan debt forgiveness.

However, while many states mirror the federal tax code to define what is taxable, some states create their own tax code while others mirror the federal tax code but they have to be updated as federal guidelines change.

The state laws are not specific to student debt, but rather canceled debt in general, which is usually taxable. Walczak tells CNBC that the state systems are a “patchwork of approaches” and that makes it difficult to predict which states will tax student loan debt when the time comes.

States could, he says, write legislation before the year is out to fix the system, but they will have to act fast. Alternatively, some states could rely on administrative guidance or regulatory rulings.

“This is not a niche issue that only affects a few people,” Walczak told CNBC. “It affects a very large number of people and hopefully, there will be clarity provided on it.”