https://sputnikglobe.com/20220905/as-truss-chancellor-to-inherit-economic-mess-will-they-manage-to-sort-things-out-1100403764.html

As Truss' Chancellor to Inherit Economic Mess, Will They Manage to Sort Things Out?

As Truss' Chancellor to Inherit Economic Mess, Will They Manage to Sort Things Out?

Sputnik International

Liz Truss won the race for the British premiership on Monday. Incumbent Business Secretary Kwasi Kwarteng is reportedly strongly considered by Truss as her... 05.09.2022, Sputnik International

2022-09-05T15:41+0000

2022-09-05T15:41+0000

2023-05-28T15:20+0000

sputnik explains

recession

liz truss

rishi sunak

uk economy

interest rates

cost of living

borrowing

strike

gdp

https://cdn1.img.sputnikglobe.com/img/105739/28/1057392872_0:60:2049:1212_1920x0_80_0_0_148565b23bb0501f8e72c4a419aaa5c4.jpg

Kwasi Kwarteng has been in "advanced talks" over who might be in his Treasury team since last week, according to Bloomberg. The media outlet noted that Kwarteng – a longtime ally of Liz Truss – is regarded as a “shoo-in to be the new chancellor," citing people familiar with the newly elected prime minister's thinking.Meanwhile, the UK is entering a perfect economic storm, with inflation already above 10% and energy costs going through the roof. Economists predict that inflation could reach a whopping 22.4% in 2023. Likewise, the British Chamber of Commerce (BCC) has projected that the country will plunge into recession before the end of the year, adding that growth will also be weak into 2023 and 2024.To keep the economy afloat, the new chancellor will have to provide support for British households and businesses, ensure the stable flow of investments, save the day for the pound, and above all, create conditions for economic growth.Households and Businesses Under PressureTruss has vowed to help families struggling to pay energy bills with a new package likely to replace the £15 billion ($17.2 billion) of aid announced by then-Chancellor Rishi Sunak in May. On August 26, energy regulator Ofgem announced an 80% increase in the energy price cap to £3,549 ($4,194) per year starting October 1 – a steep rise from the £1,277 cap in place in October 2021. Cornwall Insight, a UK company providing strategic energy market intelligence, has not ruled out the Ofgem price cap climbing to £7,000 ($8,042) in autumn 2023.The new Tory leadership is likely to reverse the planned rise in employee national insurance payments and make cuts to income tax. But when it comes to UK businesses, more radical efforts are required. As such, the BCC has urged No 10 to introduce a temporary 5% VAT reduction on energy bills and provide a COVID-style emergency energy grant for small and medium-sized businesses, according to the Guardian.Previously, incumbent Chancellor Nadhim Zahawi promised targeted reductions in VAT and business rates for the retail and hospitality sectors, but fell short of giving further clarifications. However, energy-intensive industries need stronger policies to weather skyrocketing energy costs. According to the Guardian, the new government may offer these businesses tax breaks to get through the winter.In addition, UK industries are suffering from skills shortages as Brexit limits access to workers from the Old Continent. As a result, wages increased, exerting further pressure on business owners who are facing waning sales amid a looming recession.Bad Investment Environment & Weak PoundUncertain economic prospects have had a negative impact on investments into the British economy, which turned out to be vulnerable to food and energy crises. Following London's decision to join the US' energy embargo against Russia in the wake of the latter's special military operation, global hydrocarbon prices have further gone up. Likewise, the West's sweeping sanctions on Russia's banking and financial activities, as well as logistics and trade, have contributed to already soaring food prices. As a result, the UK has to pay more for energy and food imports.Growing concerns over the UK's economic prospects backfired on the British pound, which slid from $1.36 in March to around $1.15 last week. The British currency also fell nearly 3% against the euro last month. Capital Economics projected last Wednesday that sterling would "plumb to new depths" and fall to around $1.05 by the middle of next year.A weak pound along with soaring inflation and an unfolding recession risks translating into "the largest fall in real wages on record," according to the media. The cost-of-living crisis already led to widespread strike actions across the public and private sectors in the UK earlier this year.Is UK Economic Growth Possible in the Near Term?On top of this, the new chancellor "will enter the Treasury with alarm bells ringing for economic growth," the Guardian noted. Consumer spending is plummeting due to soaring energy bills and growing borrowing rates, as the Bank of England (BoE) continues to gradually raise interest rates in a bid to tame inflation. The BoE's base rate is currently 1.75% after the increase from 1.25% on August 4.In addition, recession is likely to increase unemployment rates as businesses and industries struggle with economic hardships and falling demand. To complicate matters further, growing unemployment will come at a time of "strained labor relations between trade unions, some employers, and the government," the Guardian warned.Truss is likely to resort to "unorthodox" measures to reboot the country's economy, according to Bloomberg. Previously, she promised a 2.5% annual growth target, but her tax cut plans and aid to UK households – aimed at breathing new life in the UK economy – may cost the country around £50 billion ($57.54 billion), according to the Guardian.The Financial Times also expects "more borrowing" from the Truss government, citing "chancellor-in-waiting" Kwarteng's latest FT op-ed as a potential hint.Time will tell how the Truss cabinet will manage to navigate the British economy through the crisis. However, ex-Chancellor Sunak and some British economists warned against resorting to looser fiscal policies and excessive borrowing amid already swirling inflation.

https://sputnikglobe.com/20220905/liz-truss-wins-tory-leadership-race-to-become-next-uk-prime-minister-1100385136.html

https://sputnikglobe.com/20220902/new-british-pm-to-face-tough-winter--challenging-nine-months-ahead-economist-forecasts-1100321899.html

https://sputnikglobe.com/20220905/truss-could-freeze-energy-bills-if-elected-british-prime-minister---reports-1100370888.html

united kingdom (uk)

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

sputnik explains, recession, liz truss, rishi sunak, uk economy, interest rates, cost of living, borrowing, strike, gdp, inflation, united kingdom (uk)

sputnik explains, recession, liz truss, rishi sunak, uk economy, interest rates, cost of living, borrowing, strike, gdp, inflation, united kingdom (uk)

As Truss' Chancellor to Inherit Economic Mess, Will They Manage to Sort Things Out?

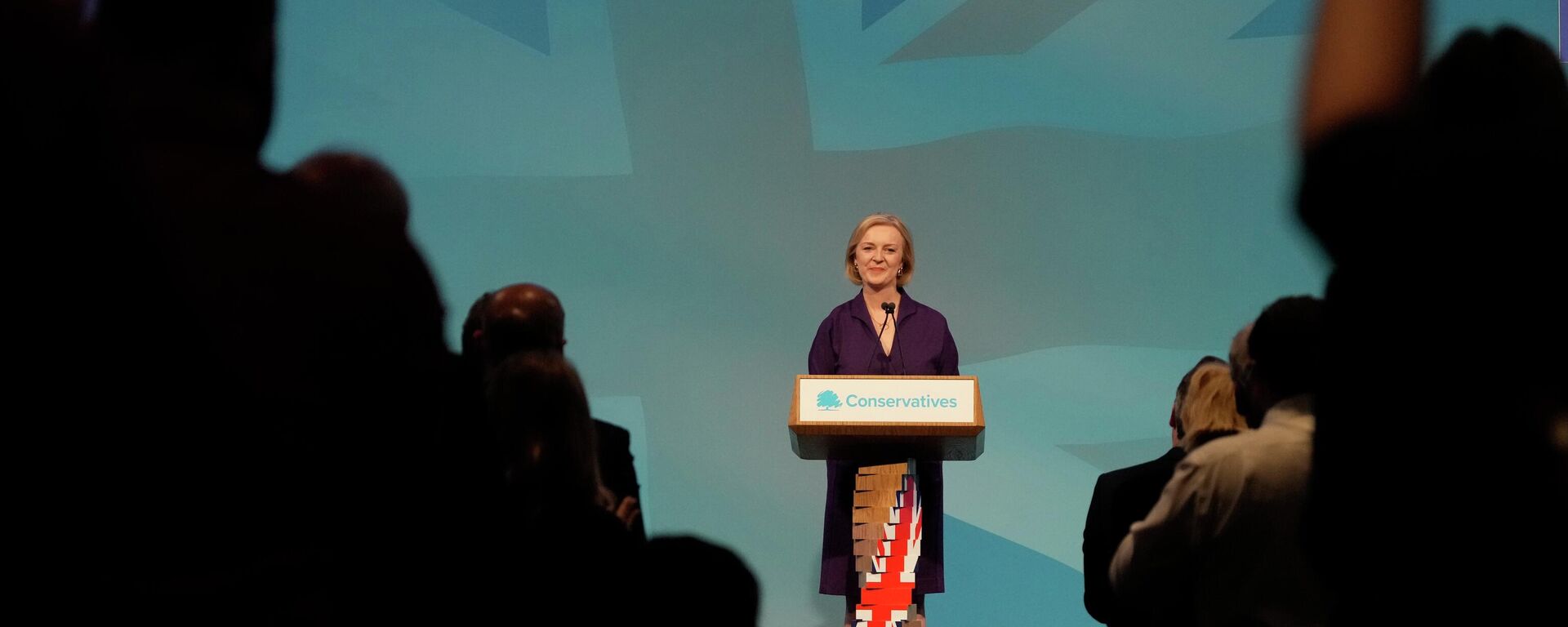

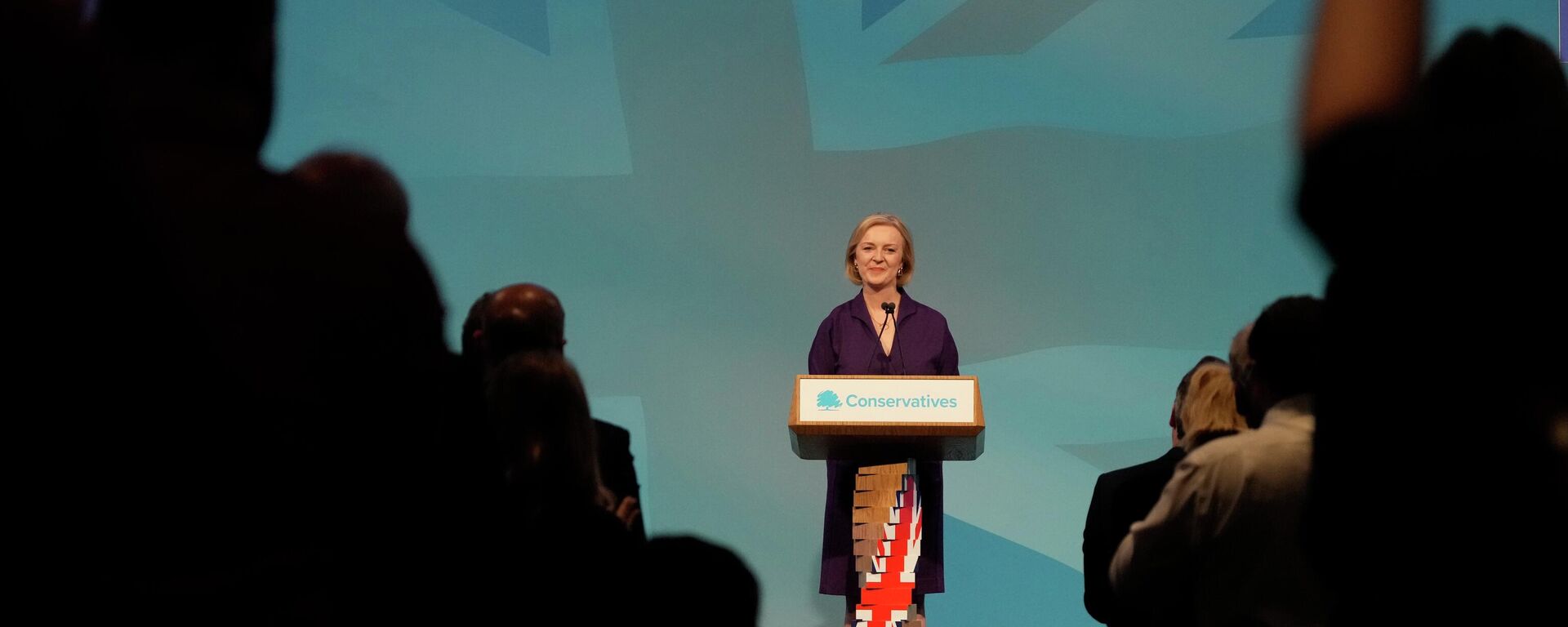

15:41 GMT 05.09.2022 (Updated: 15:20 GMT 28.05.2023) Liz Truss won the race for the British premiership on Monday. Incumbent Business Secretary Kwasi Kwarteng is reportedly strongly considered by Truss as her chancellor of the exchequer. But the new chancellor's task to keep the British economy afloat will be no piece of cake.

Kwasi Kwarteng has been in "advanced talks" over who might be in his Treasury team since last week,

according to Bloomberg. The media outlet noted that Kwarteng – a longtime ally of Liz Truss – is regarded as a “shoo-in to be the new chancellor," citing people familiar with the newly elected prime minister's thinking.

Meanwhile,

the UK is entering a perfect economic storm, with inflation already above 10% and energy costs going through the roof. Economists predict that inflation could reach a whopping 22.4% in 2023. Likewise, the British Chamber of Commerce (BCC) has projected that the country will plunge into recession before the end of the year, adding that growth will also be weak into 2023 and 2024.

To keep the economy afloat, the new chancellor will have to provide support for British households and businesses, ensure the stable flow of investments, save the day for the pound, and above all, create conditions for economic growth.

5 September 2022, 11:38 GMT

Households and Businesses Under Pressure

Truss has vowed to help families struggling to pay energy bills with a new package likely to replace the £15 billion ($17.2 billion) of aid announced by then-Chancellor Rishi Sunak in May. On August 26, energy regulator Ofgem announced an 80% increase in the energy price cap to £3,549 ($4,194) per year starting October 1 – a steep rise from the £1,277 cap in place in October 2021. Cornwall Insight, a UK company providing strategic energy market intelligence, has not ruled out the Ofgem price cap climbing to £7,000 ($8,042) in autumn 2023.

The new Tory leadership is likely to reverse the planned rise in employee national insurance payments and make cuts to income tax. But when it comes to UK businesses, more radical efforts are required. As such, the BCC has urged No 10 to introduce a temporary 5% VAT reduction on energy bills and provide a COVID-style emergency energy grant for small and medium-sized businesses,

according to the Guardian.

Previously, incumbent Chancellor Nadhim Zahawi promised targeted reductions in VAT and business rates for the retail and hospitality sectors, but fell short of giving further clarifications. However, energy-intensive industries need stronger policies to weather skyrocketing energy costs. According to the Guardian, the new government may offer these businesses tax breaks to get through the winter.

In addition, UK industries are suffering from skills shortages as Brexit limits access to workers from the Old Continent. As a result, wages increased, exerting further pressure on business owners who are facing waning sales amid a looming recession.

2 September 2022, 17:23 GMT

Bad Investment Environment & Weak Pound

Uncertain economic prospects have had a negative impact on investments into the British economy, which turned out to be vulnerable to food and energy crises. Following London's decision to join the US' energy embargo against Russia in the wake of the latter's special military operation, global hydrocarbon prices have further gone up. Likewise, the West's sweeping sanctions on Russia's banking and financial activities, as well as logistics and trade, have contributed to already soaring food prices. As a result, the UK has to pay more for energy and food imports.

Growing concerns over the UK's economic prospects backfired on the British pound, which slid from $1.36 in March to around $1.15 last week. The British currency also fell nearly 3% against the euro last month. Capital Economics projected last Wednesday that sterling would "plumb to new depths" and fall to around $1.05 by the middle of next year.

"Adding to the British pound’s woes is the persistent strength of the greenback, with the US dollar index hitting a 20-year high last week," CNBC News remarked, adding that unlike the pound and the euro, the US currency is getting stronger due to the Fed's interest rate hikes.

A weak pound along with soaring inflation and an unfolding recession risks translating into "the largest fall in real wages on record," according to the media. The cost-of-living crisis already led to widespread strike actions across the public and private sectors in the UK earlier this year.

5 September 2022, 00:32 GMT

Is UK Economic Growth Possible in the Near Term?

On top of this, the new chancellor "will enter the Treasury with alarm bells ringing for economic growth," the Guardian noted. Consumer spending is plummeting due to soaring energy bills and growing borrowing rates, as the Bank of England (BoE) continues to gradually raise interest rates in a bid to tame inflation. The BoE's base rate is currently 1.75% after the increase from 1.25% on August 4.

In addition, recession is likely to increase unemployment rates as businesses and industries struggle with economic hardships and falling demand. To complicate matters further, growing unemployment will come at a time of "strained labor relations between trade unions, some employers, and the government," the Guardian

warned.

Truss is likely to resort to "unorthodox" measures to reboot the country's economy, according to Bloomberg. Previously, she promised a 2.5% annual growth target, but her tax cut plans and aid to UK households – aimed at breathing new life in the UK economy – may cost the country around £50 billion ($57.54 billion), according to the Guardian.

The Financial Times also

expects "more borrowing" from the Truss government, citing "chancellor-in-waiting" Kwarteng's latest FT op-ed as a potential hint.

"Given the severity of the crisis we face, there will be a need for some fiscal loosening to help people through the winter," wrote Kwarteng. "The UK's ratio of debt to gross domestic product is lower than any other G7 country except Germany, so we do not need excessive fiscal tightening… I want to provide reassurance that this will be done in a fiscally responsible way… we will work to reduce the debt-to-GDP ratio over time."

Time will tell how the Truss cabinet will manage to navigate the British economy through the crisis. However, ex-Chancellor Sunak and some British economists warned against resorting to looser fiscal policies and excessive borrowing amid already swirling inflation.