https://sputnikglobe.com/20220925/these-etfs-will-allow-you-to-copy-trades-made-by-lawmakers-like-pelosi-and-cruz-1101192304.html

These ETFs Will Allow You to Copy Trades Made By Lawmakers Like Pelosi and Cruz

These ETFs Will Allow You to Copy Trades Made By Lawmakers Like Pelosi and Cruz

Sputnik International

Hundreds of millions of dollars are invested in the stock market by Congress each year. In December 2021, House Speaker Nancy Pelosi opposed a ban on the... 25.09.2022, Sputnik International

2022-09-25T00:55+0000

2022-09-25T00:55+0000

2022-12-19T13:55+0000

americas

us

nancy pelosi

ted cruz

congress

stock market

https://cdn1.img.sputnikglobe.com/img/07e6/09/11/1100910723_0:39:3071:1766_1920x0_80_0_0_721cc1b963adb6f2283755dd8e6f35c6.jpg

Members of Congress and their spouses trading stocks has come under scrutiny lately, with 70% of likely voters now supporting a ban on the practice. It is not hard to understand why, members of Congress have a plethora of insider information the rest of the market is not privy to, giving them an unfair advantage. In addition, it could affect their performance as an elected leader if they decide their stock portfolio is a higher priority for them than their constituents.Since lawmakers have an unfair advantage in the market, could traders benefit from those advantages by emulating the trades lawmakers make? That is exactly what Unusual Whales is trying to do in partnership with Subversive Capital, by proposing two new exchange-traded funds (ETF) under the tickers NANC and CRUZ, named after Democratic House Speaker Nancy Pelosi and Texas Senator Ted Cruz, respectively.If approved by the Security Exchange Commission, the ETFs could be available in November, after the midterm elections. The full names for the ETFs will be the Unusual Whales Subversive Democratic Trading ETF and the Unusual Whales Subversive Republican ETF. They would invest in stocks based on public disclosures of trades made by Republican or Democratic members of Congress and their spouses.Subversive Capital will collect a 1% management fee, Unusual Whales will not be collecting any fees on the ETFs.According to Unusual Whale, which compiled public information, trading by Congress exploded in 2021, exceeding 2020’s trades by over five times. Most of them beat the market. The ETFs will base their trades on public disclosures by members of Congress.While the idea of profiting off of the same advantages members of Congress enjoy, the true goal of the NANC and CRUZ ETFs is to bring awareness of the issue of Congress stock trading.The House may vote on a stock trading ban next week, though only a framework of a potential bill has been released. Currently, the bill would ban members of Congress, their spouses, and their dependent children from trading on the stock market. Congress has only three voting days next week, putting the bill’s status in question. Democratic Rep. Pramila Jayapal, who supports a stock ban, has complained about not being informed about what is happening with the bill. “I can’t say I’m confident,” she said about the bill’s chances.There is also a similar bill in the Senate, though it is not likely to reach the floor until after November, if at all.Seventy-two Congressional lawmakers have been found in violation of the toothless Stop Trading on Congressional Knowledge Act of 2012, which was ostensibly created to prevent Congress from trading on their insider knowledge by disclosing their investments in a timely manner. Violations typically result in a $200 fine.

https://sputnikglobe.com/20220924/trump-is-reportedly-in-legal-battle-to-block-testimony-on-bid-to-overturn-election-defeat-1101180836.html

americas

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

us, nancy pelosi, ted cruz, congress, stock market

us, nancy pelosi, ted cruz, congress, stock market

These ETFs Will Allow You to Copy Trades Made By Lawmakers Like Pelosi and Cruz

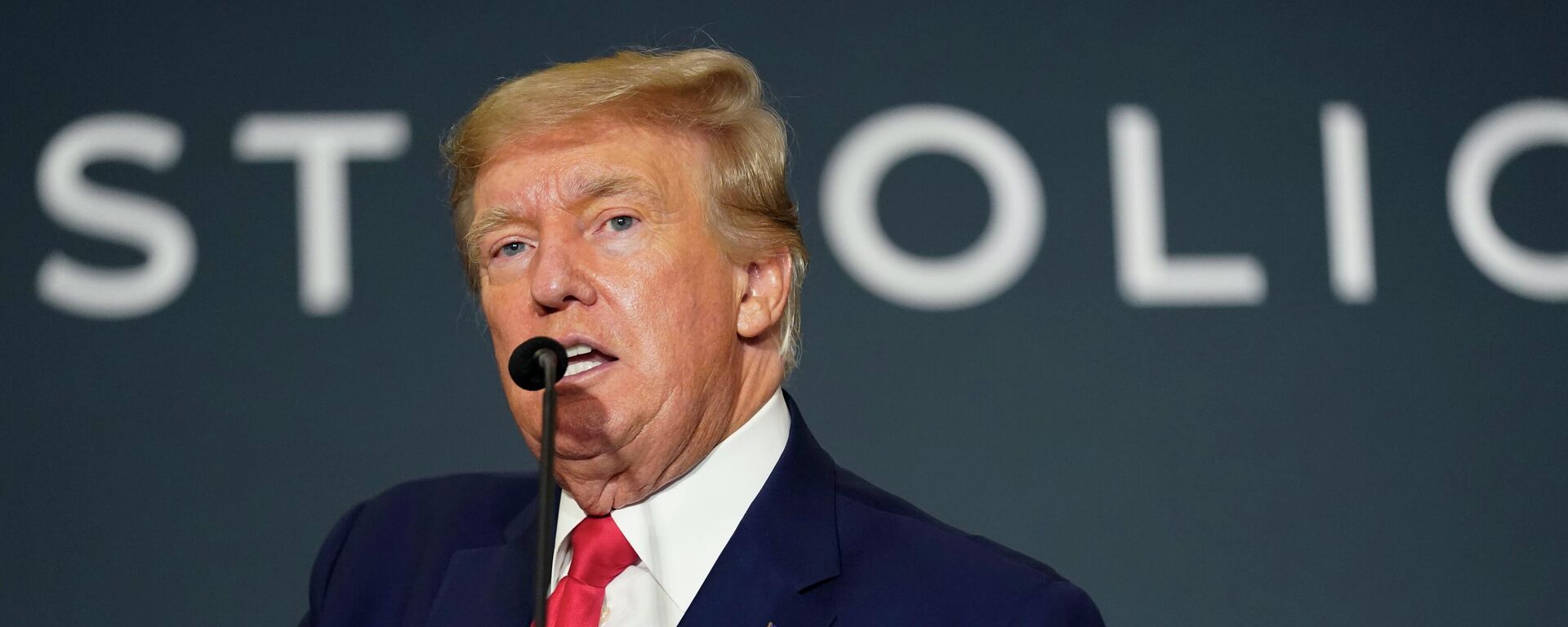

00:55 GMT 25.09.2022 (Updated: 13:55 GMT 19.12.2022) Hundreds of millions of dollars are invested in the stock market by Congress each year. In December 2021, House Speaker Nancy Pelosi opposed a ban on the practice, calling it the “free-market.” Months later, after significant pressure, she greenlighted a plan to ban trading by members of Congress.

Members of Congress and their spouses trading stocks has come under scrutiny lately, with 70% of likely voters now supporting a ban on the practice. It is not hard to understand why, members of Congress have a plethora of insider information the rest of the market is not privy to, giving them an unfair advantage. In addition, it could affect their performance as an elected leader if they decide their stock portfolio is a higher priority for them than their constituents.

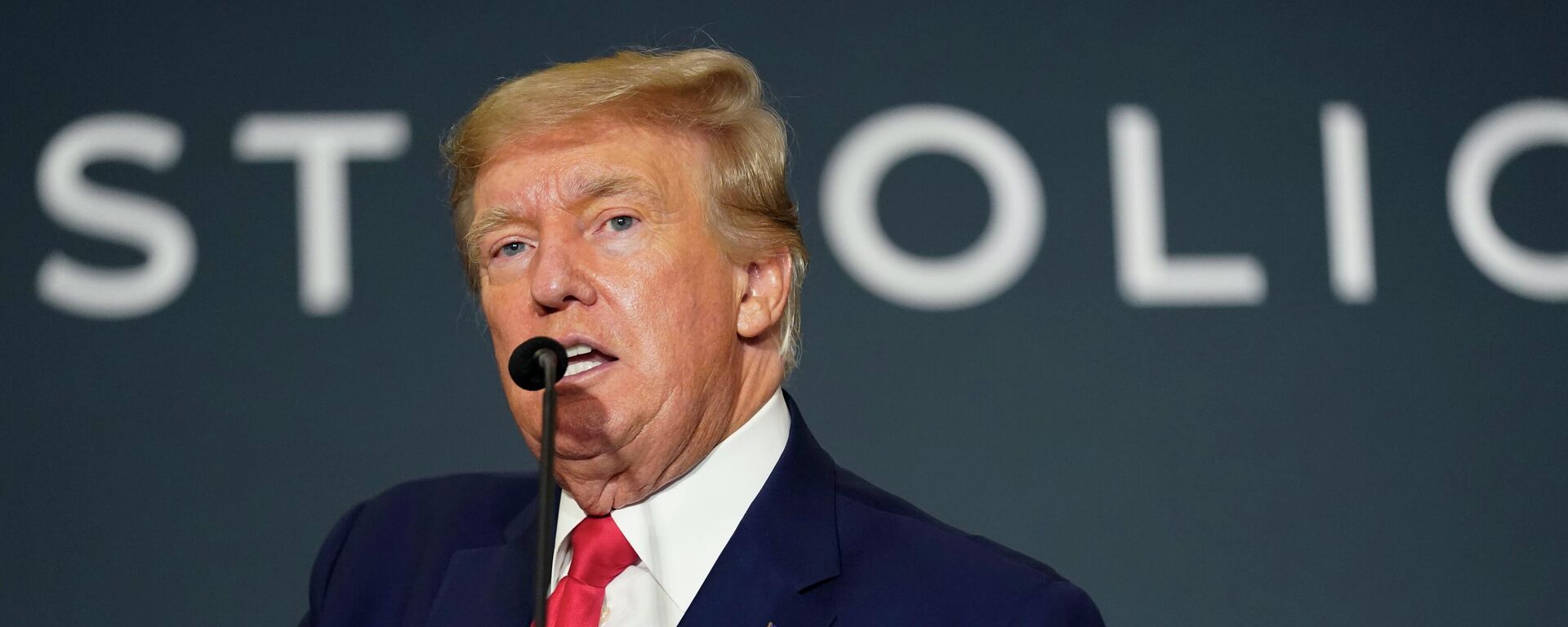

Since lawmakers have an unfair advantage in the market, could traders benefit from those advantages by emulating the trades lawmakers make? That is exactly what Unusual Whales is trying to do in partnership with Subversive Capital, by proposing

two new exchange-traded funds (ETF) under the tickers NANC and CRUZ, named after Democratic House Speaker Nancy Pelosi and Texas Senator Ted Cruz, respectively.

If approved by the Security Exchange Commission, the ETFs could be available in November, after the midterm elections. The full names for the ETFs will be the Unusual Whales Subversive Democratic Trading ETF and the Unusual Whales Subversive Republican ETF. They would invest in stocks based on public disclosures of trades made by Republican or Democratic members of Congress and their spouses.

Subversive Capital will collect a 1% management fee, Unusual Whales will not be collecting any fees on the ETFs.

According to Unusual Whale, which compiled public information, trading by Congress

exploded in 2021, exceeding 2020’s trades by over five times. Most of them beat the market. The ETFs will base their trades on public disclosures by members of Congress.

While the idea of profiting off of the same advantages members of Congress enjoy, the true goal of the NANC and CRUZ ETFs is to bring awareness of the issue of Congress stock trading.

“Unusual Whales hopes to push for changes in politics. We have been at the forefront of [a] political stock trading ban, and because of our efforts together with others, are the closest in history the US has ever come to a trading ban. One hopes this will increase public notice on the issue,” they wrote on their website.

The House may vote on a stock trading ban next week, though only a framework of a potential bill has been released. Currently, the bill would ban members of Congress, their spouses, and their dependent children from trading on the stock market. Congress has only three voting days next week, putting the bill’s status in question. Democratic Rep. Pramila Jayapal, who supports a stock ban,

has complained about not being informed about what is happening with the bill.

“I can’t say I’m confident,” she said about the bill’s chances.

24 September 2022, 16:09 GMT

There is also a similar bill in the Senate, though it is not likely to reach the floor until after November, if at all.

Seventy-two Congressional lawmakers have been found in violation of the toothless Stop Trading on Congressional Knowledge Act of 2012, which was ostensibly created to prevent Congress from trading on their insider knowledge by disclosing their investments in a timely manner. Violations typically result in a $200 fine.