https://sputnikglobe.com/20220927/why-business-wants-a-recession--1101291315.html

Why Business Wants a Recession

Why Business Wants a Recession

Sputnik International

Give Jerome Powell credit for candor: the Fed chairman admits that his policy of increasing interest rates to fight inflation might push the economy into a... 27.09.2022, Sputnik International

2022-09-27T23:30+0000

2022-09-27T23:30+0000

2022-09-27T23:27+0000

americas

columnists

us

newsfeed

https://cdn1.img.sputnikglobe.com/img/07e5/01/16/1081847401_14:0:1906:1064_1920x0_80_0_0_cf28374b59b82449015effcdd431a39a.jpg

If it does, one sector won’t be entirely displeased: employers.According to the Deloitte accounting firm, a typical Fortune 500 company spends $1 to $2 billion a year on payroll, averaging between 50% and 60% of total spending. Controlling labor costs, unsurprisingly, is a top priority for employers.In the boom-bust cycle of labor-management negotiations, the post-pandemic Great Resignation has triggered a labor shortage, a phenomenon we rarely witness that tends to fizzle out fast. Workers are quitting and retiring early, tanking the labor force participation rate. Those who remain enjoy the upper hand at interviews that feel like the job prospect is sizing up the company rather than the other way around. Labor shortages are driving up salaries, shortening hours, prompting signing bonuses and forcing bosses to accommodate people who prefer to work at home. Just 8% of office workers in Manhattan are back in the office a full five days a week.The most recent data published, for June, finds that wages and salaries soared 16.8% on an annualized basis as benefit costs went up 14.4%.Workers, angry and resentful after decades of frozen real wages and merciless downsizing, are becoming demanding. This reversal of a power dynamic in which workers were supplicants and bosses called the shots has also strengthened labor unions that had been losing membership for years.This, some CFOs may be thinking, calls for a recession.Company profit margins are at a 70-year record high, up 25% each of the last two years as the result of raising prices during the pandemic. This means that even allowing for an 8% inflation rate, a generic S&P 500 corporation should easily be able to ride out the average 26% earnings decline suffered in the most recent typical recessions that took place in 1990, 2000 and 2020. (A bigger crisis like the 2008-09 Great Recession, which reduced earnings by 57%, is another matter.)Traditional conservative allies of big business are openly arguing in favor of higher unemployment. “The recent drop in work and labor force participation — particularly among young workers — is troubling [my emphasis],” writes Sarah Greszler in a white paper for the Heritage Foundation, a right-wing think tank. “Job openings, at 11.3 million, remain near record highs, and record percentages of employers report unfilled positions and compensation increases.”Greszler summarizes: “Continued low levels of employment [sic] will reduce the rate of economic growth, reduce real incomes and output, result in greater dependence on government social programs, require higher levels of taxation, and exacerbate the US’s already precarious fiscal situation.”Workers, of course, feel like they can finally breathe. High demand for labor means that they can quit positions where they feel unappreciated and/or under-compensated, pack up and move to another state and create a healthier balance between their family and work lives. The current situation is anything but “troubling.”Executives at employers like Apple, Tesla and Uber have had enough of workers calling the shots. They’re demanding that people get back to work — at the office — or find another job. “A quickly shifting employer-employee dynamic could give companies the ammunition to take a harder line against the full-time work-at-home arrangements that many employees have pushed for, according to corporate policies experts. Perhaps no one has told CEOs that at-home work empowers them too. Rather than hiring security goons to escort laid-off workers past their terrorized colleagues, companies can memory-hole the condemned by deactivating their remote-access passwords. Who’ll notice one less square on the Zoom screen?I’m not subscribing to a dark Marxist suspicion that CEOs, the Fed and other powers-that-be are conspiring to slam the brakes on an economy that would otherwise be coming in for a soft landing as pent-up consumer demand from the pandemic naturally ebbs, in order to return their recently empowered employees to their rightful status as wage slaves. Powell and his fellow governors are doing what comes naturally to government, treating a disease based on a diagnosis that is close to a year out of date and, reasonably, including wage increases as part of their calculus of what constitutes a major driver of the inflation rate.Business, however, does see what’s coming. If the captains of industry aren’t worried enough to be calling their pet politicians to demand an end to interest-rate hikes, one reason might be that they see a silver lining to the next recession.(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, co-hosts the left-vs-right DMZ America podcast with fellow cartoonist Scott Stantis. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

americas

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

Ted Rall

https://cdn1.img.sputnikglobe.com/img/07e5/02/13/1082125340_0:0:360:360_100x100_80_0_0_1ed1a3494a53cde87e19521c3658fe92.jpg

Ted Rall

https://cdn1.img.sputnikglobe.com/img/07e5/02/13/1082125340_0:0:360:360_100x100_80_0_0_1ed1a3494a53cde87e19521c3658fe92.jpg

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Ted Rall

https://cdn1.img.sputnikglobe.com/img/07e5/02/13/1082125340_0:0:360:360_100x100_80_0_0_1ed1a3494a53cde87e19521c3658fe92.jpg

columnists, us, newsfeed

Why Business Wants a Recession

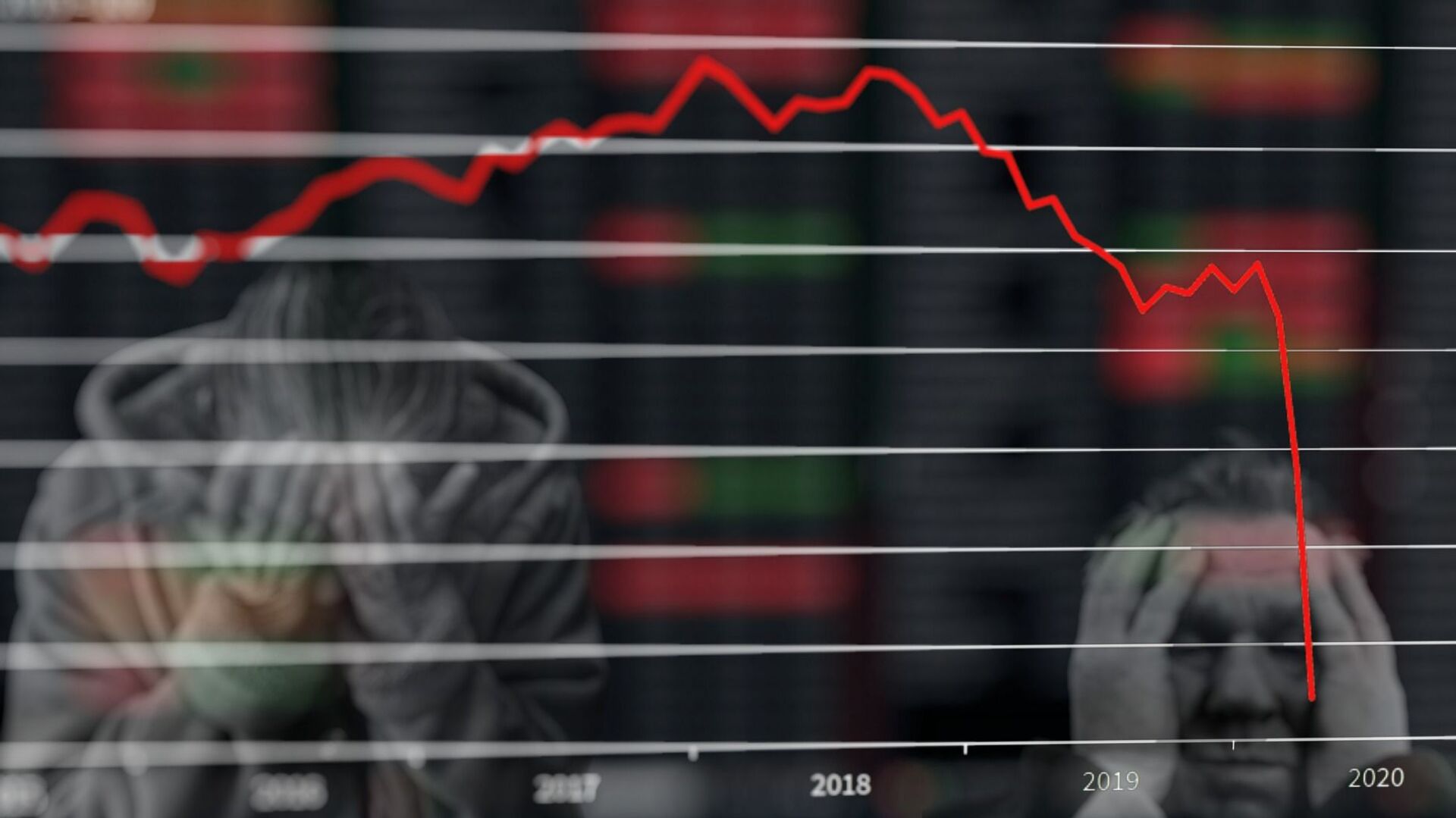

Give Jerome Powell credit for candor: the Fed chairman admits that his policy of increasing interest rates to fight inflation might push the economy into a recession. “No one knows whether this process will lead to a recession or, if so, how significant that recession would be,” he recently told reporters.

If it does, one sector won’t be entirely displeased: employers.

According to the

Deloitte accounting firm, a typical Fortune 500 company spends $1 to $2 billion a year on payroll, averaging between 50% and 60% of total spending. Controlling labor costs, unsurprisingly, is a top priority for employers.

In the boom-bust cycle of labor-management negotiations, the post-pandemic Great Resignation has triggered a labor shortage, a phenomenon

we rarely witness that tends to fizzle out fast. Workers are quitting and retiring early,

tanking the labor force participation rate. Those who remain enjoy the upper hand at interviews that feel like the job prospect is sizing up the company rather than the other way around. Labor shortages are driving up salaries, shortening hours, prompting signing bonuses and forcing bosses to accommodate people who prefer to work at home. Just

8% of office workers in Manhattan are back in the office a full five days a week.

The most recent

data published, for June, finds that wages and salaries soared 16.8% on an annualized basis as benefit costs went up 14.4%.

Workers, angry and resentful after

decades of frozen real wages and

merciless downsizing, are becoming demanding. This reversal of a power dynamic in which workers were supplicants and bosses called the shots has also

strengthened labor unions that had been losing membership for years.

This, some CFOs may be thinking, calls for a recession.

Company profit margins are at a

70-year record high, up

25% each of the last two years as the result of raising prices during the pandemic. This means that even allowing for an 8% inflation rate, a generic S&P 500 corporation should easily be able to ride out the

average 26% earnings decline suffered in the most recent typical recessions that took place in 1990, 2000 and 2020. (A bigger crisis like the 2008-09 Great Recession, which reduced earnings by 57%, is another matter.)

No corporate officer would voluntarily reduce earnings. Or would they, in order to get something more valuable: regaining leverage over labor?

Traditional conservative allies of big business are openly arguing in favor of higher unemployment. “The recent drop in work and labor force participation — particularly among young workers — is

troubling [my emphasis],”

writes Sarah Greszler in a white paper for the Heritage Foundation, a right-wing think tank. “Job openings, at 11.3 million, remain near record highs, and record percentages of employers report unfilled positions and compensation increases.”

Greszler summarizes: “Continued low levels of employment [sic] will reduce the rate of economic growth, reduce real incomes and output, result in greater dependence on government social programs, require higher levels of taxation, and exacerbate the US’s already precarious fiscal situation.”

Workers, of course, feel like they can finally breathe. High demand for labor means that they can quit positions where they feel unappreciated and/or under-compensated, pack up and move to another state and create a healthier balance between their family and work lives. The current situation is anything but “troubling.”

Executives at employers like

Apple,

Tesla and

Uber have had enough of workers calling the shots. They’re demanding that people get back to work — at the office — or find another job. “A quickly shifting employer-employee dynamic could give companies the ammunition to take a harder line against the full-time work-at-home arrangements that many employees have pushed for, according to corporate policies experts.

"In fact, they say more companies are likely to start pressing staffers to come back to the office — at least a few days a week,” reports CNBC. “The hybrid workforce is not going to go away, but the situation where employees refuse to come to the workplace at all is not likely to hold,” Johnny C. Taylor Jr. of the Society for Human Resource Management tells the network.

Perhaps no one has told CEOs that at-home work empowers them too. Rather than hiring security goons to escort laid-off workers past their terrorized colleagues, companies can

memory-hole the condemned by deactivating their remote-access passwords. Who’ll notice one less square on the Zoom screen?

I’m not subscribing to a dark Marxist suspicion that CEOs, the Fed and other powers-that-be are conspiring to slam the brakes on an economy that

would otherwise be coming in for a soft landing as

pent-up consumer demand from the pandemic naturally ebbs, in order to return their recently empowered employees to their rightful status as wage slaves. Powell and his fellow governors are doing what comes naturally to government, treating a disease based on a diagnosis that is close to a year out of date and, reasonably, including wage increases as part of their calculus of what constitutes a major driver of the inflation rate.

Business, however, does see what’s coming. If the captains of industry aren’t worried enough to be calling their pet politicians to demand an end to interest-rate hikes, one reason might be that they see a silver lining to the next recession.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, co-hosts the left-vs-right DMZ America podcast with fellow cartoonist Scott Stantis. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)