https://sputnikglobe.com/20221011/uk-chancellor-will-need-60bln-of-brutal-spending-cuts-to-fund-mini-budget-ifs-warns-1101708576.html

UK Chancellor Will Need £60Bln of ‘Brutal’ Spending Cuts to Fund Mini Budget, IFS Warns

UK Chancellor Will Need £60Bln of ‘Brutal’ Spending Cuts to Fund Mini Budget, IFS Warns

Sputnik International

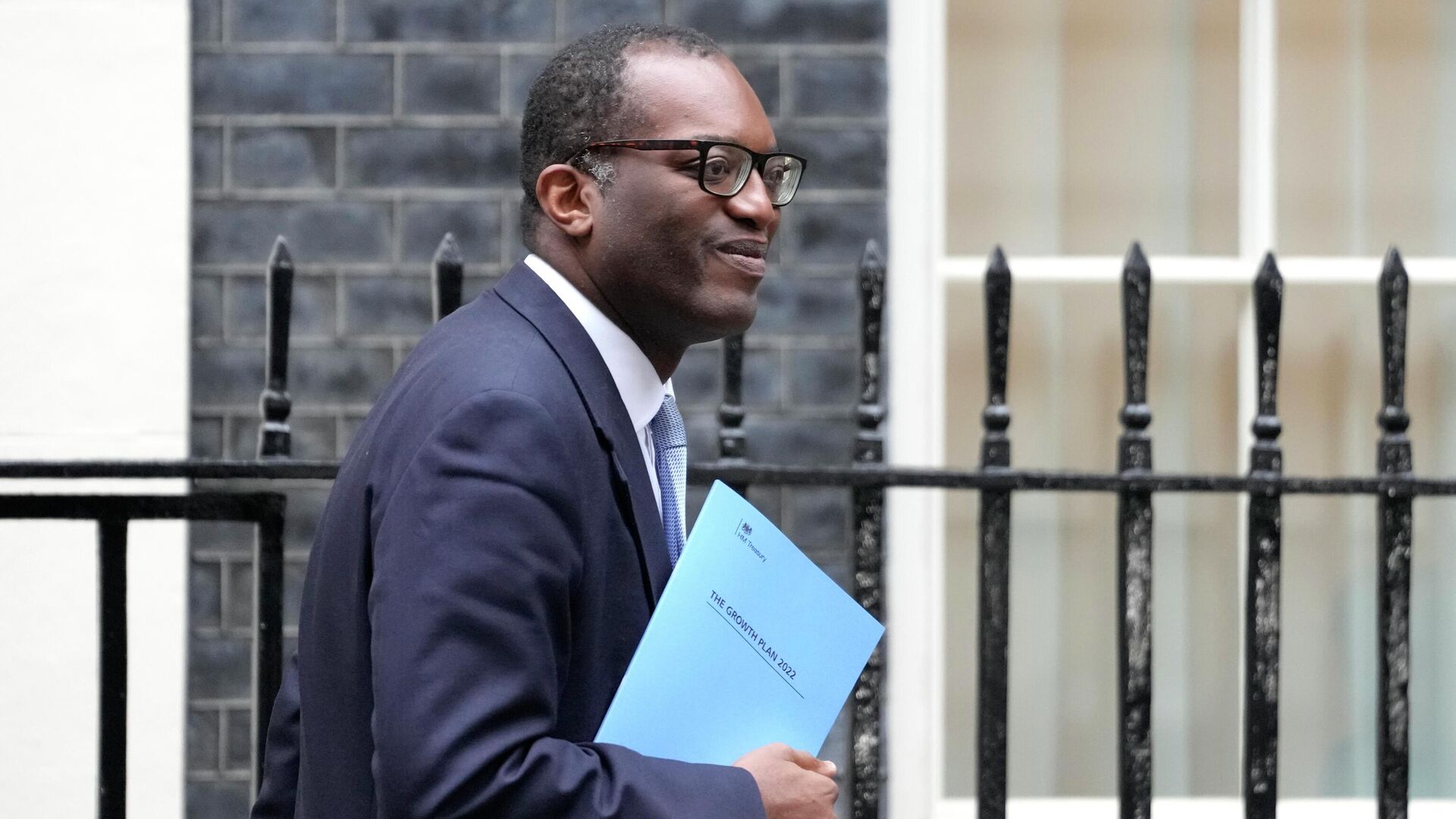

UK Chancellor Kwasi Kwarteng's mini budget, with its £45Bln of unfunded tax cuts unveiled on 23 September, sent the markets into turmoil, with sterling... 11.10.2022, Sputnik International

2022-10-11T10:27+0000

2022-10-11T10:27+0000

2023-05-28T15:21+0000

kwasi kwarteng

world

liz truss

inflation

united kingdom (uk)

https://cdn1.img.sputnikglobe.com/img/07e6/0a/03/1101455179_0:0:3073:1728_1920x0_80_0_0_4e649148adf1f6a2bdfc6c8a6e359878.jpg

Britain’s Chancellor of the Exchequer, Kwasi Kwarteng, will need to cut government spending or raise taxes by £60Bln ($66Bln) to fill the gap left by the unfunded tax cuts contained in his mini budget, the Institute for Fiscal Studies has warned.If Prime Minister Liz Truss’ government wants to adhere to its pledges to cap government debt while offering a £43Bln tax giveaway and supporting households struggling with spiraling energy costs, brutal choices will need to be made, the 'Green Budget' from the Institute for Fiscal Studies (IFS), together with investment bank Citi, has stated.The scale of the cuts needed is immense, about double the size of the defense budget, according to the research.The measures announced since the Truss government took office - reversal of tax increases such as corporation tax and national insurance - and its Energy Price Guarantee, are leading UK government debt down an unsustainable path, according to the 'Green Budget'. The amount the government is set to pay on debt interest is predicted to soar in the next couple of years to its highest level since the late Forties.According to the IFS, even the government’s mulled controversial money-saving measure to raise working age benefits in line with earnings rather than inflation would only save a fraction of the amount needed - about £13Bln annually. Although it would be “technically possible” for the Chancellor to seek a way out via spending cuts, doing so would hugely affect public-sector spending that already had “not much fat left to cut,” IFS director, Paul Johnson, said.Any hope that the books could be balanced by relying on economic growth would hinge on luck more than specific forecasts, the IFS further cautioned, citing projections from Citigroup. Citi emphasized that the economy was facing soaring inflation and a moderate but protracted recession, prompting the Bank of England to hike interest rates. “The specifics of the UK government’s fiscal strategy are under more scrutiny by financial markets than at any point in the recent past. The Chancellor should not rely on over-optimistic growth forecasts or promises of unspecified spending cuts. To do so would risk his plans lacking the credibility which recent events have shown to be so important,” said IFS Director Paul Johnson.

https://sputnikglobe.com/20221005/uk-home-secretary-accuses-tory-rebels-of-trying-to-oust-truss-after-kwartengs-u-turn-on-mini-budget-1101528714.html

https://sputnikglobe.com/20220928/uk-food-price-inflation-reaches-record-106-in-september-retail-consortium-says-1101299496.html

united kingdom (uk)

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

kwasi kwarteng, liz truss, inflation, united kingdom (uk)

kwasi kwarteng, liz truss, inflation, united kingdom (uk)

UK Chancellor Will Need £60Bln of ‘Brutal’ Spending Cuts to Fund Mini Budget, IFS Warns

10:27 GMT 11.10.2022 (Updated: 15:21 GMT 28.05.2023) UK Chancellor Kwasi Kwarteng's mini budget, with its £45Bln of unfunded tax cuts unveiled on 23 September, sent the markets into turmoil, with sterling collapsing and the Bank of England having to step in to save some pension funds.

Britain’s Chancellor of the Exchequer, Kwasi Kwarteng, will need to cut government spending or raise taxes by £60Bln ($66Bln) to fill the gap left by the unfunded tax cuts contained in his mini budget, the Institute for Fiscal Studies

has warned.

If Prime Minister Liz Truss’ government wants to adhere to its pledges to cap government debt while offering a £43Bln tax giveaway and supporting households struggling with spiraling

energy costs, brutal choices will need to be made, the 'Green Budget' from the Institute for Fiscal Studies (IFS), together with investment bank Citi, has stated.

The scale of the cuts needed is immense, about double the size of the defense budget, according to the research.

The measures announced since the Truss government took office - reversal of tax increases such as corporation tax and national insurance - and its Energy Price Guarantee, are leading UK government debt down an unsustainable path, according to the 'Green Budget'. The amount the government is set to pay on debt interest is predicted to soar in the next couple of years to its highest level since the late Forties.

5 October 2022, 10:23 GMT

According to the IFS, even the government’s mulled controversial money-saving measure to raise

working age benefits in line with earnings rather than inflation would only save a fraction of the amount needed - about £13Bln annually.

Although it would be “technically possible” for the Chancellor to seek a way out via spending cuts, doing so would hugely affect public-sector spending that already had “not much fat left to cut,” IFS director, Paul Johnson, said.

Any hope that the books could be balanced by relying on economic growth would hinge on luck more than specific forecasts, the IFS further cautioned, citing projections from Citigroup. Citi emphasized that the economy was

facing soaring inflation and a moderate but protracted recession, prompting the Bank of England to hike interest rates.

"With monetary and fiscal policy now working in opposite directions, we think the broader risks around UK monetary-financial stability are growing. In the years ahead, 'supply shocks' such as those seen in recent months seem likely to grow more frequent. That may require profound changes in the way macroeconomic policy is conducted if we are to avoid another decade of stagnation. The UK can ill afford further policy mistakes," Benjamin Nabarro, leading UK economist at Citigroup, said.

28 September 2022, 08:07 GMT

“The specifics of the UK government’s fiscal strategy are under more scrutiny by financial markets than at any point in the recent past. The Chancellor should not rely on over-optimistic growth forecasts or promises of unspecified spending cuts. To do so would risk his plans lacking the credibility which recent events have shown to be so important,” said IFS Director Paul Johnson.