https://sputnikglobe.com/20221014/kwasi-kwarteng-reportedly-sacked-as-uk-finance-minister-1101843492.html

Jeremy Hunt Named New UK Chancellor After Kwasi Kwarteng Given the Boot

Jeremy Hunt Named New UK Chancellor After Kwasi Kwarteng Given the Boot

Sputnik International

Markets had already perked up after rumours of a U-turn on Kwarteng's fiscal policies, with the pound climbing back to the $1.13 mark it held before his... 14.10.2022, Sputnik International

2022-10-14T11:36+0000

2022-10-14T11:36+0000

2023-05-28T15:21+0000

world

kwasi kwarteng

jeremy hunt

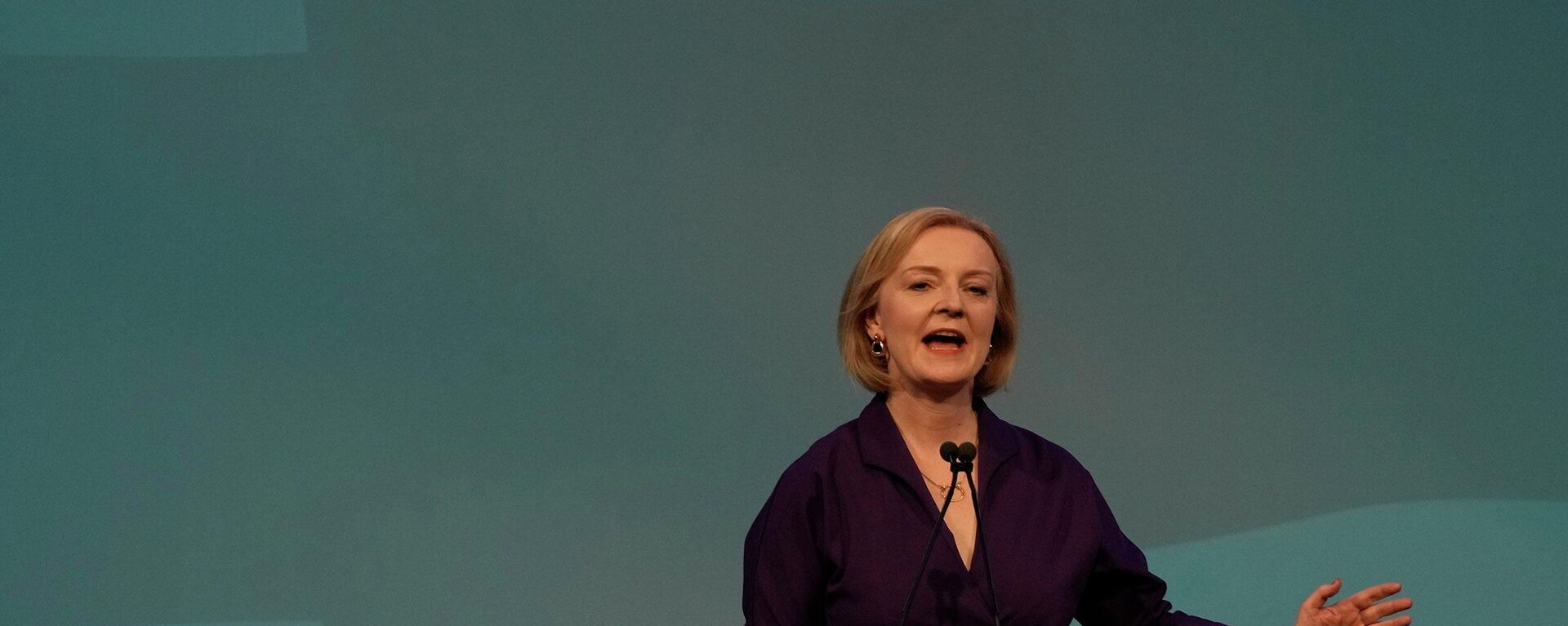

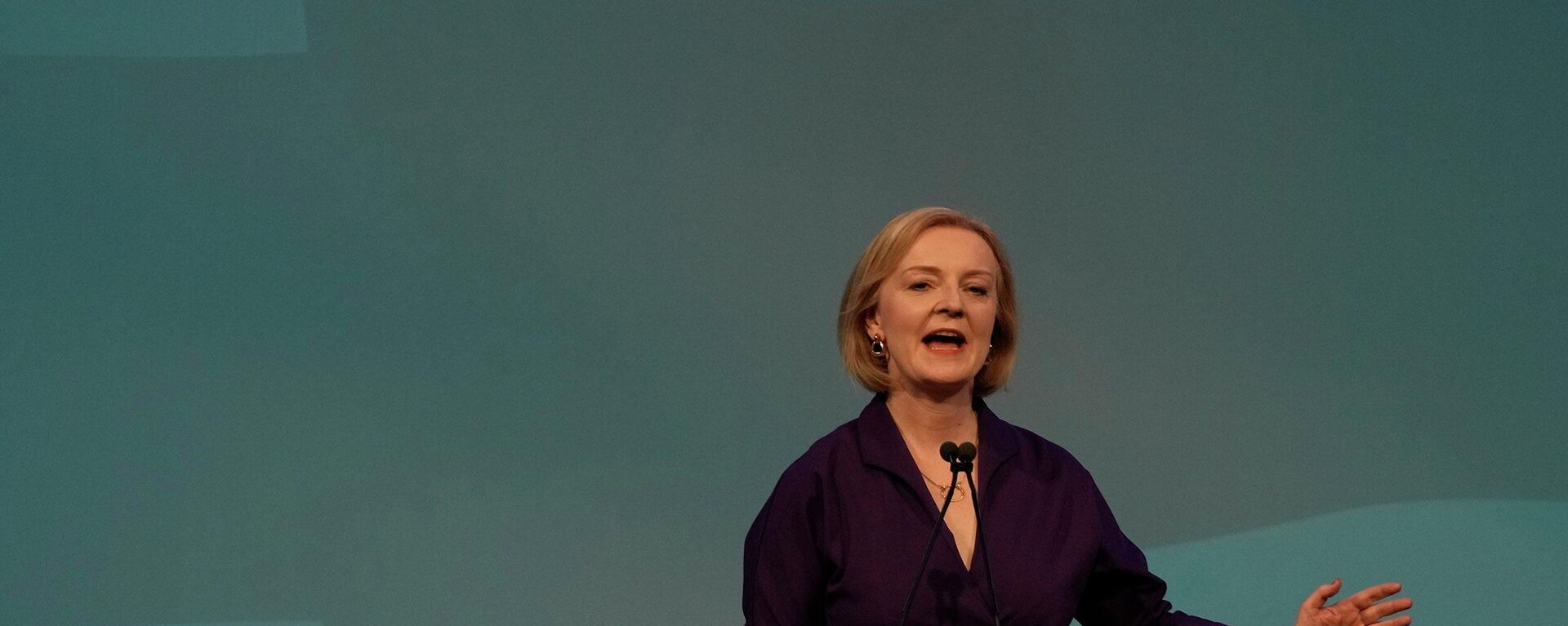

liz truss

britain

great britain

budget

interest rates

united kingdom (uk)

https://cdn1.img.sputnikglobe.com/img/07e6/0a/0e/1101850061_0:32:3093:1772_1920x0_80_0_0_435561f7fb85ffd155c9481a002d1373.jpg

Downing Street has confirmed rumours former Foreign Secretary Jeremy Hunt, an opponent of Britain's exit from the European Union (EU) like Liz Truss, would replace Kwasi Karteng.British Prime Minister Liz Truss sacked Chancellor of the Exchequer Kwasi Kwarteng ahead of an expected reversal of his mini-budget last month.The chancellor, who had held office for just five weeks, resigned at Truss' request after being called back early from a meeting with the International Monetary Fund in Washington DC.There was speculation that Kwarteng's reversal of his predecessor Rishi Sunak's Corporation Tax rise from 19 to 25 percent — a central pledge of Truss' summer campaign for the Conservative Party leadership — would be cancelled following a run on the pound Sterling and government bonds, known as gilts.Markets perked up on the back of those rumours, with the pound climbing back to the $1.13 mark it held before the autumn spending review and gilts rallying.Kwarteng tweeted his resignation letter shortly after his exit from 11 Downing Street was announced."When you asked me to serve as your Chancellor, I did so in the full knowledge we faced was incredibly difficult," Kwarteng wrote, listing rising global interest rates and the energy crisis as challenges.But he warned Truss against changing course on economic policy.Sunak raised the business earnings rate, along with National Insurance contributions — the UK's social security tax — to pay for hundreds of billions in spending on the COVID-19 pandemic.The Bank of England effectively pulled the rug from under Kwarteng's feet earlier this week when it announced that its emergency buy-up of government bonds, launched to save pension funds from bankruptcy, would end.But the question of soaring national debt — to pay for state aid to households and businesses hit by the energy price crisis — remained unanswered.Some economists have said the debt rather than tax cuts, prompted the crisis of confidence in the heavyweight British financial system. But Britons would face a cold winter, with many small firms going out of business, if the government's energy price guarantee scheme is cut back.The energy crisis was precipitated by sanctions and export embargoes on Russia over its military operation in the Ukraine. Those sanctions were led by the US and enthusiastically followed by the EU and most of its members states.

https://sputnikglobe.com/20221014/poll-majority-of-uk-nationals-call-truss-appointment-as-prime-minister-mistake-1101838941.html

britain

great britain

united kingdom (uk)

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

James Tweedie

https://cdn1.img.sputnikglobe.com/img/07e4/08/1c/1080307270_0:3:397:400_100x100_80_0_0_7777393b9b18802f2e3c5eaa9cbcc612.png

James Tweedie

https://cdn1.img.sputnikglobe.com/img/07e4/08/1c/1080307270_0:3:397:400_100x100_80_0_0_7777393b9b18802f2e3c5eaa9cbcc612.png

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

James Tweedie

https://cdn1.img.sputnikglobe.com/img/07e4/08/1c/1080307270_0:3:397:400_100x100_80_0_0_7777393b9b18802f2e3c5eaa9cbcc612.png

kwasi kwarteng, jeremy hunt, liz truss, britain, great britain, budget, interest rates, united kingdom (uk)

kwasi kwarteng, jeremy hunt, liz truss, britain, great britain, budget, interest rates, united kingdom (uk)

Jeremy Hunt Named New UK Chancellor After Kwasi Kwarteng Given the Boot

11:36 GMT 14.10.2022 (Updated: 15:21 GMT 28.05.2023) Markets had already perked up after rumours of a U-turn on Kwarteng's fiscal policies, with the pound climbing back to the $1.13 mark it held before his mini-budget last month, with government bonds rallying as well.

Downing Street has confirmed rumours former Foreign Secretary

Jeremy Hunt, an opponent of Britain's exit from the European Union (EU) like Liz Truss, would replace Kwasi Karteng.

British Prime Minister Liz Truss sacked Chancellor of the Exchequer Kwasi Kwarteng ahead of an expected reversal of his

mini-budget last month.

The

chancellor, who had held office for just five weeks, resigned at Truss' request after being called back early from a meeting with the International Monetary Fund in Washington DC.

There was speculation that Kwarteng's reversal of his predecessor Rishi Sunak's Corporation Tax rise from 19 to 25 percent — a central pledge of Truss' summer campaign for the Conservative Party leadership — would be cancelled following a run on the pound Sterling and government bonds, known as gilts.

Markets perked up on the back of those rumours, with the pound climbing back to the $1.13 mark it held before the autumn spending review and gilts rallying.

Kwarteng

tweeted his resignation letter shortly after his exit from 11 Downing Street was announced.

"When you asked me to serve as your Chancellor, I did so in the full knowledge we faced was incredibly difficult," Kwarteng wrote, listing rising global interest rates and the energy crisis as challenges.

But he warned Truss against changing course on economic policy.

"For too long this country has been dogged by low growth rates and high taxation — that must still change if this country is to succeed," Kwarteng wrote.

Sunak raised the business earnings rate, along with National Insurance contributions — the UK's social security tax — to pay for hundreds of billions in spending on the COVID-19 pandemic.

The Bank of England effectively pulled the rug from under Kwarteng's feet earlier this week when it announced that its emergency buy-up of government bonds, launched to save pension funds from bankruptcy, would end.

14 October 2022, 09:22 GMT

But the question of soaring national debt — to pay for state aid to households and businesses hit by the energy price crisis — remained unanswered.

Some economists have said the debt rather than tax cuts, prompted the crisis of confidence in the heavyweight British financial system. But Britons would face a cold winter, with many small firms going out of business, if the government's energy price guarantee scheme is cut back.

The energy crisis was precipitated by sanctions and export embargoes on Russia over its military operation in the Ukraine. Those sanctions were led by the US and enthusiastically followed by the EU and most of its members states.